Mexican Peso takes a hit due to US election risk

- The Mexican Peso is weakening as the probability of a Donald Trump victory in the election increases.

- Trump’s threat to impose tariffs on Mexican imports may be difficult to implement due to highly integrated supply chains.

- USD/MXN starts a new up leg of a bullish ‘abc’ pattern move.

The Mexican Peso (MXN) edges lower in its most heavily-traded pairs on Monday, extending the weakness witnessed on Friday. The US election risk is a growing factor for the Peso as polls show a very tight race for the White House. A victory for Republican nominee Donald Trump would be negative for the Peso due to his tough talk on tariffs on Mexican imports. Further weakness may be due to Mexican domestic political risk as the government seeks to impose judicial reform, making judges electable and limiting the judiciary's influence in constraining the legislature.

Recent below-par macroeconomic data from Mexico has not helped the MXN. Economic Activity and Retail Sales missed expectations in August, and core annualized half-month inflation showed a further decline in October. This suggests a greater chance the Bank of Mexico (Banxico) will cut interest rates by 25 basis points (bps) (0.25%) at its meeting in November.

Inflows from the carry trade, however, may counterweight negative factors as the Japanese Yen (JPY) weakens due to the ruling Liberal Democratic Party (LDP) party losing its majority in elections over the weekend.

Mexican Peso subject to election risk

The Mexican Peso is facing considerable risk from the increasingly ambiguous outcome of the US presidential election on November 5.

When Trump won the 2016 election, the Mexican Peso depreciated substantially, with USD/MXN rising from 18.60 Mexican Pesos per US Dollar (USD) to 20.90 after the result. The exchange rate rose even higher, to almost 22.00 after Trump took office in January 2017, according to El Financiero.

Trump now has a slightly higher 52% chance of winning compared to Vice President Kamala Harris’ 48%, according to the statistical model of leading US election website FiveThirtyEight, even though the Democratic nominee is still marginally ahead in the polls. The inconsistency is because of the electoral college system and the greater weight that a few key swing states have in deciding the outcome.

Trump’s tariff threat may in reality be difficult to implement

The risk to the Mexican Peso from a Trump re-election mainly stems from his championing of putting tariffs on foreign imports. However, an estimated 15% of all US imports now come from Mexico, and their supply chains are so intertwined that it may be difficult to impose such sanctions in reality.

Product eco-systems across North America (NA) are now deeply integrated as a result of the 1994 NAFTA free trade agreement and the more recent USMCA accord. Most imports are now composed of parts from all three countries, which would make it difficult for Trump to actually tariff them without also harming the US economy.

“You really can’t talk about a US-made car or a Canadian-made car or a Mexican-made car. These autos are really North American (NA),” says David Eaton, Director for Business Development at CPKC Mexico. “The car’s parts and components cross the border 1000s of times before a car is made,” he says in an interview with Bloomberg News’ David Westin.

“USMCA says that 70% or 75% of the content or value of a car must meet with NA content requirements to get duty free treatment,” continues Eaton.

Instead of buying rolled steel from Brazil, auto manufacturers in Mexico now make steel using Iron Ore from the US in order to comply with USMCA requirements. If Trump rips up the agreement, he won’t only be damaging Mexico but also inflicting a wound on the US.

Many US companies already have huge factories based in Mexico, producing finished products using raw materials or parts made in the US or Canada. The toy manufacturer Mattel, for example, which owns the Barbie brand, makes most of its toys in Mexico using resin brought in from the US Gulf Coast, according to Westin.

As such, the risk from tariffs may not, in reality, materially affect Mexican-US trade as much as feared, leading to more modest depreciation for the Peso.

Technical Analysis: USD/MXN begins new up leg

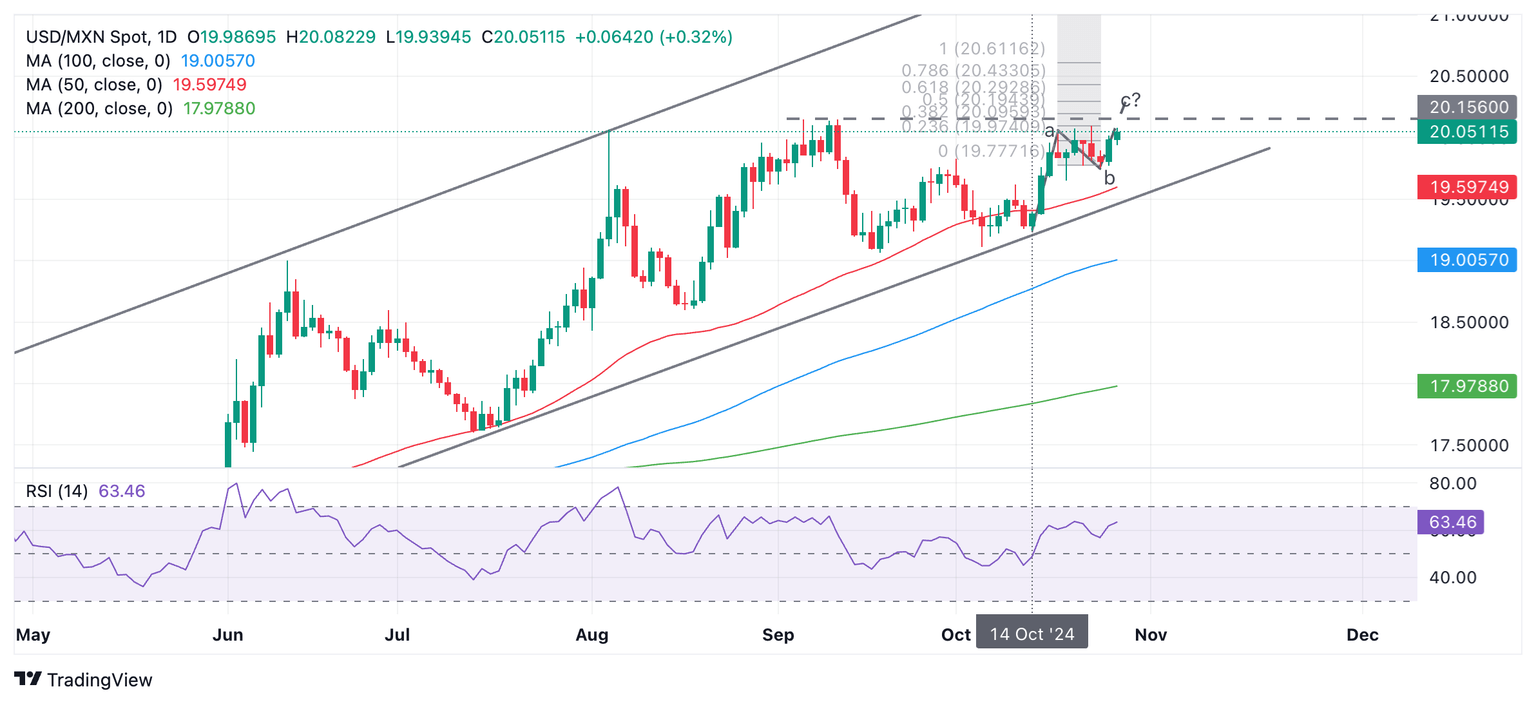

USD/MXN appears to have begun a fresh leg higher after a mild pullback. This leg is probably the “c wave” of a bullish “abc” pattern, which began life at the October 14 swing low. This wave will probably reach the Fibonacci 61.8% of the length of wave a, giving an upside target of 20.29. Such a move would gain confirmation from a break above the high of wave b at 20.09.

USD/MXN Daily Chart

USD/MXN is also probably in an uptrend on a short, medium and long-term basis and is trading in a rising channel. Given the technical dictum “the trend is your friend,” the odds favor a continuation higher.

In addition, the original break above 19.83 (October 1 high) has already confirmed a probable move up, with a target in the vicinity of the September 10 high at 20.13.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.