Mexican Peso strengthens on inflation spike, post US-UK trade deal

- Mexico’s inflation accelerates in April, but Banxico’s Heath signals easing path to continue.

- USD/MXN pressured by improved risk sentiment after US-UK trade deal lifts EM currencies.

- Despite strong US jobless claims data, US Dollar remains muted ahead of Friday’s Fed commentary.

The Mexican Peso advanced on Thursday against the Greenback as prices in Mexico accelerated near the top of Banco de Mexico’s (Banxico) inflation tolerance range. Additionally, an improvement in risk appetite due to the US/UK trade deal increased Peso’s appeal. At the time of writing, the USD/MXN trades at 19.55, down 0.15%.

Inflation in Mexico accelerated in April, as revealed by the Instituto Nacional de Estadística, Geografía e Informática (INEGI). Although this suggested caution by Banxico, its Deputy Governor, Jonathan Heath, said that it is highly probable the central bank will continue to lower its interest rates, even though inflation risks are skewed to the upside.

Heath added that in the second half of 2025, the decision would be taken with more caution, adding that there is room for easing policy. In the meantime, market participants seem confident that Banxico will cut rates by 50 basis points at the May 15 meeting.

In the US, President Donald Trump announced a trade deal with the UK, which market participants perceived as positive news, and supported the emerging market (EM) currency. Wall Street extended its gains on Thursday, ahead of a busy schedule for Fed officials on Friday, which are expected to grab headlines amid an absent economic docket.

Data-wise, the number of Americans filling for unemployment benefits was lower than expected, indicating a robust labor market. Despite this, the USD/MXN failed to gain traction, remaining muted during the day and confined to the 19.50-19.61 range.

Daily digest market movers: Mexican Peso holds firm as sentiment improves

- Following the Fed’s decision, data from the Chicago Board of Trade (CBOT) suggests that traders are pricing 67 bps of easing toward the end of 2025.

- Mexico’s April CPI rose by 3.93% YoY, above the 3.90% forecast and up from 3.80% compared to last year’s range. Core CPI increased by 3.93%, up from 3.64%, exceeding estimates of 3.92%.

- The Citi Mexico Expectations Survey indicates that most analysts expect Banxico to cut rates by 50 bps at the May 15 meeting.

- The US Initial Jobless Claims for the week ending May 3 came in at 228K, slightly below the expected 230K and an improvement from the prior week's 241K, according to the Department of Labor. The data signals a modest rebound in labor market stability.

- Although Mexico’s economy narrowly avoided a technical recession, tariffs imposed on Mexican products, a reduced budget, and geopolitical uncertainties will continue to strain the country’s finances and impact the Peso.

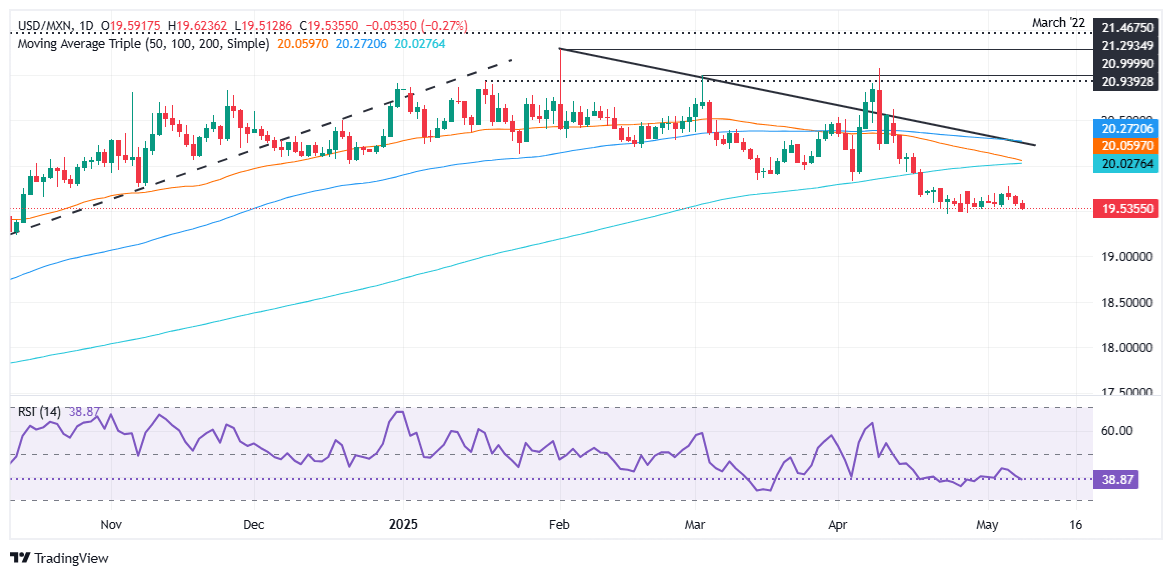

USD/MXN technical outlook: Mexican Peso loses steam as USD/MXN consolidates

The USD/MXN is bearishly biased, though sellers had failed to drag the exchange rate past the current year-to-date (YTD) low of 19.46. This suggests bears’ lack of strength, clearing the path for a recovery.

Momentum remains bearish, yet the Relative Strength Index (RSI) flattish slope confirms consolidation ahead.

If USD/MXN drops below 19.46, the next support would be the 19.00 psychological figure. Conversely, if USD/MXN climbs past 19.78, expect a test of the 200-day SMA at 19.98. A breach of the latter will expose the 20.00 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.