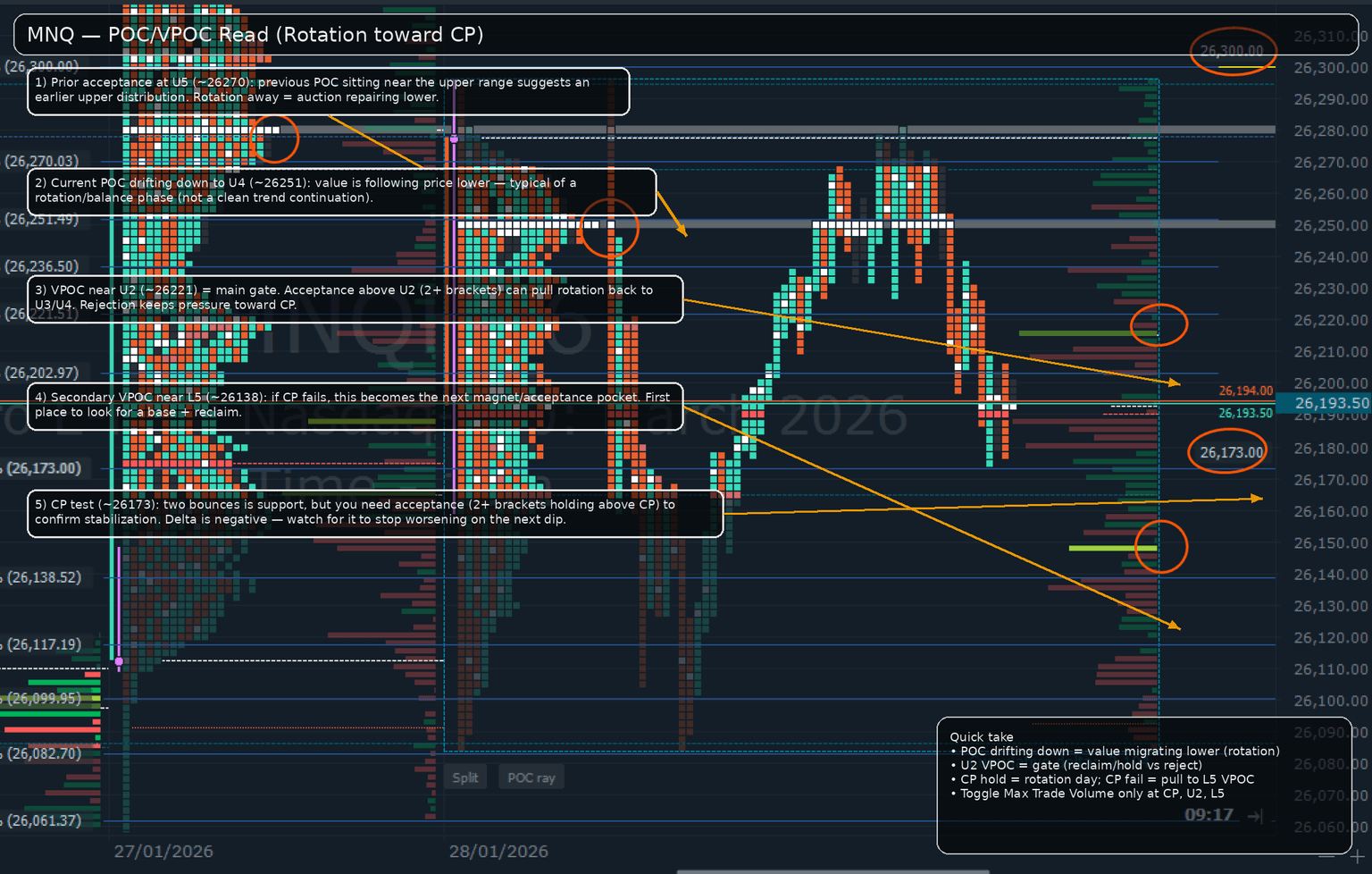

Nasdaq 100 futures hover near 26,173 pivot as value drifts lower

MNQ rotates down from 26,270 as 26,173 decides balance vs a pull toward 26,138 and 26,082–26,061.

MNQ — MacroStructure desk log

London – New York transition Jan 29, 2026

Rotation repair tests Central Pivot (26173). Failure to hold opens the lower structure.

Session state (rotation away from prior upper acceptance)

London trade continues to unwind from the prior upper distribution, rotating down from the U5 zone (~26270) and compressing back toward the mid-range. The profile reads more like repair/balance rotation than clean trend continuation, with price repeatedly interacting with the central magnet into the New York handover.

Value map (POC drift + VPOC gates)

The value structure supports the idea that acceptance is migrating lower. The prior POC was anchored near ~26270 (U5), while the current POC is ~26270 (U5), while the current POCcloser to ~26251 (U4). The primary VPOC is near ~26221 (U2), which acts as the key reclaim gate inside the upper structure. A secondary VPOC is visible near ~26138 (L5), which becomes the natural magnet if the market loses balance below the central pivot.

Central Pivot (26173) is the decision line into New York

Two reactions off CP 26173 suggest responsive buying is present, but the session remains in a decision pocket until New York confirms whether price can hold above CP or accept below it.

If CP holds (balance/rotation scenario)

What matters is whether downside attempts fail to build acceptance below 26173. If the market stabilises and reclaims the upper gate, the key confirmation is acceptance back above U2 26221 (time/letters holding). That keeps the rotation constructive toward 26236 → 26251 (current POC zone), with the upper band potentially reopening later if acceptance persists.

If CP fails (lower structure activates)

Failure is defined by acceptance below 26173 (not just a sweep). If that occurs, the auction has a clear path to the next acceptance pocket at 26138 (L5 / secondary VPOC). Below there, the lower ladder opens toward 26117 → 26100 → 26082 (L2 demand gate) → 26061, with 26026 as the lower pivot/cap if the release accelerates.

Flow check (execution confirmation)

Cumulative delta remains negative into this rotation lower, which fits the move. Into New York, the main tell is whether delta stops worsening on the next dip into CP / 26138—often a sign of seller exhaustion and a potential rotation back toward balance.

These desk updates document a structure-first process, observing how price accepts or rejects predefined levels over time. Coverage spans futures, commodities, forex, bonds, crypto, stocks, and indices, with structure providing context before direction. This observation is for informational purposes only and does not constitute financial advice.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.