Mexican Peso surges despite Powell's cautious tone on economy

- Mexican Peso appreciates 0.58% as USD/MXN dips below 20.00 on sour risk tone, weak US Dollar.

- Powell signals caution on inflation, notes downside risks and solid labor market; Fed seen holding rates steady.

- China’s Q1 GDP beats forecasts, boosting EM currencies; chip export curbs hit US tech sector and NASDAQ.

- Sheinbaum downplays US tomato tariffs, says Mexico remains key supplier amid trade tensions.

The Mexican Peso continues to appreciate against the US Dollar as market appetite remains sour, while Fed Chair Jerome Powell emphasized that he remains slightly focused on inflation as the economy is near maximum employment. At the time of writing, the USD/MXN trades at 19.96, down 0.58%.

The market mood is downbeat as fears about tariffs remain. The US imposing restrictions on chip exports to China weighed on major semiconductor companies, sending the tech-heavy NASDAQ drifting lower. Despite this, China’s reported better-than-expected Gross Domestic Product (GDP) figures in Q1 2025 sponsored a leg-up on emerging market (EM) currencies like the Peso.

Powell said that policy is well-positioned, adding that the economy is “solid” despite uncertainty and downside risks. He stated that growth likely slowed for Q1 2025, engendering the possibility of a stagflationary scenario, after saying, “The Fed's two goals are not yet in tension, but the impulse is for higher unemployment and higher inflation.”

Meanwhile, Mexico’s President, Claudia Sheinbaum, continued negotiating with her US counterpart to avoid Trump's higher tariffs and said that 20.91% tariffs on tomatoes are not going to happen. She added, “This process has been done many times, and Mexico has always won. But even if this sanction were to be applied, Mexican tomatoes would still continue to be exported to the United States because there's no substitute; the main problem would be that tomatoes would be more expensive in the United States.”

Across the northern border, US Retail Sales fared better than expected, while US Industrial Production contracted more than foreseen.

Ahead in the docket, Mexico will feature Retail Sales, mid-month inflation for April, and Economic Activity for February until the next week. In the US, housing and Initial Jobless Claims data will be revealed on Thursday.

Daily digest market movers: Mexican Peso advances amid absent economic docket

- Mexico’s Retail Sales in January were 0.6% MoM and 2.7% YoY. If the data falls below those figures, it would be another signal that the economy is slowing down, as Banco de Mexico (Banxico) Governor Victoria Rodriguez Ceja mentioned.

- Before the Senate, Victoria Rodriguez Ceja said the Governing Board is still unsatisfied with the inflation rate, which stood at 3.8% YoY in March, though far from the 3% target. She added that the disinflation process and the economic slowdown justify Banxico’s dovish approach and hinted that the central bank might continue easing policy.

- A reduction of the interest rate differential between Mexico and the United States, suggests that further upside is seen in the USD/MXN exchange rate. This is because Banxico is expected to reduce rates by 50 basis points (bps) at the May meeting, while the Fed’s first move is projected for July.

- Money market players had priced in 91 bps of easing by the Fed toward the end of 2025. The first cut is expected in July.

- US Retail Sales rose 1.4% MoM in March, beating expectations of 1.3% and were sharply higher than February’s 0.2%, driven by strong auto sales. However, the control group, which feeds into GDP calculations, increased by only 0.4%, down from 1.3% in February and below the 0.6% forecast.

- The Federal Reserve revealed that US Industrial Production fell 0.3% following an increase of 0.8% in February.

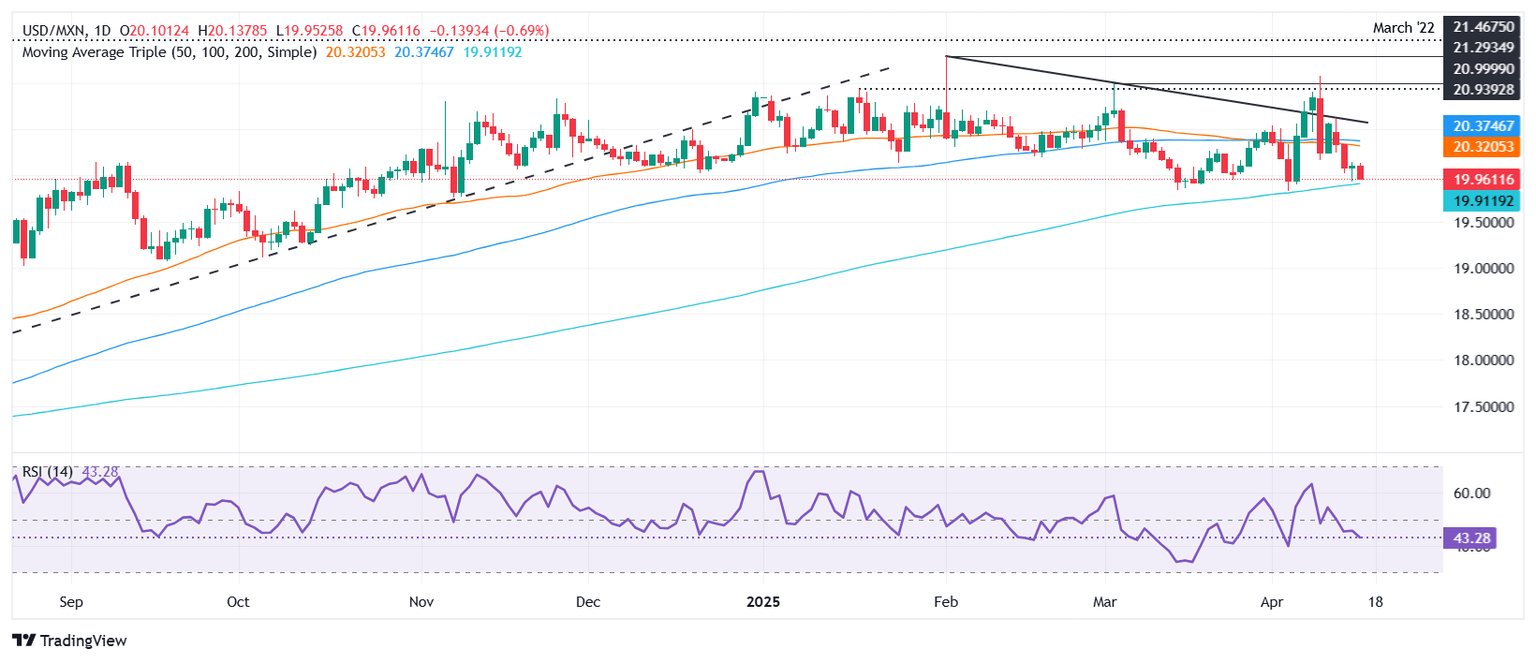

USD/MXN technical outlook: Mexican Peso gains ground as USD/MXN tumbles below 20.00

The USD/MXN uptrend remains intact, although the pair drifts below the 20.00 level. Sellers seem poised to test the 200-day SMA at 19.86, but they will need to clear it on a daily closing, so they could remain hopeful of challenging the 19.50 figure. In that outcome, the next support would be 19.00.

Conversely, if buyers push the USD/MXN exchange rate above 20.00, this could open the door to test the April 14 high of 20.29, which would open the door to the 50-day and 100-day SMA confluence near 20.30–20.36, followed by the 20.50 resistance. Clearing those levels could lead to a retest of the April 9 peak at 21.07.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.