MSTR Elliott Wave technical analysis [Video]

![MSTR Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/nvidia-02_XtraLarge.jpg)

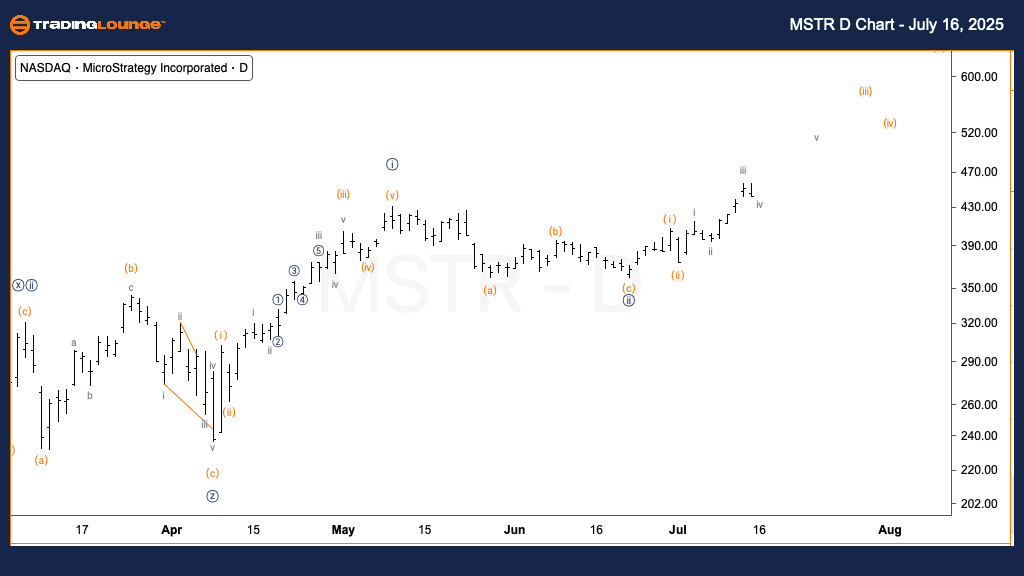

MSTR Elliott Wave technical overview

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (iii) of {iii}.

Direction: Uptrend continuing in wave (iii).

Details: Recent confirmation supports continued upside into wave (iii).

The daily chart for MicroStrategy Inc. (MSTR) shows a strong bullish trend supported by an impulsive wave structure. The stock has confirmed entry into wave (iii) of {iii}, which typically marks a high-momentum phase within Elliott Wave theory. This structure suggests increased buying pressure and the potential for further gains. The motive pattern is developing cleanly, reinforcing the broader uptrend.

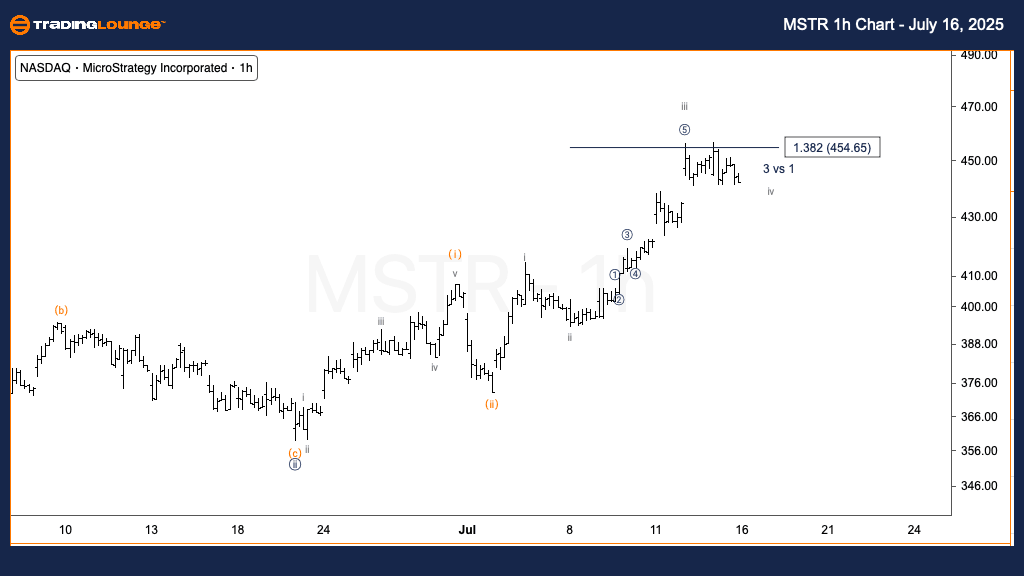

MSTR Elliott Wave technical overview

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave iv of (iii).

Direction: Potential bottom in wave iv.

Details: A final push higher in wave v of (iii) is anticipated.

On the 1-hour chart, MSTR is currently in wave iv of (iii), with recent price action suggesting a possible bottom is forming. The broader impulse structure remains incomplete, implying that wave v of (iii) is yet to unfold. Given the ongoing momentum and impulsive clarity, the short-term trend remains upward, and traders should prepare for the final wave of this bullish sequence.

MSTR Elliott Wave technical overview [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.