MVIS Stock Price: Microvision inc ready to extend rally amid rumors of a takeover, ahead of earnings

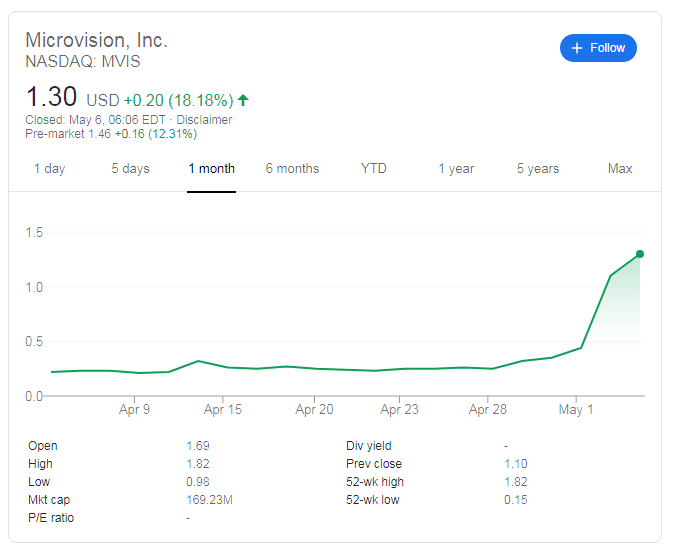

- Microvision is trading around 13% in premarket trading after closing 18% on Tuesday.

- Rumors about a potential acquisition can explain some of the vertical upswings

- Tension is mounting ahead of MVIS's earnings report due out on Thursday.

Microvision inc's impressive rally may have more room to run. Premarket data suggests an increase of $0.20 or around 15% at the timing of writing, to a price of $1.50. To put current levels in proportion, MVIS hovered approximately $0.25 in late April, and it is already worth more than five times this value, leading to a sixfold increase.

The 52-week high is $1.82 and the low has been only $0.15.

NASDAQ: MVIS news

The developer of laser scanning technology for 3D sensing, projection, and other uses is set to report earnings on May 7. Some fear that the report could be another negative one. Microvision's per-share earnings stood at $0.03 in the fourth quarter of 2019, and it is unclear if the company could log a profit.

The Redmond, Washington-based tech company's prices may have risen thanks to rumors about a purchase from a larger firm based in the same northwestern town – Microsoft. There is speculation about cooperation around the LIDAR technology. Moreover, another report suggests that the two companies are linked at the patent office, with Microsoft (MSFT) referencing to Pico-projections technology developed by Microvision.

The earnings report is an opportunity to announce an acquisition or any other type of cooperation. Denial may bring the stock down.

Microvision's market capitalization stands at $169.2 at the time of writing, relatively minuscule in comparison to Microsoft, which is valued at over one trillion dollars.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.