MP continues to report operating losses: Can it bounce back?

MP Materials Corp. (MP) has reported operating losses and negative operating margins for consecutive eight quarters, due to escalating costs.

In 2024, the company’s cost of sales nearly doubled to $192.6 million from $92.7 million in 2023. Costs rose to around 94% of revenues in 2024 from just 37% a year earlier. This steep rise was due to higher production costs associated with the initial ramp of production of separated rare earth products.

In the first half of 2025, the cost of sales was up 29% from the year-ago period. Producing separated products is more cost extensive than producing rare earth concentrates due to the additional processing required. These additional costs pertain to chemical reagents, employee labor, maintenance expenses and consumables. The increase in MP Material’s costs also reflects the production of magnetic precursor products, specifically neodymium-praseodymium (NdPr) metal at its Independence Facility.

Selling, general and administrative (SG&A) expenses were up 5% in 2024 as the company expanded its workforce to support the downstream expansion. In the first half of 2025, SG&A expenses were up 21%.

This sharp escalation in both cost of sales and SG&A has driven total operating expenses higher for MP Materials leading to continued operating losses. As the company expands production of separated rare earth products at the Mountain Pass site and ramps up output of magnetic precursor products at the Independence Facility, the cost of sales is expected to stay elevated through 2025. Additionally, SG&A expenses are likely to rise further as MP continues investing in its downstream expansion. This will pressure its margins in the near term.

Meanwhile, NdPr production volumes continue to increase with further progress on process optimization and ramp. This, higher production and sales volumes of NdPr in the ongoing quarter and consequently, sales volumes along with higher pricing, are expected to drive its NdPr revenues higher in the forthcoming quarterly performances. This is likely to provide some respite.

Margin trends of peers

Energy Fuels (UUUU) is a major producer of uranium in the United States and owns the White Mesa Mill, the only operating conventional uranium mill in the country. After making enhancements, the mill started producing separated NdPr in 2024 and has plans to start "heavy" rare earth oxide production by the fourth quarter of 2026.

Energy Fuels witnessed a 48% surge in its cost of sales to $21.8 million in the first half of 2025 due to higher costs related to the mining of lower-grade Heavy Mineral Sand products at the end of the Kwale mine life. Costs were a staggering 103% of its revenues. Total operating expenses surged 78% year over year to $73.5 million in the first half, attributed to a 193% surge in exploration, development and processing expenses and a 118% spike in SG&A expenses. Energy Fuels reported operating losses in both the quarters of 2025 due to lower sales as well as higher costs.

In fiscal 2024, Energy Fuels saw a 208% increase in costs to $55.9 million (72% of its revenues) and total operating expenses had surged 79%. The company had reported an operating loss of $47.5 million in 2024.

Lynas Rare Earths Limited (LYSDY) is engaged in the exploration, development, mining, extraction and processing of rare earth minerals in Australia and Malaysia. Lynas recently reported full-year 2025 results for the year ended June 30, 2025. Cost of sales in fiscal 2025 moved up 29% year over year to AUD 426.7 million ($281.5 million). Costs of sales were 77% of revenues for the year. Lynas reported an operating profit of AUD 6.2 million, ($4.09 million), 92% lower than the prior fiscal.

MP’s price performance, valuation and estimates

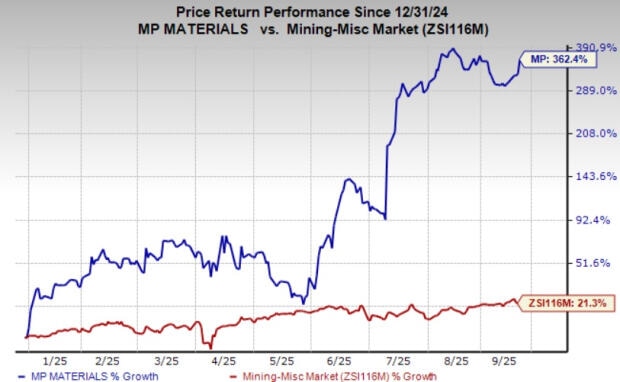

MP Materials’ shares have skyrocketed 362.4% so far this year compared with the industry’s 21.3% growth.

Image Source: Zacks Investment Research

MP is trading at a forward 12-month price/sales multiple of 25.39X, a significant premium to the industry’s 1.18X.

Image Source: Zacks Investment Research

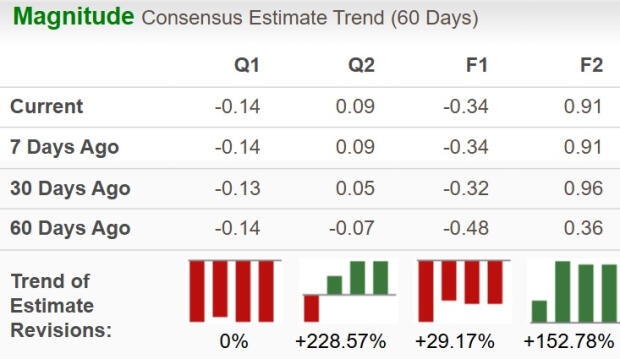

The Zacks Consensus Estimate for MP Materials’ 2025 earnings is pegged at a loss of 34 cents per share. However, the bottom-line estimate for 2026 is pegged at earnings of 91 cents per share, indicating a solid improvement. The estimates for both 2025 and 2026 have moved up in the past 60 days, as shown in the chart below.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Author

Zacks

Zacks Investment Research

Zacks Investment Research provides unbiased investment research and tools to help individuals and institutional investors make confident investing decisions.