Nikkei (NKD_F) looking to end impulsive rally [Video]

![Nikkei (NKD_F) looking to end impulsive rally [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nikkei/nikkei-225-index-17329557_XtraLarge.jpg)

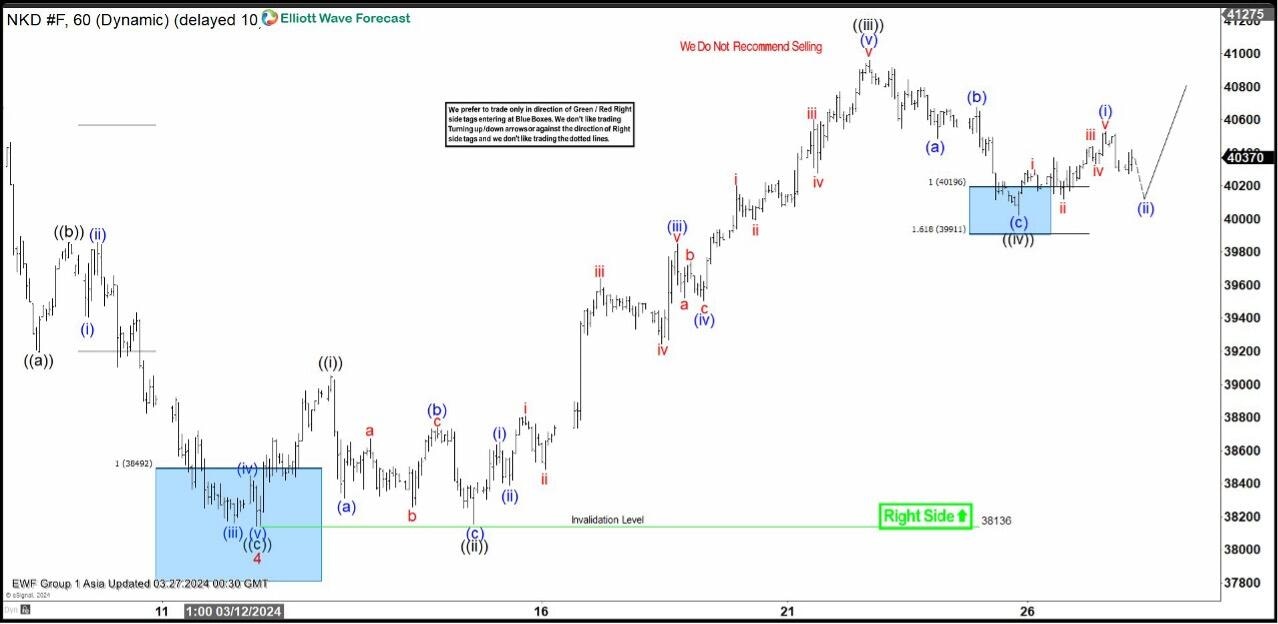

Short term Elliott Wave view in Nikkei (NKD) suggests pullback to 38136 on 3.12.204 low ended wave 4. Index then turns higher in wave 5. The rally from 3.12.2024 low is in progress as a 5 waves impulse. Up from wave 4, wave ((i)) ended at 39055. Pullback in wave ((ii)) ended at 38155 as a zigzag. Down from wave ((i)), wave (a) ended at 38310, wave (b) ended at 38740 and wave (c) lower ended at 38155. Index then resumed higher in wave ((iii)).

Up from wave ((ii)), wave (i) ended at 38650 and wave (ii) pullback ended at 38390. Wave (iii) higher ended at 39850 and pullback in wave (iv) ended at 39505. Final leg wave (v) ended at 40960 which completed wave ((iii)). Down from there, wave ((iv)) unfolded as a zigzag Elliott Wave structure. Down from wave ((iii)), wave (a) ended at 40490 and wave (b) ended at 40680. Wave (c) lower ended at 40025 which completed wave ((iv)). Nikkei has resumed higher in wave ((v)). Up from wave ((iv)), wave (i) ended at 40530 and dips in wave (ii) ended at 40275. Near term, as far as pivot at 38136 low stays intact, expect Index to extend higher.

Nikkei (NKD_F) 60 minutes Elliott Wave chart

NKD_F Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com