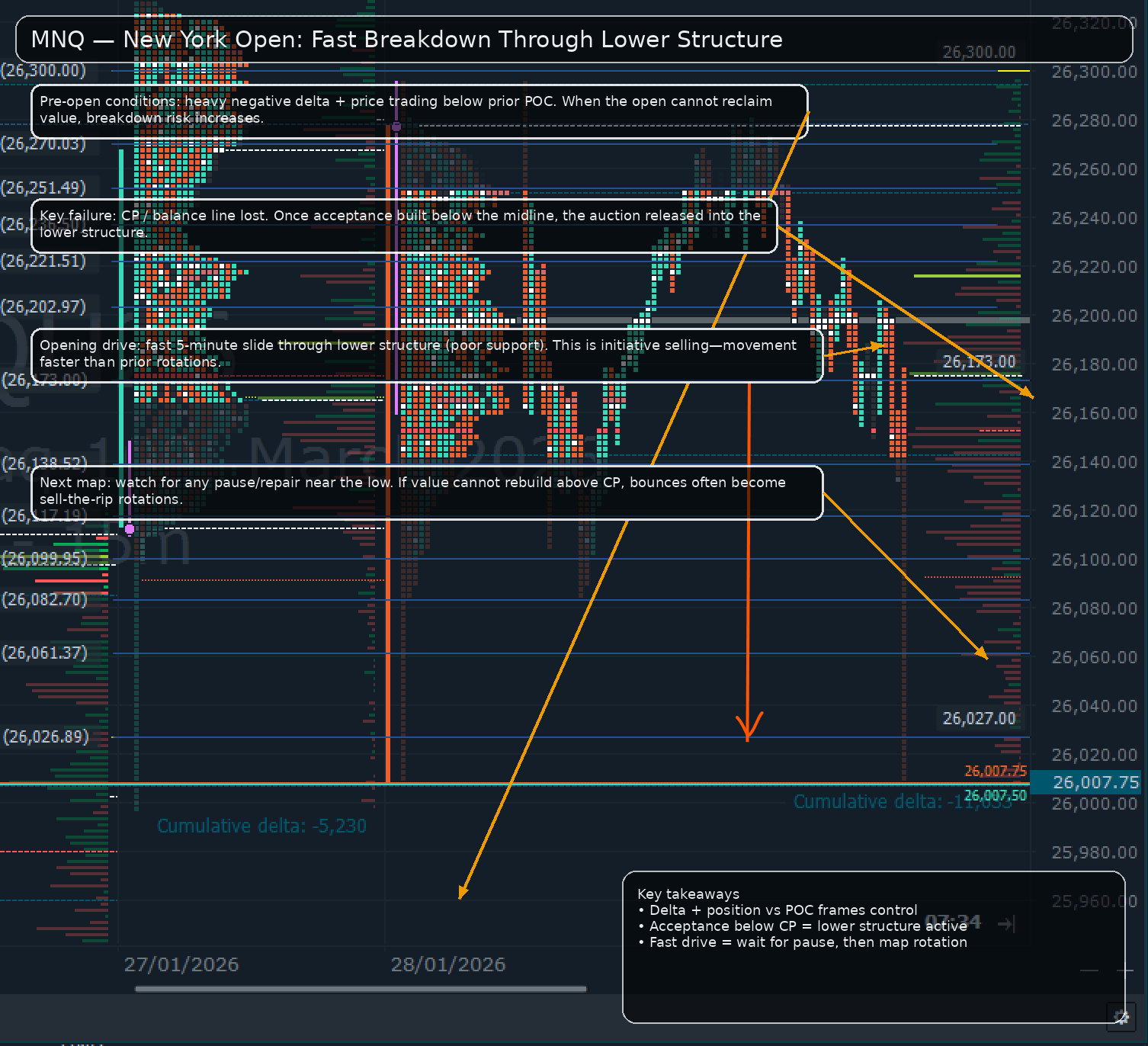

Nasdaq slides over 2.5% as New York open triggers a fast break down below 26,173

This is a follow-up to the pre–New York desk note: heavy delta and weak value location preceded the open, and price failed to reclaim 26,173 before accelerating lower.

This update follows the pre–New York desk note published earlier during the London → New York transition, which highlighted a fragile setup into the open: delta remained heavy, price was trading below prior value/POC, and the market was leaning on the 26,173 balance line without building clean acceptance above it.

New York opening trade confirmed that framework. Price failed to reclaim 26,173, and the auction shifted from two-way rotation to initiative selling, producing a fast drive that cut through the lower structure in minutes. Rather than pausing to rebuild value, the tape repriced lower quickly—consistent with what Market Profile often shows when the open cannot re-accept value at a central reference.

The key takeaway from the chart is straightforward: the pre-open signs (heavy delta + weak value location + failed reclaim at 26,173) aligned with the opening impulse. This follow-up simply documents how that pre-New York structure resolved at the open.

MacroStructure desk coverage tracks these transitions daily across Nasdaq, S&P 500, and Dow futures, using structure, value, and delta to frame the opening risk.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.