Mexican Peso depreciates sharply on tariff woes ahead of inflation data

- Mexican Peso pressured despite Bessent’s trade optimism as markets react to US tariff escalation against China.

- Citi survey shows Banxico expected to cut rates by 50 bps in May; growth forecasts revised lower.

- Traders await Mexico CPI and US inflation data with Fed minutes likely to shape rate expectations.

The Mexican Peso prolonged its losses for the third straight day against the Greenback as market sentiment improved, spurred by revelations of US Treasury Secretary Scott Bessent that deals could be made with major trading partners. At the time of writing, the USD/MXN trades at 20.83, up 0.75%.

As of this writing, the global equity sell-off has paused, yet bulls are not out of the woods, even though Bessent's words provide hope. Nevertheless, news broke that the White House confirmed that 104% tariffs on China went into effect at 12:00pm EST

The Peso weakened slightly on the headlines amid a scarce economic docket. USD/MXN traders are awaiting the release of the Consumer Price Index (CPI) for March, which is expected to rise slightly.

Citi Mexico Expectations Survey hints that most economists project further easing by Banco de Mexico (Banxico), which is expected to cut rates 50 basis points (bps) in May. The USD/MXN exchange rate would likely remain below 21.00, and the economy is expected to grow less than expected in the previous survey.

Across the border, Chicago Fed Governor Austan Goolsbee crossed the wires, saying that tariff rates are much more than what the Fed had been modelling. On the data front, the schedule is absent, yet investors are eyeing the release of the Fed’s latest minutes, alongside US CPI and PPI data.

Daily digest market movers: Mexican Peso drops as economists project a deeper economic slowdown

- Citi Mexico Expectations Survey revealed that Banxico will likely cut rates to 8% toward the end of 2025. For the next year, rates are expected to fall to 7%.

- The poll showed that the USD/MXN is projected to end at 20.90, while inflation in 2025 will be 3.80% for the full year and increase from 3.66% to 3.7% by the year’s end.

- Mexico’s Gross Domestic Product (GDP) is expected to grow by 0.3% in 2025, less than the previous survey of 0.6%.

- Banxico’s Governor, Victoria Rodríguez Ceja, stated that the central bank will remain attentive to US trade policies and their impact on the country, with a primary focus on inflation.

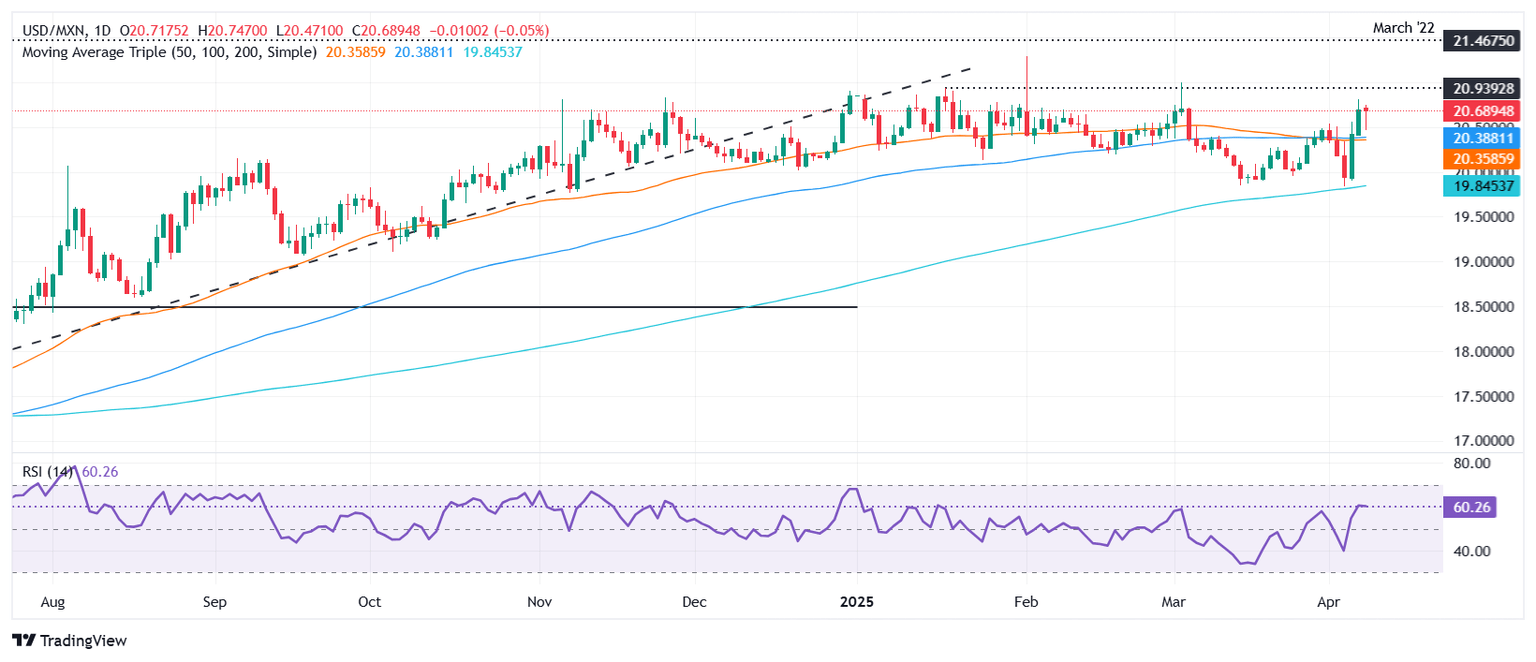

USD/MXN technical outlook: Mexican Peso treads water as USD/MXN surges past 20.70

The uptrend remains in place as the USD/MXN cleared the confluence of the 50-day and 100-day Simple Moving Averages (SMAs) near 20.34/36, keeping the rally alive. On further strength, buyers could challenge the March 4 peak at 20.99, followed by the year-to-date (YTD) high of 21.28.

Conversely, if USD/MXN falls below 20.34, the first support will be the psychological 20.00 figure. A breach of the latter will expose the 200-day SMA at 19.80.

Economic Indicator

12-Month Inflation

The 12-month inflation index released by the Bank of Mexico is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of Mexican Peso is dragged down by inflation. The inflation index is a key indicator since it is used by the central bank to set interest rates. Generally speaking, a high reading is seen as positive (or bullish) for the Mexican Peso, while a low reading is seen as negative (or Bearish).

Read more.Next release: Wed Apr 09, 2025 12:00

Frequency: Monthly

Consensus: 3.8%

Previous: 3.77%

Source: National Institute of Statistics and Geography of Mexico

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.