Microsoft (MSFT Stock) impulsive bullish sequences forecasting the rally

Hello fellow traders. In this technical blog, we’re going to take a quick look at the Elliott Wave charts of Microfost published in the members' areas of the website. As our members know, Microsoft is showing impulsive bullish sequences and we’ve been calling a rally in the Stock. $MSFT recently made ((4)) pullback. We expected the Stock to find buyers at the extreme zone from the 306.11 peaks. In the further text, we are going to explain the Elliott Wave forecast.

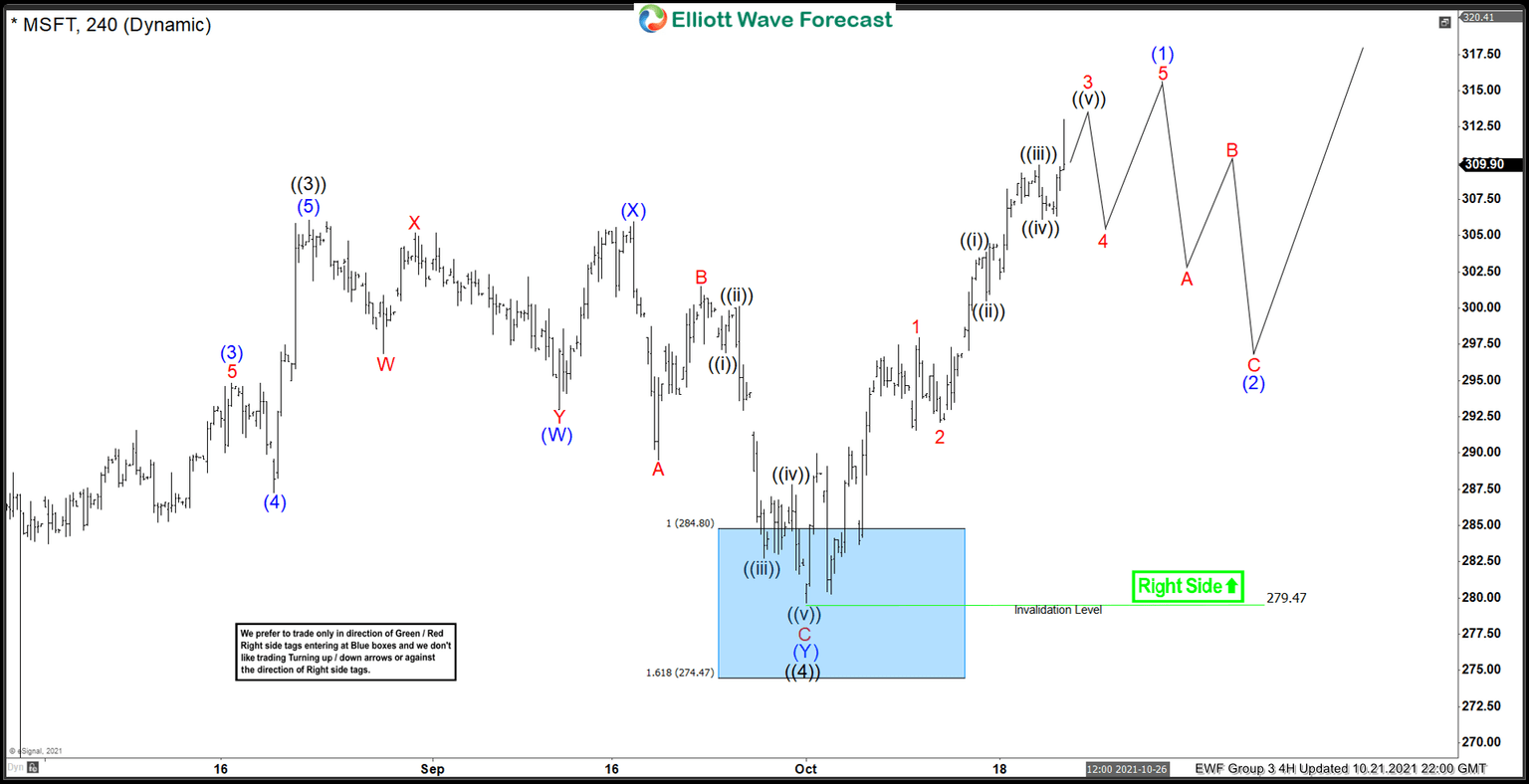

Microsoft Elliott Wave 4 hour chart 09.30.2021

In the chart below we can see ((4)) pullback reached extreme zone Blue Box at 284.8-274.4 area. As the main trend is bullish, we expect buyers to appear at the marked zone for a further rally toward new highs ideally. We don’t recommend selling the Stock and favor the long side from the blue box area. Invalidation for potential long trades would be broken below 1.618 fib ext: 274.47. As the main trend is bullish, we expect to get 3 waves to bounce at least. Once bounce reaches 50 Fibs against the (B) blue high, buyers should ideally make a long position risk-free ( put SL at BE).

As our members know, Blue Boxes are no enemy areas, giving us an 85% chance to get a bounce.

Microsoft Elliott Wave 4 hour chart 10.14.2021

The stock found buyers as we expected. We got a nice reaction from the blue box. At this moment rally exceeded 50 fibs against the (B), so any long trades from the blue box should be risk-free at this stage. Wave ((4)) pullback is completed at 279.47 low. Now we would like to see a break of 08/20 – ((3)) black high, to confirm the next leg up in progress. We don’t recommend selling the stock, while keep favoring the long side.

Microsoft Elliott Wave 4 hour chart 10.21.2021

Eventually, the price broke above the 10/20 peak, confirming the next leg up is in progress. Now the stock is bullish against the 279.47 low. It’s expected to keep finding buyers in 3,7,11 swings.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com