Mexican Peso declines an average of 5% in its key pairs this week

Most recent article: Mexican Peso soars as Powell signals Fed easing

- The Mexican Peso tries to find a floor after losing an average of roughly 5% in its main pairs so far this week.

- Weakness has come about as a result of cooler inflation data, weaker retail sales and political factors.

- Technically, USD/MXN extends its uptrend within a rising channel.

The Mexican Peso (MXN) trades just off its lows of the week on Friday after a run of three consecutive days where it lost a minimum of over 1.0% in value per day, in its three most-traded pairs (USD/MXN, EUR/MXN and GBP/MXN). This brings the Peso’s total depreciation so far this week to between 4.0% and 6.0% depending on the pair in question.

A combination of cooler-than-expected Mexican inflation data for August, weaker retails sales in July and resurfacing concerns regarding the impact of proposed changes to the Mexican constitution by the new government, are weighing.

These factors, and the unwinding of the carry trade, in which investors borrow in a currency where interest rates are low – like the Japanese Yen (JPY) – in order to purchase a currency where interest rates are high – like the Peso – (thereby pocketing the differential) are providing headwinds for the Peso.

The decline in Mexican 1st half-month inflation and core inflation in August indicates a greater chance of a further 0.25% cut in interest rates in September. Since lower interest rates are negative for a currency – as they reduce foreign capital inflows – MXN is pressured lower.

At the time of writing, one US Dollar (USD) buys 19.47 Mexican Pesos, EUR/MXN trades at 21.65, and GBP/MXN at 25.55.

Mexican Peso weakens the most against Pound Sterling

The Mexican Peso is weakening the most versus the Pound Sterling (GBP), against which it has fallen by roughly 6.0% so far this week.

The Pound has been supported in all its pairs by higher-than-expected UK Retail Sales data and more recently, survey data from key sector purchasing managers showing upbeat activity and an optimistic outlook in the major industry groups of the economy.

The preliminary S&P Global/CIPS Composite Purchasing Manager Index (PMI) for August, for example, rose to 53.4 from 52.8 in July, and beat estimates of 52.9. Both Manufacturing and Services PMIs also rose more than expected.

MXN weakens versus Euro despite negative data

Against the Euro (EUR), the Mexican Peso has fallen about 5.36% so far this week despite lackluster data out of the Eurozone.

Eurozone’s Negotiated Wage Rates growth in Q2 fell quite steeply to 3.55% from 4.74% in Q1, and German HCOB PMIs fell in August in all major sectors.

Furthermore, the large gains in French Services PMI to 55.0 from 50.1 was almost exclusively put down to the passing effect of the Paris Olympics, whilst underlying French data remained weak, according to Capital Economics.

“Part of the improvement (in Eurozone PMIs) seems to have been due to a temporary boost from the Paris Olympics. The Composite PMI for France rose to a 17-month high, entirely due to a very large increase in the services index. But the employment, output expectation, and backlog of work indices fell, suggesting that the underlying economic situation in France actually worsened,” says Franziska Palmas, Senior Europe Economist at Capital Economics.

Surprise losses against the weakening US Dollar

The Mexican Peso has fallen roughly 4.50% against the US Dollar so far this week, despite USD itself falling to new year-to-date lows according to the US Dollar Index (DXY).

USD was pressured by increasing bets the Fed will cut rates in September. The Minutes of the Fed July policy meeting, for example, noted, “the vast majority” of participants observed that “it would likely be appropriate to ease policy at the next meeting (September 18)”.

Additionally, the downward revision of 818,000 to the Nonfarm Payroll (NFP) survey results in the 12 months to March 2024 reignited question marks about the health of the US employment market. The US PMI data for August was mixed.

Fed Chairman Jerome Powell’s speech at the central banking symposium in Jackson Hole on Friday could impact USD pairs, although he is expected to endorse the view that rate cuts are coming down the track.

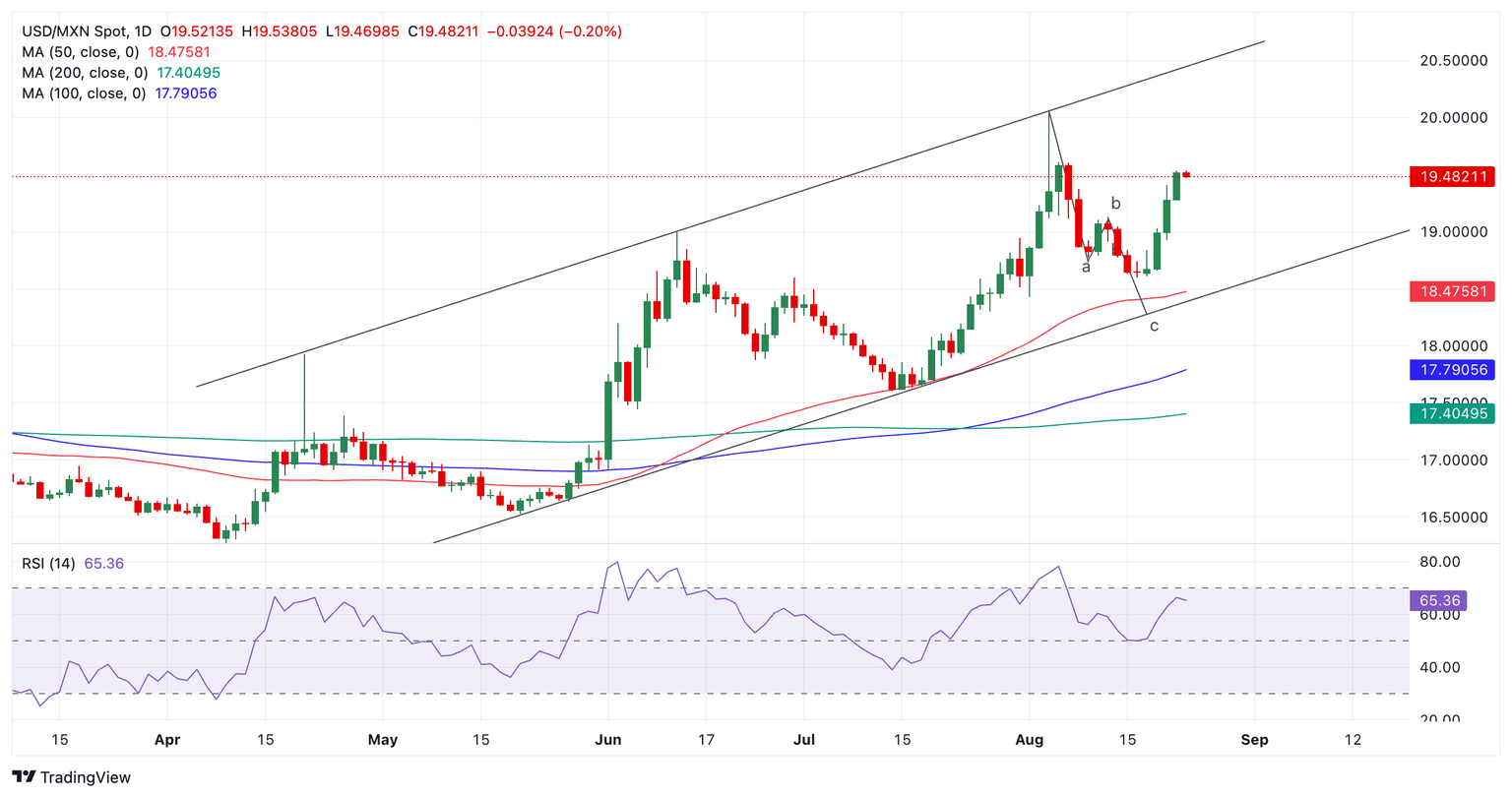

Technical Analysis: USD/MXN continues rallying within rising channel

USD/MXN extends its rally within a rising channel.

After falling in a Measured Move within the channel that ended with a foreshortened final “c” wave a new leg higher within the channel has started to unfold.

USD/MXN Daily Chart

The up leg could take the pair back up to the channel highs at roughly 20.50. A break above 19.61, the August 6 high, would provide added bullish confirmation.

The overall trend on the medium and longer-term time frames is arguably up, suggesting a bullish backdrop that provides extra support to the view that a new upward move is underway.

Economic Indicator

1st half-month Core Inflation

The 1st half-month core inflation index released by the Bank of Mexico is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services, excluding taxes and energy. The purchase power of Mexican Peso is dragged down by inflation. The inflation index is a key indicator since it is used by the central bank to set interest rates. Generally speaking, a high reading is seen as positive (or bullish) for the Mexican Peso, while a low reading is seen as negative (or Bearish).

Read more.Last release: Thu Aug 22, 2024 12:00

Frequency: Monthly

Actual: 0.1%

Consensus: 0.19%

Previous: 0.18%

Source: National Institute of Statistics and Geography of Mexico

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.