MULN Stock Forecast: Despite stake in Bollinger Motors, MULN trading down 9% on Friday

- NASDAQ:MULN fell by 9.27% during Thursday’s trading session.

- Mullen acquired a 60% stake in EV Truck startup Bollinger Motors.

- General Motors is banking on the Electric version of its Equinox SUV.

UPDATED: Mullen Automotive stock dropped more than 9% on Friday to trade around $0.5545 despite the recent news of its majority stake in Bollinger Automotive. That news sent the stock up to $0.76 at the beginning of Thursday's session, but the rest of the day saw traders take profits. MULN stock is now down 30% over the past month. It began trading on August 9 around $0.79. Shares of the EV startup have now broken through support from February in the low $0.60s.

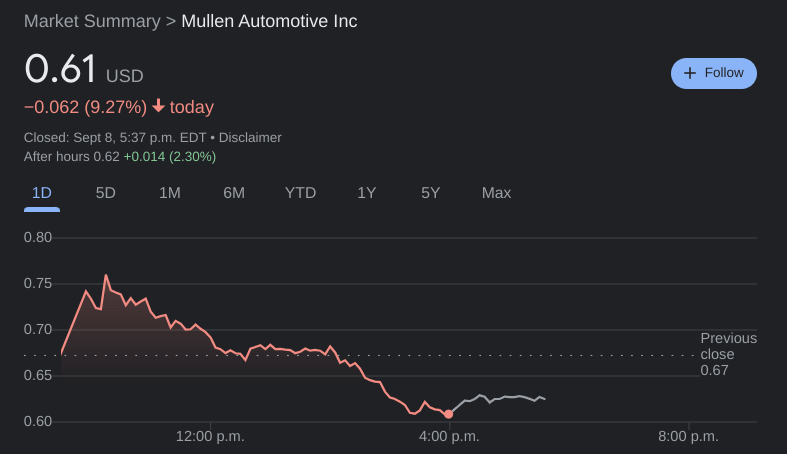

NASDAQ:MULN had a volatile day of trading and was even halted at one point in the morning due to the impending announcement. On Thursday, shares of MULN tumbled by 9.27% and closed the trading session at a price of $0.61. Stocks extended their gains from Wednesday as all three major averages closed higher for the second straight day. The markets briefly dipped into the red as Chairman Powell reiterated the need to hike rates to battle inflation. Overall, the Dow Jones gained 193 basis points, the S&P 500 added 0.66%, and the NASDAQ rose higher by 0.60% during the session.

Stay up to speed with hot stocks' news!

The major announcement that halted Mullen’s stock this morning was that the company acquired a controlling stake in Bollinger Motors. Bollinger is an EV Truck startup that made headlines as a potential early competitor to Tesla’s (NASDAQ:TSLA) Cybertruck. Mullen acquired the 60% stake in the company for a price of $148.2 million cash, which investors clearly thought could be spent better elsewhere. The stock initially surged higher by double digits, only to pare those gains and close the day nearly 10% lower.

Mullen stock price

In other EV news, General Motors (NYSE:GM) is counting on a mass adoption of its EV offerings with the $30,000 Equinox SUV model. It will be one of the more affordable offerings in the industry and is set to hit retail floors next fall. GM is working on transitioning its full lineup of vehicles to all electric by the year 2035.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet