Mexican Peso trades higher in major pairs at start of week

- The Mexican Peso gains against rivals on Monday.

- The week ahead promises to be busy for traders of the Peso’s key counterparts, given scheduled events and data.

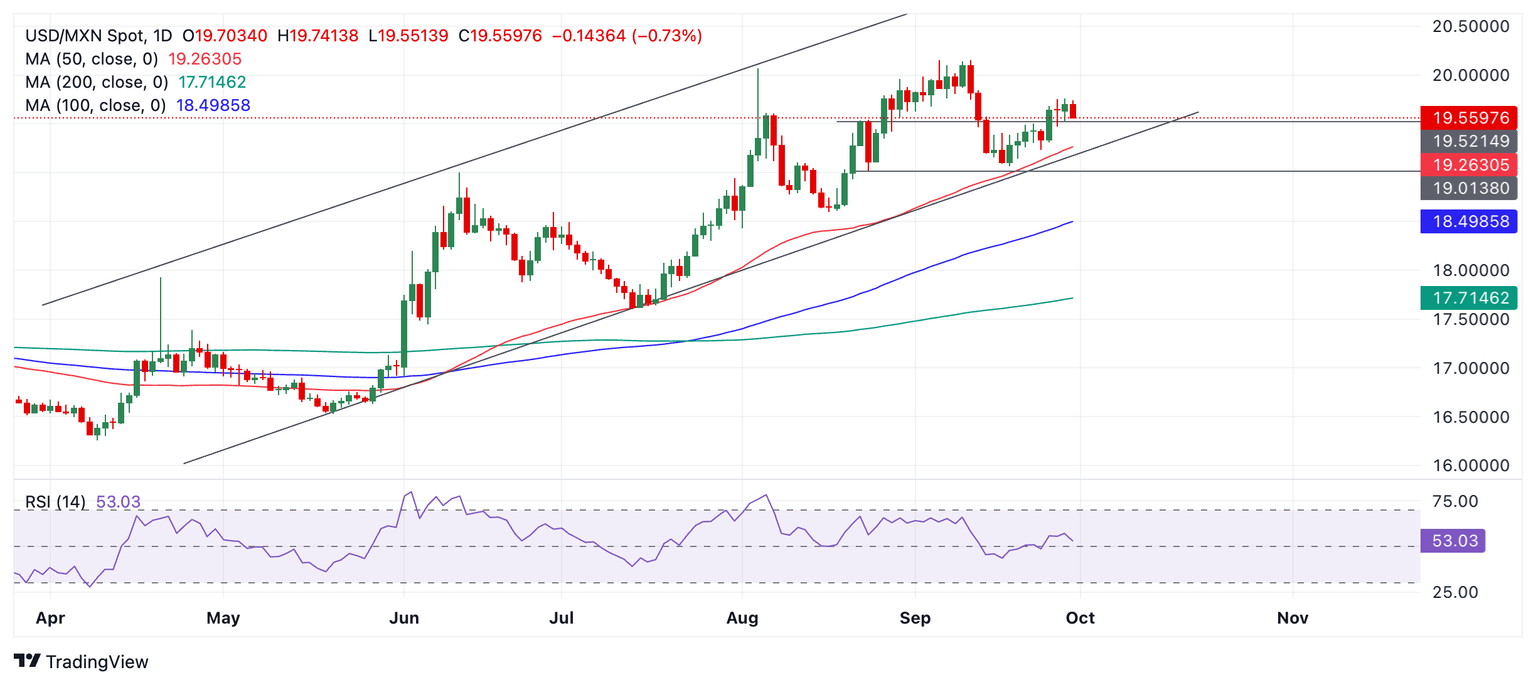

- USD/MXN extends its steady climb within a rising channel.

The Mexican Peso (MXN) rises in its key pairs on Monday after falling an average of 1.5% last week. The Peso is seeing gains against the Euro (EUR) after the release of below-expectations German inflation data indicated the bloc's largest economy might be at risk of a more protracted slowdown than previously thought. The Peso is also making gains against the US Dollar (USD) and the Pound (GBP) amidst a general sell-off in financial markets during the European and the start of the US sessions.

The Bank of Mexico’s (Banxico) decision to cut interest rates by 25 basis points (0.25%) at its September meeting on Thursday, bringing the official cash rate down to 10.50%, as well as a downward revision to its forecasts for the economy, contributed to the Peso’s devaluation last week.

Data showing a widening trade deficit added to the negativity surrounding the Mexican Peso after official figures showed it widened to $4.868 billion in August from $1.278 billion a year ago. These figures significantly exceeded market expectations of a $0.500 billion gap and reached a new two-year high.

The proximity of the United States (US) election and prospects of former President Donald Trump winning and then imposing an “America First” agenda, with negative implications for trade with Mexico, further add to the concerns regarding Mexico’s persistent trade deficit, which amounts to $10.438 billion for the first eight months of 2024.

Mexican Peso traders prepare for data-heavy week

The Mexican Peso recovers on Monday ahead of a busy week of macroeconomic data releases and key events for its major peers – the US Dollar (USD), Euro (EUR) and Pound Sterling (GBP).

On Monday, speeches by European Central Bank (ECB) President Christine Lagarde and Chairman of the Federal Reserve (Fed) Jerome Powell could impact the EUR and USD, respectively. Recent weak data from the Eurozone, in particular, is leading to speculation in markets that the ECB will have to be more aggressive about cutting interest rates to aid growth, potentially weakening the Euro. In Mexico, Fiscal Balance data for August will be released, revealing the government’s spending shortfall.

On Tuesday, preliminary Eurozone inflation data for September, and then the Nonfarm Payrolls (NFP) on Friday, are further key data releases relating to key Peso pairs. The NFP release will be watched closely for signs of a slowdown in the labor market after the Fed made it clear it is now taking into account its mandate to provide full employment as part of its decision-making on interest rates.

Technical Analysis: USD/MXN trends higher within channel

USD/MXN pauses as it climbs steadily higher within its rising channel, continuing its short, medium and long-term bullish trends.

USD/MXN Daily Chart

Friday’s close above 19.68 (September 25 high) provided more bullish certainty of the pair’s near-term upside bias towards a target at 20.15, the high of the year reached in early September.

A further break above 19.76 (the September 27 high) would create a higher high and provide yet more proof of an extension of the uptrend.

Economic Indicator

Central Bank Interest Rate

The Bank of Mexico announces a key interest rate which affects the whole range of interest rates set by commercial banks, building societies and other institutions for their own savers and borrowers. Generally speaking, if the central bank is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the Mexican Peso.

Read more.Last release: Thu Sep 26, 2024 19:00

Frequency: Irregular

Actual: 10.5%

Consensus: 10.5%

Previous: 10.75%

Source: Banxico

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.