NIO Stock News: Nio Inc hangs around $19 as market examines US-China negotiations on ADR stocks

- NYSE:NIO gained 0.47% during Monday’s trading session.

- Beijing has denied a tiered system that would allow US ADR stocks to prevent being delisted.

- Nio outlines its next steps in its European expansion plans.

UPDATE: NIO stock keeps range-trading on Tuesday, right at the $19 mark at the time of this update (14.30 GMT), one hour after Wall Street market open. The Chinese EV automaker has seemingly halted the losses from last week finding support below $20 as reports about US and China nearing a deal on avoiding ADR stock delisting surfaced in financial media outlets. NIO had enjoyed a comeback in May and June as EV stocks finally found some legs to rally after a dismal first four months of the year. The electric vehicle sector is a high-growth stock segment of the market and current risk-off dominance, with inflation and recession dominating market talk, is limiting gains for these companies with a much brighter future than present order books.

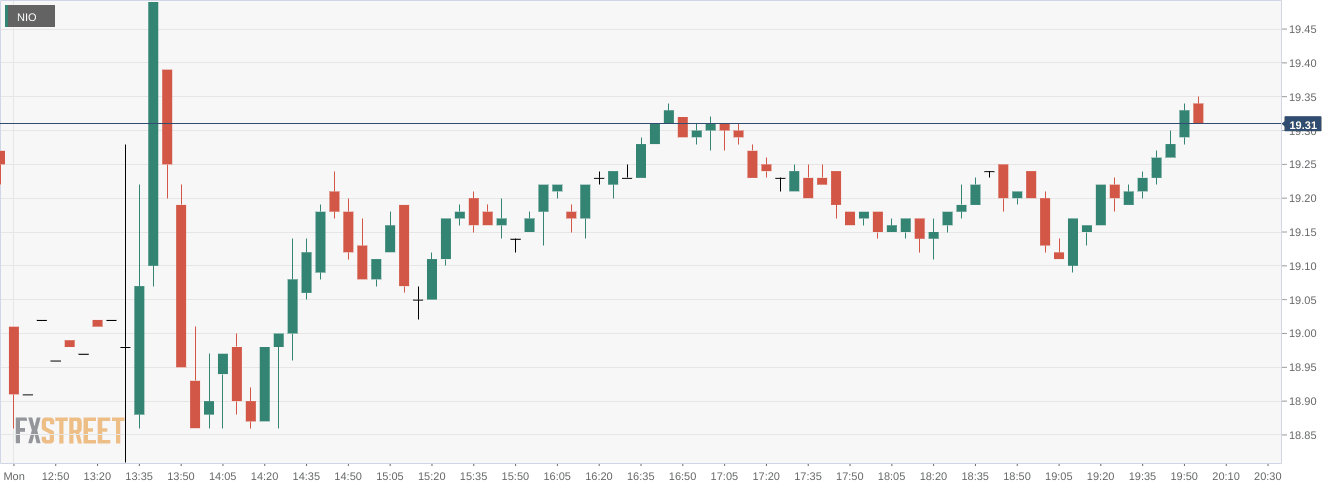

NYSE:NIO kicked the week off on a flat note, although the stock recovered its earlier losses by the time the markets closed for the day. On Monday, shares of NIO added 0.47% and closed the trading session at $19.33. Stocks were mixed to start a pivotal week for the markets ahead of another Fed rate hike and earnings from big tech companies. Overall, the Dow Jones managed to gain 90 basis points, the S&P 500 rose by 0.13%, while the NASDAQ posted a 0.43% loss for the session.

Stay up to speed with hot stocks' news!

A report from over the weekend in the Financial Times has suggested that Beijing and the US are close to agreeing on a three-tiered system for US-listed ADR stocks. This system would separate companies by the sensitivity of their data, and would allow stocks to avoid delisting if they do not accommodate all of the regulatory auditing rules of the United States. Unfortunately on Monday, Chinese regulators denied the plan which led to investors wondering if Nio would still be in danger of being delisted. Shares were down by nearly 3.0% during morning trading, but recovered most of those losses by the closing bell.

NIO stock forecast

In other news, Nio is marching forward with its European expansion plans, and has revealed that it is working on its impending launch in Germany. The EV maker is building Nio Houses in both Munich and Rotterdam in the Netherlands, which is one of the next markets on the list. After Holland, it is believed that Denmark and Sweden are next up, as Nio aggressively pushes its ET7 sedan across the continent.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet