MULN Stock News: Mullen Automotive soars after reporting strong financial numbers

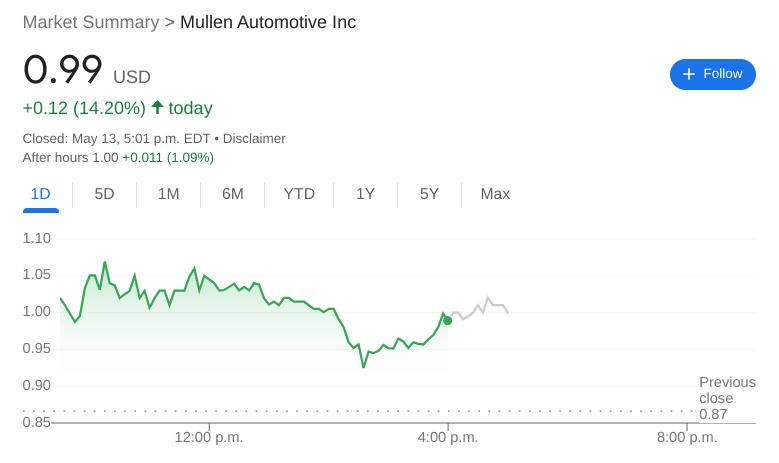

- NASDAQ:MULN gained 14.20% during Friday’s trading session.

- Mullen Automotive reported some of its financial figures on Friday.

- EV stocks fly higher again as markets rally into the weekend.

NASDAQ:MULN rose for the third consecutive day to close the week as the beaten-down EV startup managed to reclaim the $1.00 price level in after-hours trading. On Friday, shares of MULN jumped by a further 14.20% and closed the trading week at $0.99. It was a bullish day all around as the major indices snapped out of their recent funk. The Dow Jones ended its six-day losing streak as the blue-chip index gained 466 basis points. The S&P 500 rose by 2.39% and the NASDAQ rose by 3.82% during the session. All three averages still closed the week in the red.

Stay up to speed with hot stocks' news!

Mullen Automotive sent out a press release of its financial figures early in Friday’s session which resulted in the stock’s major spike. The company reported cash equivalents of $65.2 million at the end of the second quarter, while its net assets rose and its debt fell sequentially by 10.8% from last quarter. It’s a great snapshot of Mullen’s financials, but the EV startup still needs to prove to shareholders and the market that it can produce a competitive product at some point in the near future.

MULN stock forecast

EV stocks were on the rise again on Friday led by industry leader Tesla (NASDAQ:TSLA) which saw its largest gain of the week. Shares of Tesla jumped as CEO Elon Musk said he is re-evaluating his acquisition of Twitter (NYSE:TWTR) although he reiterated he is still committed to the deal. Other EV stocks that were flying higher include Lucid (NASDAQ:LCID), Rivian (NASDAQ:RIVN), and Nio (NYSE:NIO). Ford (NYSE:F) stock was up by 8.52% after Morgan Stanley upgraded its stock to an equal weight rating with a price target of $13.00.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet