Natural Gas Futures: Weakness is not expected to last

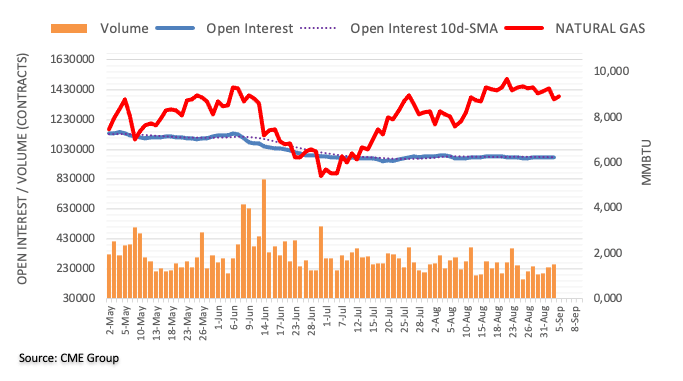

Considering advanced prints from CME Group for natural gas futures markets, traders trimmed their open interest positions by more than 4K contracts on Friday, reversing the previous daily build. On the other hand, volume increased for the third straight session, now by nearly 19K contracts.

Natural Gas remains limited by $10.00

Friday’s downtick in prices of natural gas was on the back of shrinking open interest, which leaves the prospects for further decline somewhat curtailed in the near term. In the meantime, the upside remains capped by the YTD peaks around the $10.00 mark per MMBtu.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.