Nasdaq Micro E-mini (MNQU2025) daily playbook

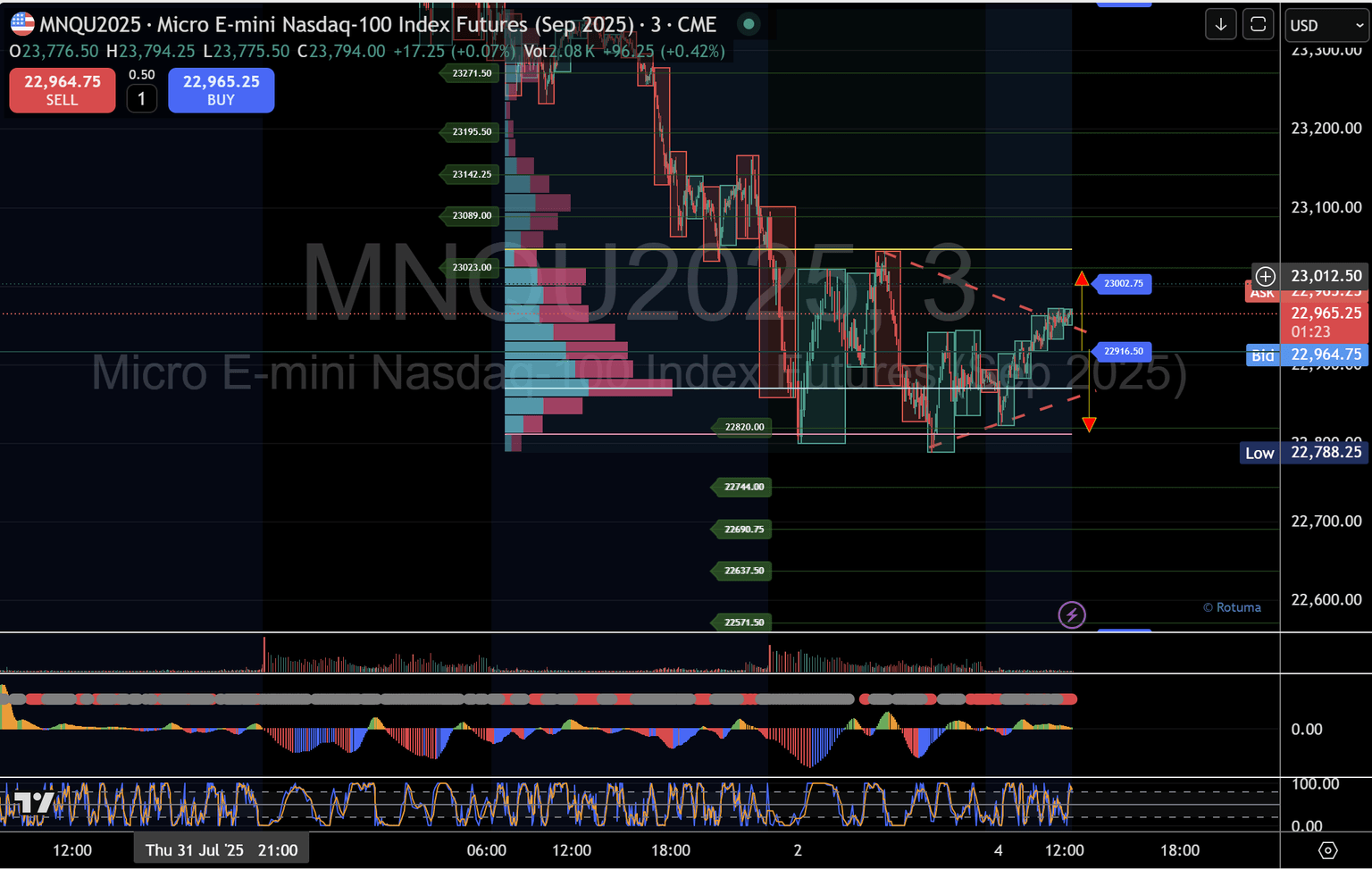

Reclaiming Daily Mid-Range at 22,820 Sets Stage for Intraday Micro Pivot Battles.

1. Daily market context

-

Prior Week’s Sell-Off: Two consecutive daily declines tested strong demand at 22,820 (daily micro 5).

-

50% Retracement Zone: Price probing the mid-range of 23,593–22,056 (~22,825–22,850 area) during the Asian session—a key battleground between buyers and sellers.

-

Daily Bias: Neutral to mildly bullish if 22,820 holds and price can sustain above the 50% retracement (~22,825). Failure opens the door back toward 22349 and 22,056 support.

2. Key daily levels

Daily High (Supply) - 23,593 - Upper resistance; swing high from early July.

50% Retracement Band 22,825 - Mid-range equilibrium.

Daily Low (Demand) - 22,056 - Major support; 100% retracement.

3. Intraday playbook (three-min and one-hour zones)

Our intraday strategy focuses on two “micro” setups derived from major daily pivots.

A. Micro one setup (bullish breakout)

- Trigger: Clean break & hold above 23,023 (upper daily pivot).

- Entry: Long on 1-to-3-candle pullback to 23,023 after breakout.

- Targets:

- Micro 2 → 23,089

- Micro 3 → 23,142

- Micro 4 → 23,195

- Stop-Loss: Below 22,960 (just under recent local swing).

B. Micro five setup (bullish reversal at demand)

- Trigger: Rejection & bullish price action at 22,820 (daily demand micro 5).

- Entry: Long on a confirming micro signal (e.g. hammer or bullish engulfing) in 3-minute chart around 22,820–22,840.

- Targets:

- Micro 4 → 22,744 (initial)

- Micro 3 → 22,690

- Micro 2 → 22,637

- Micro 1 → 22,571

- Stop-Loss: Below 22,780 (invalidation of daily demand).

C. Pivot-point decision zone (neutral to directional)

- Key Level: 22,916.50 pivot—the midpoint between 23,023 and 22,820.

- Above 22,916.50: Bias skewed toward Micro 1 breakout (look to scale into longs toward 23,023+).

- Below 22,916.50: Bias toward retest of 22,820 (prepare for Micro 5 reversal or break lower).

4. Session notes and execution tips

- Asian session (00:00–06:00 GMT+10):

- Observe reaction around daily mid-range (22,825).

- Capture early Micro 5 or Micro 1 plays on a clear 3-minute structure.

- European session (06:00–14:30 GMT+10):

- Watch for liquidity pull to daily pivots.

- Use 1-hr VWAP or volume profile swings to confirm intraday zones.

- US open (14:30–21:00 GMT+10):

- Expect increased momentum—trail stops into second targets.

- If unresolved at 22,916.50, positions often resolve decisively at open.

- Risk management:

- Keep individual trade risk ≤ 0.3% of account.

- Scale out partially at first target; move stop to breakeven thereafter.

- Avoid chasing: if a micro zone is missed, wait for the next pivot rotation to occur.

5. Summary and watch-points

-

Bullish Scenario: Hold 22,820 – reclaim 22,916.50 – break 23,023 – 23,089+.

-

Bearish Scenario: Fail 22,916.50 – retest 22,820 – break lower into 22,744–22,571.

-

Headline Trigger: Victory or rejection at 22,820–23,023 pivots will define intraday trend.

Stay disciplined—trade only when structure aligns with our Micro Pivot rules. Good luck!

The content provided above is for educational and informational purposes only and does not constitute financial, investment, tax, or legal advice. Trading in futures, currencies, equities, or any other financial instrument involves significant risk of loss and is not suitable for all investors. You should assess your financial situation, risk tolerance, and consult with a qualified financial advisor before making any trading decisions. Past performance is not indicative of future results. The author and publisher assume no responsibility for errors, omissions, or any actions taken based on the information presented.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.