Mexican Peso holds firm despite Powell ouster talk, USD/MXN below 20.00

- Mexican Peso shrugs off modest rebound in USD as market distrust in Fed independence.

- USD/MXN edges up 0.05% after Peso’s 3% rally last week, fueled by political turmoil in Washington.

- Sheinbaum says no deal yet with Trump on tariffs, defends Mexico’s trade position on steel and aluminum.

- Key Mexico data ahead: Retail Sales, mid-April inflation, and economic activity will set tone for Peso direction.

The Mexican Peso erased some of its earlier gains, yet it remains poised to continue to gain ground against the US Dollar as investors keep the Greenback bid after US President Donald Trump's comments that he could oust Federal Reserve (Fed) Chair Jerome Powell rattled the markets. The USD/MXN trades at 19.71, up 0.05%.

Last week, the Peso registered close to 3% gains, with the USD/MXN falling from 20.29 to 19.70 as market participants sold the US Dollar due to their lack of confidence in policymakers. The trade war weighed on the Greenback as the US Dollar Index (DXY), which tracks the performance of the American currency against six others, fell 1.06% to 98.35.

Mexico’s President Claudia Sheinbaum commented that there is not an agreement with Trump about lifting US tariffs. She said, “We didn’t reach an agreement, but we did establish our arguments. In the case of steel and aluminum, we established that we have a deficit. The US exports more steel and aluminum to Mexico than Mexico to the US.”

Mexico’s economic docket will be busy this week, with traders awaiting the release of Retail Sales, Mid-month inflation, and Economic Activity data.

Mexican products have dodged most tariffs. Nevertheless, US imports of steel, aluminum cars and auto parts remain subject to 25% duties. Last week, Washington decided to apply 21% tariffs on tomatoes.

Daily digest market movers: Mexican Peso stays firm amid absent economic docket

- Postures between Banco de Mexico (Banxico) and the Fed favor further upside in the USD/MXN. At the May meeting, Banxico is expected to lower interest rates by 50 basis points (bps). On the contrary, the Fed is seen as cautious, as some officials have shown concerns about a reacceleration of inflation spurred by tariffs.

- Mexico’s Mid-month inflation is expected to rise from 3.67% to 3.79% YoY and core figures to increase from 3.56% to 3.77% YoY.

- Economists project that the Mexican economy will most likely improve in February after contracting -0.2% MoM in January and will expand by 0.6%. Every year, the economy is projected to contract sharply from -0.1% to -0.6%.

- Banxico Governor Victoria Rodriguez Ceja said the central bank is ready to continue easing policy.

- Money market players have priced in 96 bps of Fed easing toward the end of 2025 with the first cut expected in July.

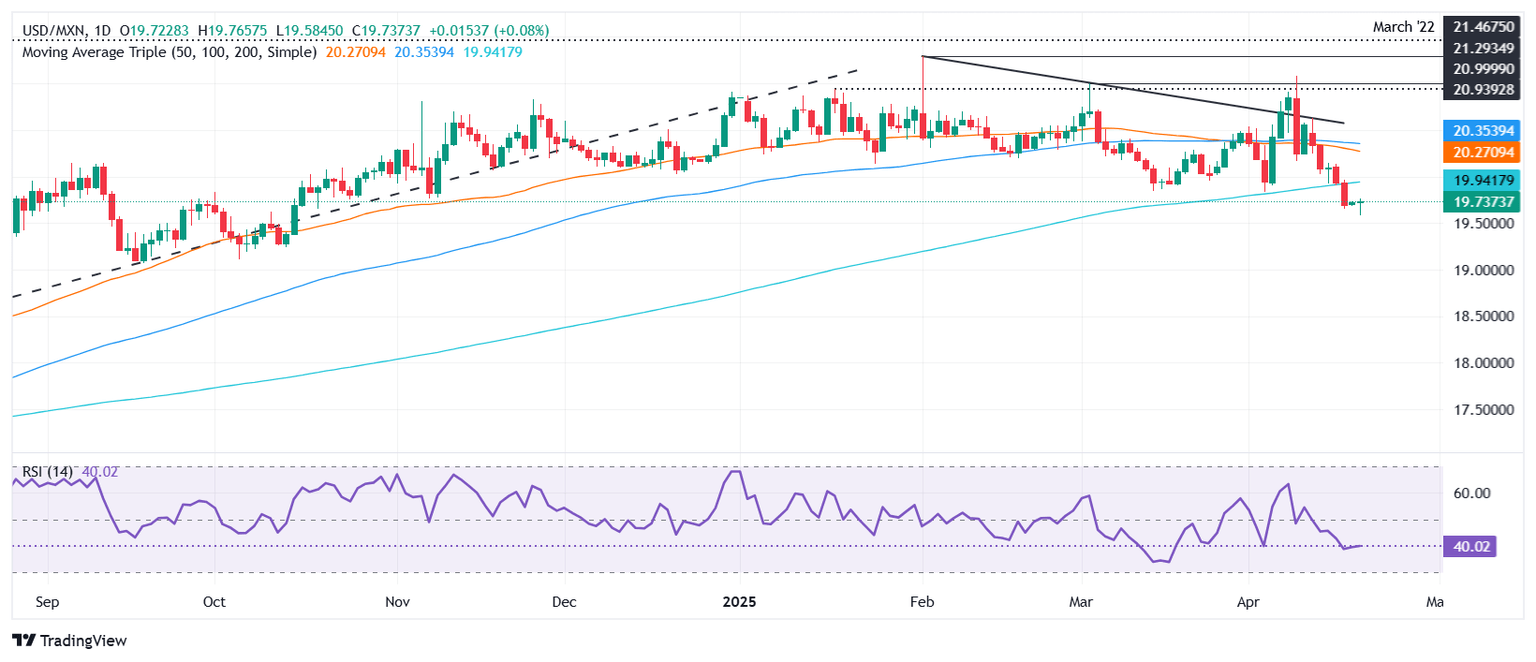

USD/MXN technical outlook: Mexican Peso holds firm as USD/MXN stays below 20.00

The USD/MXN turned bearish after it dropped below the 200-day Simple Moving Average (SMA) of 19.89. This exacerbated the drop toward 19.58, a five-month low, before paring some losses. The Relative Strength Index (RSI) has shown that sellers are losing momentum, opening the door for buyers to challenge the 200-day SMA.

A breach of the latter will expose the psychological 20.00 barrier. If cleared, the next stop would be the confluence of the April 14 high and the 50-day SMA near 20.25-20.29 before testing the 100-day SMA at 20.33.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.