Mexican Peso trades lower as government looks to pass key reform bill

- The Mexican Peso trades slightly lower amid investor concerns the government will pass through a controversial judicial reform bill.

- Rumors an opposition senator has crossed the floor and will vote with the government are weighing.

- USD/MXN continues rising in a bullish channel.

The Mexican Peso (MXN) trades marginally lower on Tuesday, maintaining the steady bear trend established in its key pairs since April. The Peso is weakening amid investor concerns the government will successfully vote through a controversial judicial reform bill in the country’s upper house, the Senate.

MXN is also facing pressure following the release of lower inflation data for August, which increases the chances the Bank of Mexico (Banxico) will cut interest rates at its next meeting. This would be negative for the Peso as lower interest rates reduce foreign capital inflows.

On the upside, the Peso could be finding support from long-term geopolitical shifts amid deeper global trade fragmentation, after former President Donald Trump threatened to impose tariffs on countries who refuse to trade in the US Dollar (USD) if he is elected as President. Such a move, however, could place Mexico in a strong position as an intermediary.

Over recent days, Trump has recovered after lagging in opinion polls ahead of a key televised presidential debate with rival US Vice President Kamala Harris, scheduled for Tuesday.

Mexican Peso faces heat on rumors opposition senator could dissent

The Mexican Peso is under pressure as the Mexican government gets closer to voting through a bill of reforms to the judiciary that will allow judges to be elected rather than appointed. Most investors view these reforms as potentially negative for inbound investment and the economy.

The bill is now being debated in the Senate, where the government is one seat short of the majority necessary to vote it through. However, rumors that a member of the (PAN) opposition party, Miguel Angel Yunes, is considering crossing the floor to vote alongside the government suggest there is a good chance the reforms will pass, according to El Financiero. Lawmakers will vote on the bill either on Tuesday or Wednesday. The result is likely to impact the Mexican Peso.

Several big-name investors have come out against the reforms, including US investment banking giant Morgan Stanley. More recently, Julius Baer warned that rating agencies could change Mexico’s creditworthiness as soon as next year if the judicial reform is approved. Erini Tsekeridou, a fixed-income analyst, said, “although the economic impact is not yet fully clear, markets are concerned about the potential weakening of the rule of law and the concentration of judicial and executive power, which would reduce oversight and accountability,” according to Christian Borjon Valencia, Analyst at FXStreet.

“Julius Baer added their name to Morgan Stanley, Bank of America, JP Morgan, Citibanamex and Fitch ratings warnings of the economic and financial impact regarding the approval of judicial reform,” added Borjon Valencia in his report.

August Mexican inflation data shows price gains cooling more than expected

The Mexican Peso is further weighed after data out on Monday showed 12-month headline inflation in Mexico fell to 4.99% in August from 5.57% in July, according to INEGI. The result was below economists' forecasts of 5.09%.

Core Inflation, meanwhile, fell to 4.00% from 4.05% over the same period.

The data reinforces expectations that Banxico will cut interest rates by 0.25% at its next meeting, bringing the official bank rate down to 10.50%.

“The larger-than-expected fall in Mexico’s headline inflation rate, to 5.0% y/y in August, alongside the likelihood of a Fed rate cut next week, mean that Banxico is on track to lower its policy rate by another 25bp at its meeting later this month,” said Kimberley Sperrfechter, Emerging Markets Economist at Capital Economics.

At the time of writing, one US Dollar (USD) buys 19.95 Mexican Pesos, EUR/MXN trades at 22.00, and GBP/MXN at 26.09.

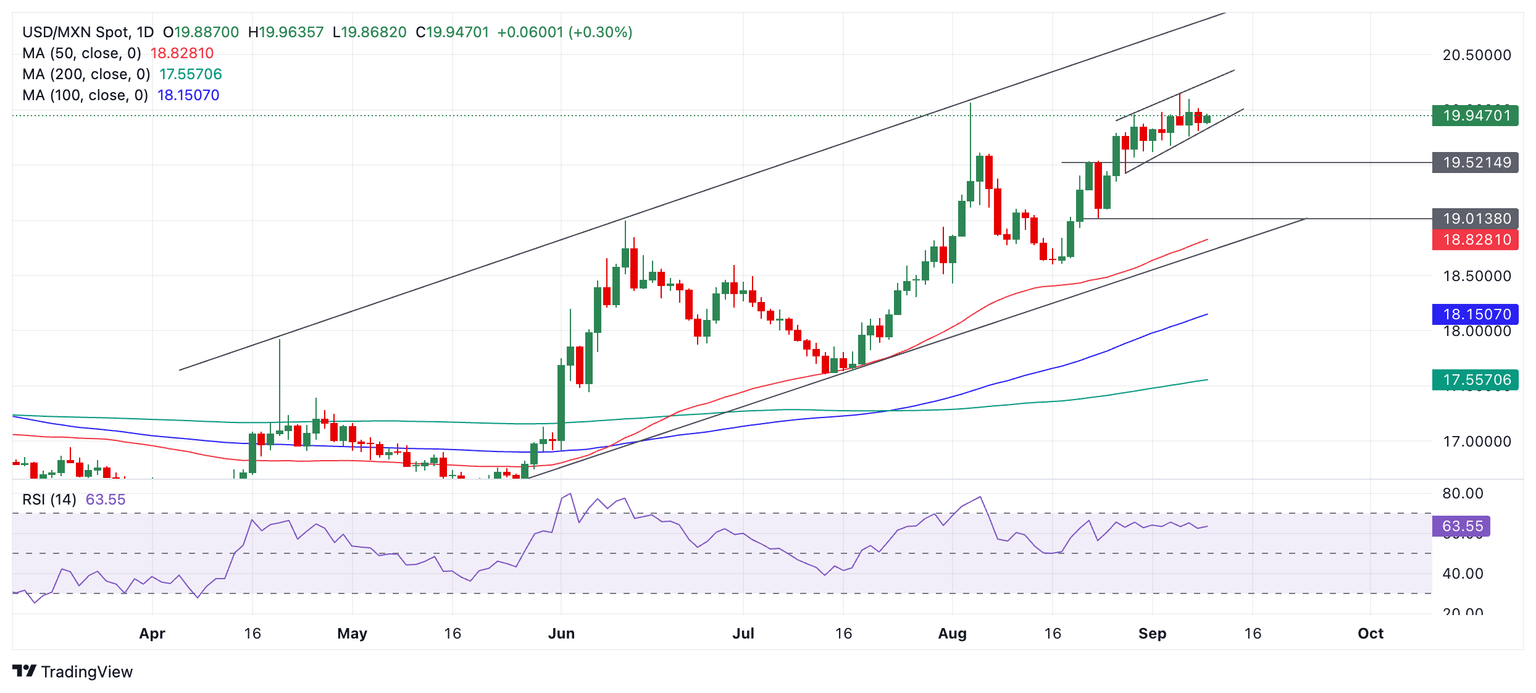

Technical Analysis: USD/MXN rising in a bullish channel

USD/MXN is trading within the bounds of a gently ascending mini-channel, which itself lies within a broader rising channel that began in April.

USD/MXN Daily Chart

The overall trend is bullish, and since, according to technical analysis theory, “the trend is your friend,” this favors more upside. As such, any weakness may be temporary before the pair rallies again.

A break above the top of the mini-channel and year-to-date high at 20.15 would provide added confirmation of a continuation of the bull trend, with the next target at the upper channel line in the 20.60s.

It would require a decisive breakout below the mini-channel lows to bring into doubt the short-term uptrend bias.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.