Natural Gas Futures: Extra rebound on the table

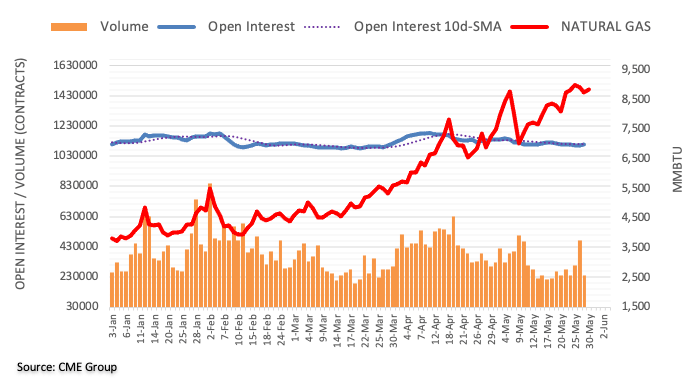

Considering advanced prints from CME Group for natural gas futures markets, open interest rose for the second session in a row on Friday, now by nearly 6K contracts. Volume, instead, reversed two consecutive daily pullbacks and went up by around 237.5K contracts.

Natural Gas remains focused on $9.50

Natural gas prices briefly dropped to multi-day lows near $8.30 just to end the day with modest losses on Friday. The rebound was on the back of rising open interest, which should expose the continuation of the uptrend in the very near term and with the next target at the 2022 peak near $9.50 per MMBtu (May 26).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.