Mexican Peso weakens further after Republicans take Congress

- The Mexican Peso is resuming its downtrend after Republicans have won a majority in Congress.

- This will augment their power to push through radical fiscal and immigration policies that could be detrimental to the Peso.

- USD/MXN closes in on the November high after rebounding from the base of a rising channel.

The Mexican Peso (MXN) resumes the slide in its key pairs on Thursday after briefly pausing on Wednesday following the release of US inflation data. Republicans winning a majority in the US Congress is weighing on the Peso as it gives the party a “clean sweep” of the Presidency, the US Senate, and the House of Representatives. This will augment its power to push through policies, many of which the market is assessing as directly negative to the Peso (or positive for the US Dollar (USD)).

A more immediate bearish factor for the Peso comes in the form of market expectations that the Bank of Mexico (Banxico) will cut its main interest rate by 25 basis points (bps) (0.25%) to 10.25% at its meeting on Thursday. In a Reuters survey, 19 out of 20 economists said they expected Banxico to cut by 0.25% at the meeting, according to Christian Borjon Valencia, Editor at FXStreet.

Mexican Peso faces headwinds from US protectionism

The Mexican Peso continues to face broader headwinds from the prospect of increased US protectionism under the leadership of President-elect Donald Trump. The imposition of tariffs on Mexican imports and the threat to deport millions of illegal workers who regularly send remittances home are both likely to reduce demand for the Peso.

The Peso steadied on Wednesday amid US Dollar weakness after the US Consumer Price Index (CPI) in October aligned with economists’ expectations. This solidified expectations that the US Federal Reserve (Fed) will cut interest rates by a quarter of a percent (25 bps) at its meeting in December. This, in turn, restrained the strength of the US Dollar since lower interest rates reduce foreign capital inflows – and gave the Peso some breathing space.

Comments from Mexican Finance Minister Marcelo Ebrard further supported the MXN after he said on Wednesday that the level of Foreign Direct Investment (FDI) in Mexico likely hit a new record high of $35.732 billion in 2024, according to El Financiero. Ebrard also hit back at suggestions from Canada’s Prime Minister of Ontario, Doug Ford, that the US and Canada should sign their own private free trade deal, saying that it was better for the Canadian economy to include Mexico, thereby maintaining the current USMCA tripartite agreement.

Technical Analysis: USD/MXN closes in on November high

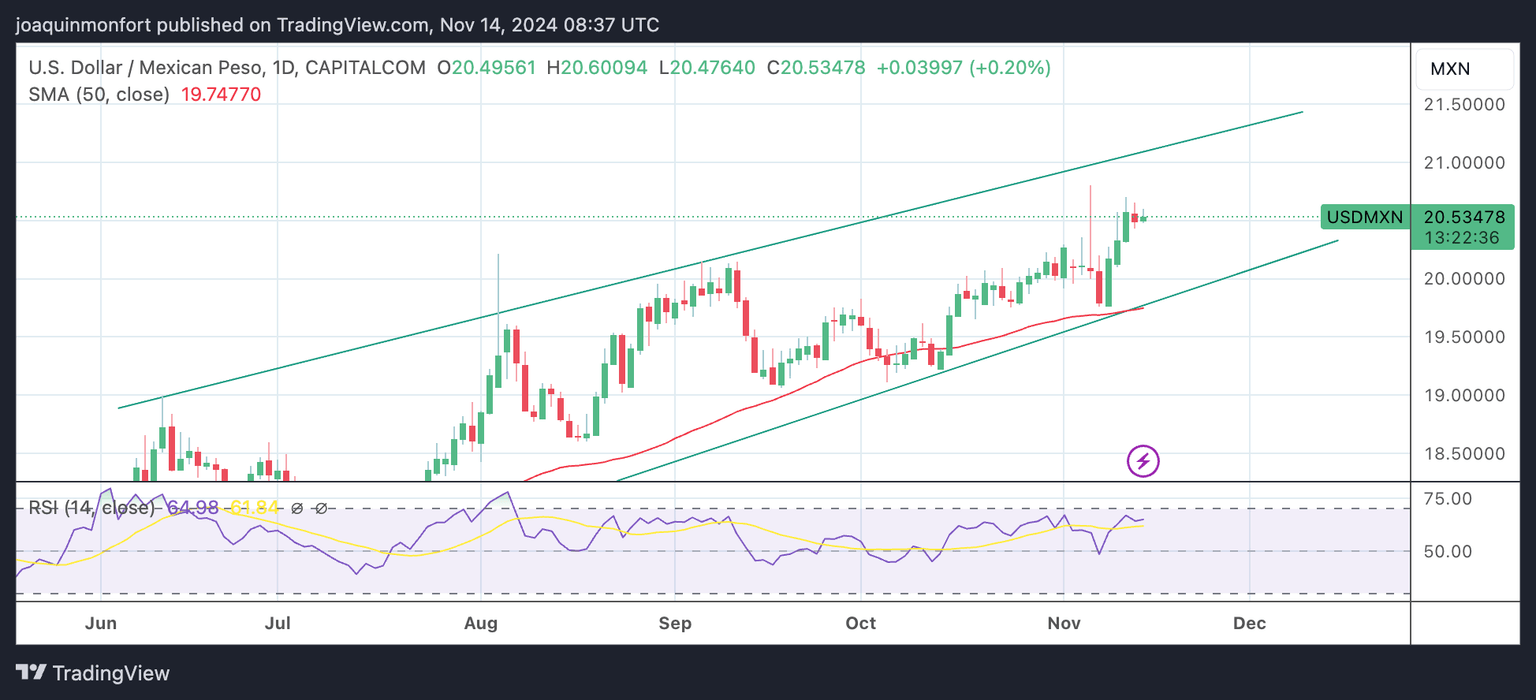

USD/MXN resumes its rally within a rising channel after a brief pause. The short-term trend is bullish, and given the technical analysis saying that “the trend is your friend,” the odds favor a continuation higher.

USD/MXN Daily Chart

USD/MXN is also in an uptrend on a medium and long-term basis, adding weight to the move higher. A break above 20.80 (November 6 high) would confirm a higher high and an extension of the bullish trend. The next upside target lies at 21.00 (round number, upper boundary of channel), where buyers could start to meet resistance.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.