Microsoft (MSFT Stock) hits a fresh record high ahead of its earnings release

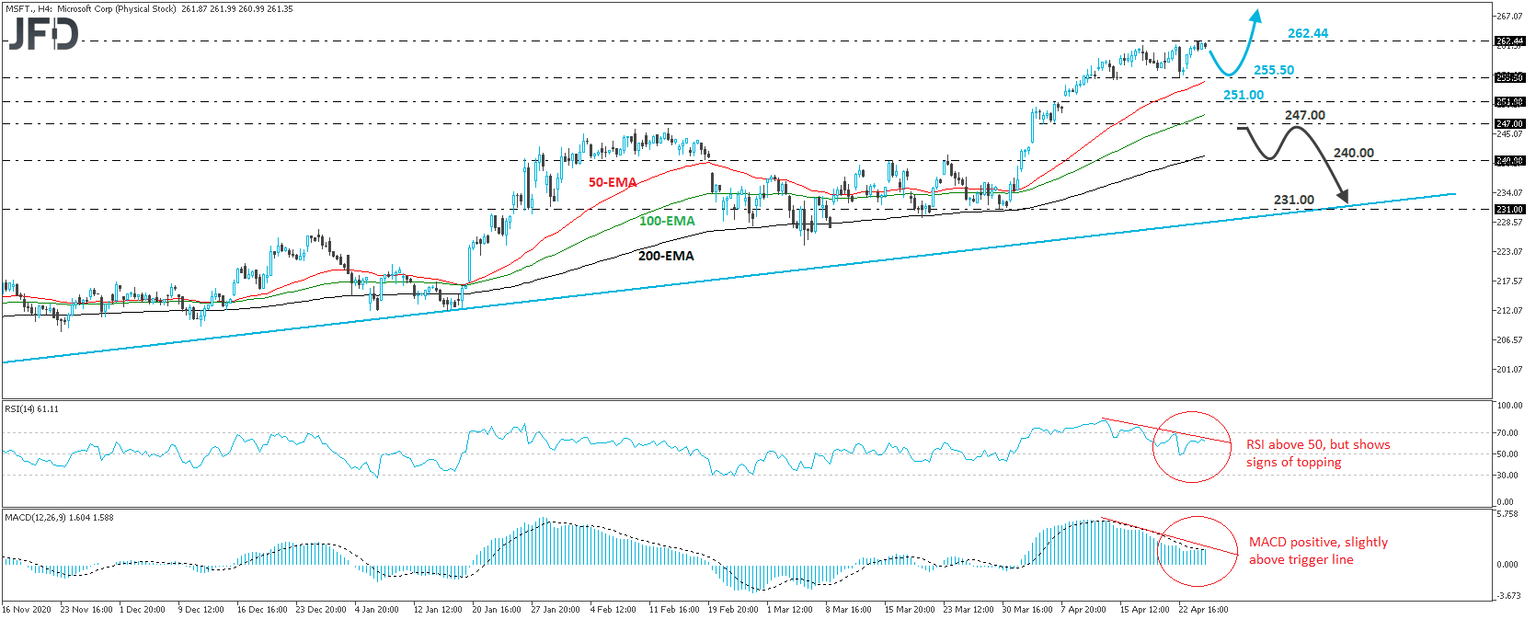

Microsoft Corp. (NASDAQ: MSFT) traded higher yesterday, hitting a new all-time high at 262.44. Then, it continued consolidating below that level for the rest of the session. Overall, the stock remains well above the upside support line drawn from the low of October 30th, and even if it corrects lower, as long as this is the case, we will hold a positive stance.

As we already noted, the stock may slightly pull back, perhaps to test once again Thursday’s low of 255.50. If investors are willing to jump in from that point, we could see a rebound back near the all-time high of 262.44, where a break would take the stock into territories never seen before.

Shifting attention to our short-term oscillators, we see that the RSI, although above 50, shows signs of topping, while the MACD is positive but flat near its trigger line. What’s more, there is negative divergence between both these indicators and the price action. In our view, this increases the chances for the stock to pull back before the next positive leg.

Now, in order to start examining a bigger correction to the downside, we would like to see a dip below 247.00, a support marked by the low of April 7th. This may trigger declines towards the 240.00 zone, which provided resistance on March 16th and 23rd, the break of which could pave the way towards the aforementioned upside line, or the low of March 30th, at 231.00.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

JFD Team

JFD