Nasdaq 100 Elliott Wave update: New ATHs are on tap

In our December update, we combined the Elliott Wave (EW) Principle with the Armstrong Pi-cycle turn dates and concluded for the NASDAQ 100 (NDX) that

“…if the November 21 low at 23854 holds, based on current data, the Bull market will likely continue, ideally well into April next year, before a 2022-like Bear market begins. Below that level, it will strongly suggest that the bear market is already underway.”

Closer to home, we

“… adjusted our perspective to view the [December 10] 25835 high as only the gray Wave-i of a larger (green) 5th wave, with W-ii to ideally ~24600 now underway.”

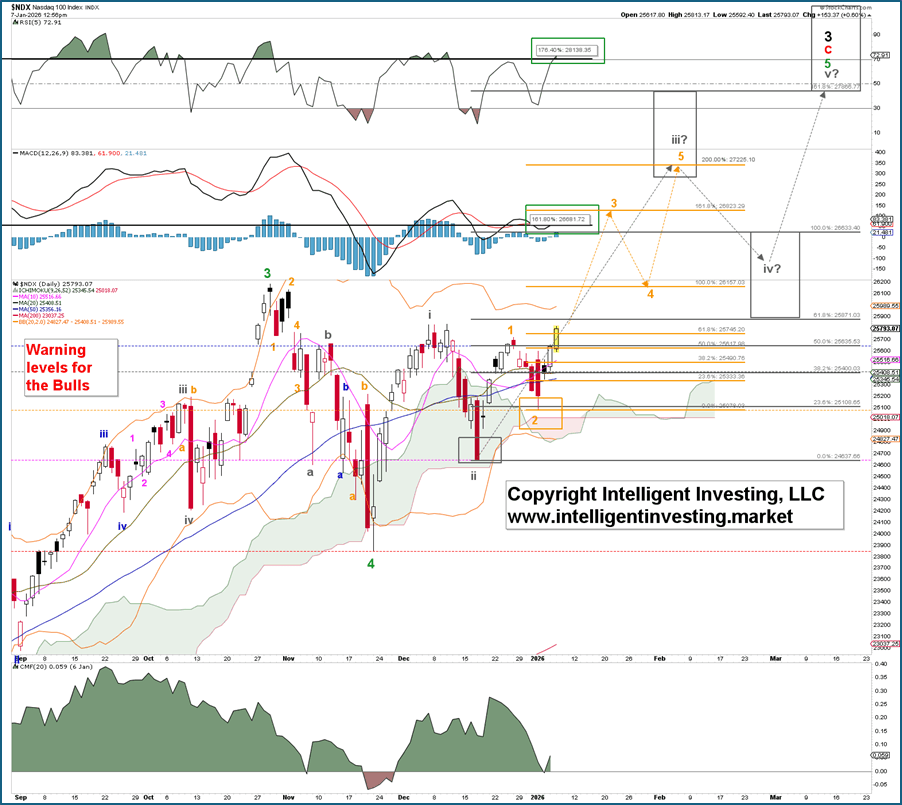

Fast forward to today. The index bottomed at 24647 (gray W-ii), rallied to 25716 on December 26 (orange W-1), bottomed out on January 2nd at 25086 (orange W-2), and is now trading in the 25700s. Thus, the Bulls held the November lows elegantly, and the index is most likely advancing in the 3rd of a 3rd wave (orange W-3 of gray W-iii) for the final 5th wave (green W-5). See Figure 1 below.

Figure 1. Short-term Elliott Wave count for the NDX

Contingent on price remaining above the warning levels*, with each successive break below increasing the odds by 20% that the uptrend has ended, we expect the index to ideally reach ~26825 for the orange W-3, then drop to ~26155 for the orange W-4, and rally to approximately 27225 for W-5, etc. Here, the standard impulse pattern is shown; however, the green W-5 can also develop into an overlapping ending diagonal, resulting in an overlapping rally to the lower end of the target zone (~27860). For now, we have no indication that this will occur. But make no mistake, once this green W-5 completes, we still expect a 2022-like bear market before the next larger multi-year rally to new ATHs can start.

*Warning levels for the Bulls: 25639, 25428,25086, 24647, and 23854. These will be adjusted upwards when the index continues to rise.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.