Mexican Peso firms as softer US data boosts risk appetite

- Mexican Peso appreciates as USD/MXN slips to 19.56 on hopes for US tariff relief.

- Wall Street gains spark demand for riskier assets like the Mexican Peso.

- Trump hints at easing auto tariffs; potential trade deals with India or South Korea eyed.

- Traders await Mexico’s Q1 GDP and US Core PCE data for fresh direction.

The Mexican Peso (MXN) appreciated against the US Dollar (USD) after touching a daily low of 19.65, as risk appetite improved following the release of softer-than-expected data. At the time of writing, USD/MXN trades at 19.56, down 0.12%.

Wall Street closed with gains, depicting an upbeat market mood and appetite for risk-sensitive currencies like the Peso. The Wall Street Journal revealed that US President Donald Trump might soften the impact of automotive tariffs. Traders cheered this and US Commerce Secretary Howard Lutnick's comments about a trade deal pending approval, which, according to the WSJ, could be with India or South Korea.

In the US, the agenda featured the US Job Labor and Turnover Survey (JOLTS) report for March, which was dismal and missed estimates. At the same time, US Consumer Confidence deteriorated in April, with households growing pessimistic about future expectations on the economy.

In Mexico, the economic docket was absent on Tuesday as traders await the release of Gross Domestic Product (GDP) figures for the first quarter of 2025. On the US as well, USD/MXN traders are eyeing the release of GDP figures for the first quarter and the Federal Reserve’s (Fed) preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Mexican Peso edges up awaiting GDP data

- Mexico’s economic data revealed on Monday showed that the Balance of Trade printed a surplus and that labor market conditions remain solid as the Unemployment Rate ticked lower in March compared to February

- Economic data revealed last week showcasing the ongoing economic slowdown as Retail Sales in February missed estimates. However, not all has been said, as traders await GDP for Q1.

- The latest inflation report showed that prices edged up in the first half of April, revealed INEGI.

- Last week, Banxico’s Deputy Governor Omar Mejia Castelazo revealed that the economy has been undergoing a slowdown since Q4 2023, he said in Washington.

- According to Citi Mexico's expectations survey, Mexico’s economy is expected to grow 0.2% in 2025, below the 0.3% projected in the prior survey.

- The US Department of Labor reported that JOLTS job openings dropped to 7.192 million in March, the lowest since September, missing the 7.5 million forecast and down from 7.48 million previously, pointing to softening labor demand.

- Similarly, the Conference Board’s Consumer Confidence Index fell sharply to 86.0 in April, its lowest in nearly five years, down from 93.9 and below the 87.5 estimate, highlighting growing consumer pessimism.

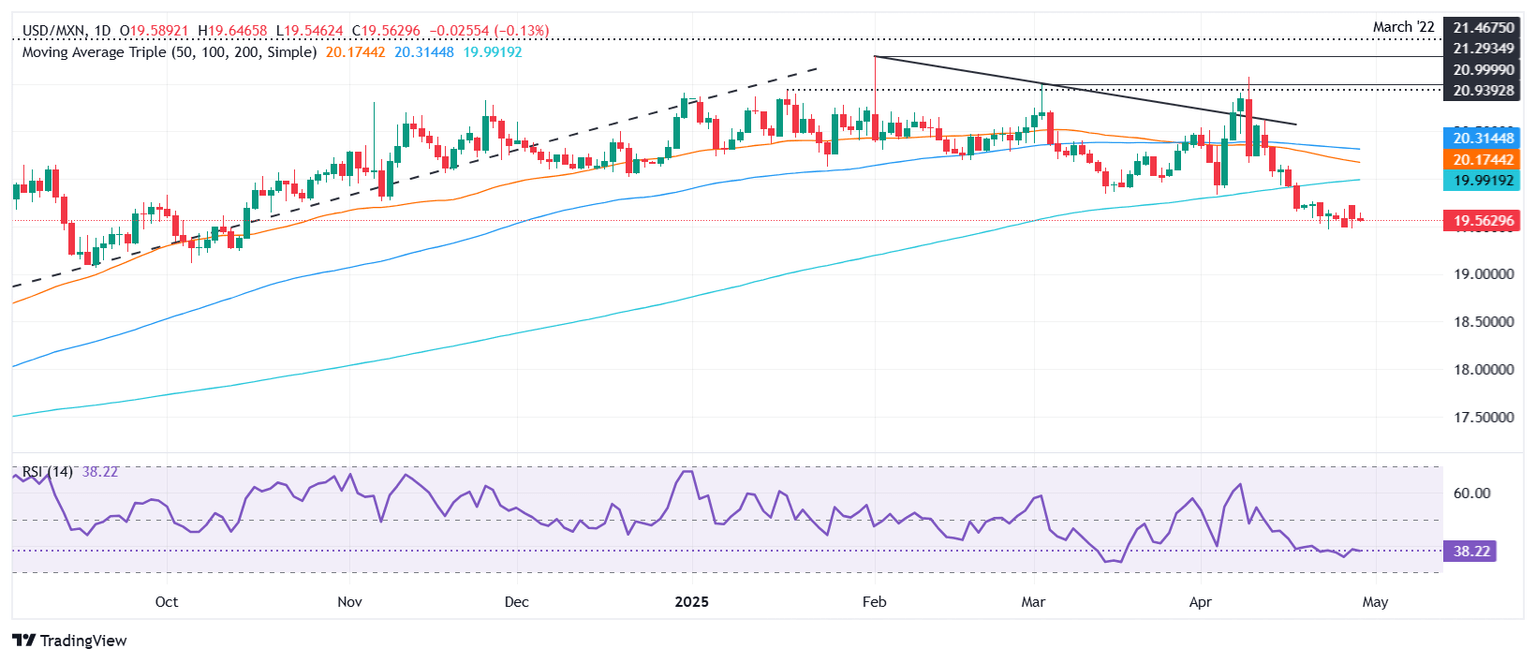

USD/MXN technical outlook: Mexican Peso remains bullish as USD/MXN stays below 200-day SMA

USD/MXN remains downward biased after breaking below the 200-day Simple Moving Average (SMA) at 19.94, fueling the drop toward yearly lows at 19.46. Sellers remain in control, but a daily close below 19.46 is needed to open the door for a test of the 19.00 psychological level.

On the flip side, a move back above the 200-day SMA could allow buyers to retake momentum, targeting 20.00 initially, followed by the 20-day SMA at 20.15 if momentum builds.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.