Mexican Peso rallies amid soft US Dollar, eyes on Trump speech

- Mexican Peso gains 0.53% despite weak Mexican data, supported by broad USD softness after gloomy US data.

- Markets now price in 79 bps of Fed rate cuts by end-2025, adding pressure to the Greenback.

- Eyes on as Trump prepares to unveil new tariffs; Mexico’s Gross Fixed Investment data also in focus.

The Mexican Peso (MXN) recovers some ground on Tuesday as traders brace for “Liberation Day” on Wednesday, when the United States (US) President, Donald Trump, is expected to announce additional tariffs aimed at reducing the trade deficit. Earlier, US economic data painted a gloomy economic outlook, which weighed on the Greenback as reflected by the USD/MXN pair trading at 20.35, down 0.53%.

Mexico’s economic docket revealed that Business Confidence deteriorated in March, according to the Instituto Nacional de Estadística Geografía e Informática (INEGI). Other data by S&P Global reported that manufacturing activity contracted for the ninth consecutive month, reaching its lowest level in three years.

Although the data suggest that Mexico’s economy is slowing down, the Peso benefits from broad US Dollar (USD) weakness, ahead of Trump’s announcement on Wednesday.

In the meantime, the Greenback weakened due to a softer-than-expected ISM Manufacturing PMI print in March, alongside a drop in job vacancies, as revealed by the February Job Openings and Labor Turnover Survey (JOLTS) report.

After the data release, market participants began to price in 79 basis points (bps) of easing by the Federal Reserve (Fed) toward the end of 2025.

This week, Mexico’s economic agenda will include Gross Fixed Investment data. In the US, traders are focusing on the Trump tariff announcement, the ISM Services PMI for March, Nonfarm Payroll figures, and Fed Chair Jerome Powell's speech.

This week, the Mexican economic schedule will feature Business Confidence, S&P Global Manufacturing PMI, and Gross Fixed Investment figures.

Daily digest market movers: Mexican Peso recovers as US Dollar weakens

- Mexico’s Business Confidence in February deteriorated sharply, according to INEGI. Confidence fell to 49.9, down from 50.4 in February, indicating that companies are becoming increasingly pessimistic about the economy, with the result being its lowest level since May 2021.

- Mexico’s S&P Global Manufacturing PMI remained in contractionary territory for the ninth consecutive month, at 46.5, which is worse than February’s 47.6.

- US ISM Manufacturing PMI plunged from 50.3 to 49 in March. Comments of the survey suggest that tariffs are the main driver in most sub-components of the index.

- JOLTS data reported by the US Department of Labor revealed that vacancies decreased in February but remained near the previous level, according to the release. The figures came in at 7.568 million, down from 7.762 million and missing the estimate of 7.63 million.

- In the US, S&P Global revealed that manufacturing activity expanded, with the PMI rising from 49.8 to 50.2.

- Banxico’s Governor, Victoria Rodríguez Ceja, stated that the central bank will remain attentive to US trade policies and their impact on the country, with a primary focus on inflation, as she noted in an interview with El Financiero.

- JP Morgan supports an additional 50 bps cut due to the risks of an imminent recession, according to analyst Steven Palacio at the bank.

- “It's inevitable that Mexico will go through a recession because the tariffs and the uncertainty surrounding their implementation are occurring in an economic context that was already in sharp decline,” Palacio said.

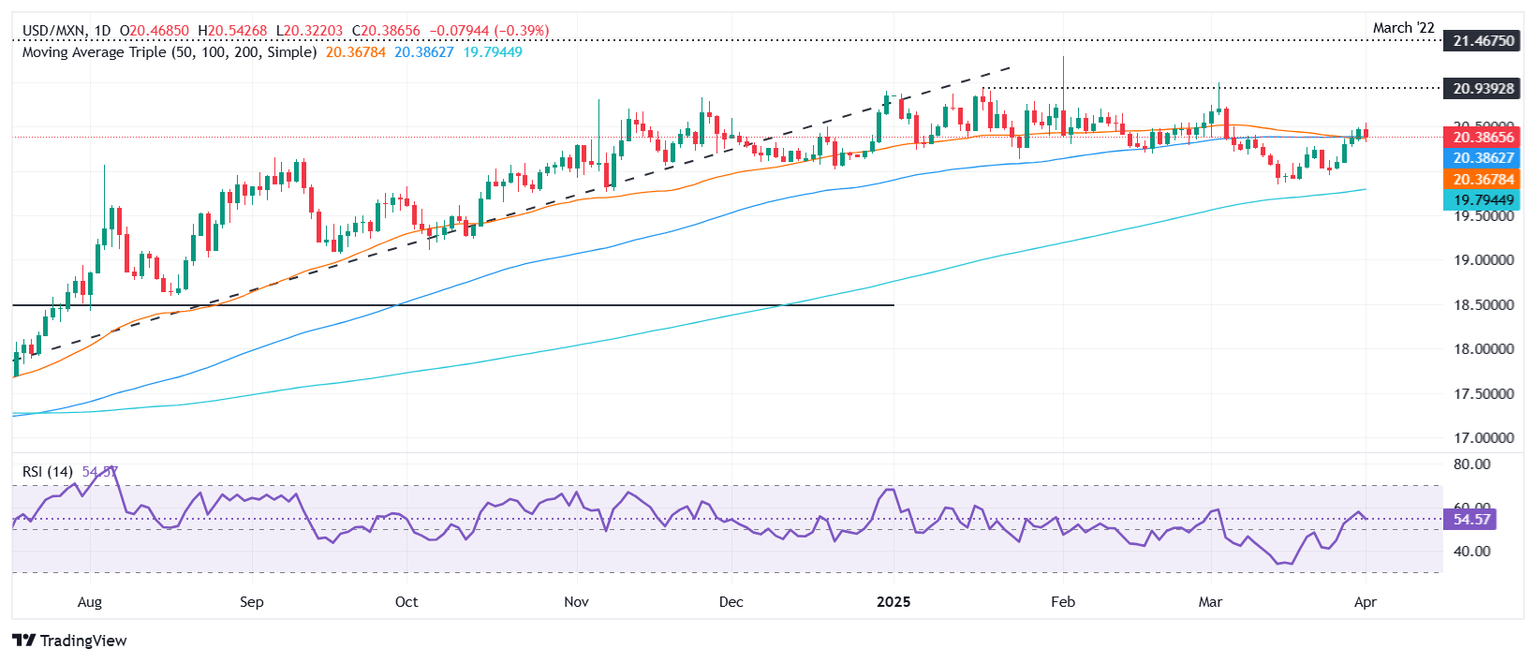

USD/MXN technical outlook: Mexican Peso advances water as USD/MXN tumbles below 20.40

The uptrend in USD/MXN remains intact even though the pair dipped to the confluence of the 100 and 50-day Simple Moving Averages (SMAs) near 20.35/36. Momemntum remains bullish, but in the short term, the Relative Strength Index (RSI) aims lower, an indication that sellers are gathering pace.

If USD/MXN drops below 20.30, the next support would be 20.00, followed by the 200-day SMA at 19.75. On the other hand, if buyers reclaim 20.50, the next resistance would be the March 4 peak of 20.99, followed by the year-to-date (YTD) high of 21.28.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.