Meta Platforms Inc. (META) Elliott Wave technical analysis [Video]

![Meta Platforms Inc. (META) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nasdaq/nasdaq-website-17398480_XtraLarge.jpg)

META Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate wave (5).

Direction: Upside in wave (5).

Details: We are looking for further upside into wave (5) which could reach Medium Level at 650$.

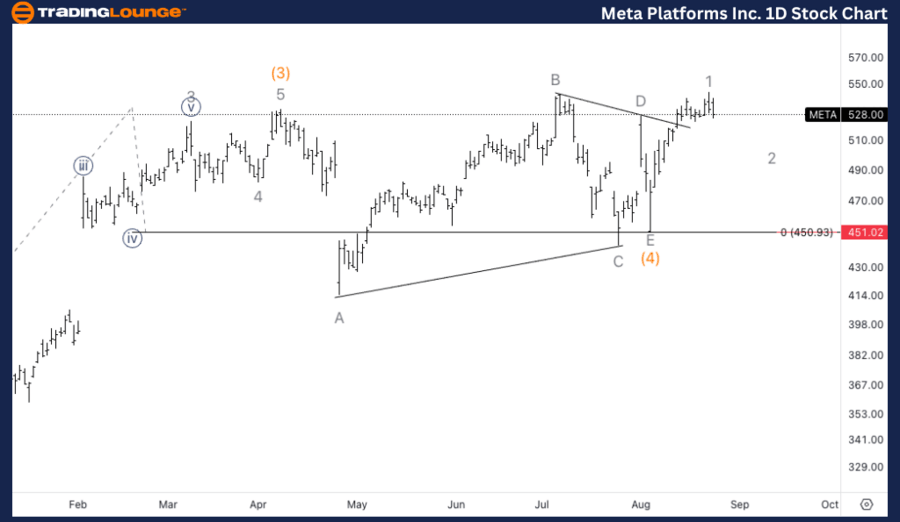

META Elliott Wave technical analysis – Daily chart

META is currently progressing in intermediate wave (5), with the potential to reach the Medium Level target of $650. The overall trend remains bullish, and the market is expected to continue its upward trajectory as wave (5) unfolds. Traders should monitor price action closely as it approaches the $650 level, which could serve as a significant resistance area and potential target for this impulsive wave.

META Elliott Wave technical analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 2.

Direction: Bottom in wave 2.

Details: Here we can see the subdivision of wave 5 into what seem to be a clear five wave move. We seem to have topped in wave 1, as long as we stay above TL5 at 500$ we can look for further upside.

META Elliott Wave technical analysis – One-hour chart

The 1-hour chart shows a completed five-wave structure in wave 1, followed by a corrective wave 2. As long as the price remains above TL5 at $500, we can expect further upside potential. This corrective phase could offer a buying opportunity for traders looking to capitalize on the next impulsive move, likely wave 3, which would continue the overall uptrend.

Welcome to our latest Elliott Wave analysis for Meta Platforms Inc. (META). This report delves into META's price action using Elliott Wave Theory, providing traders with insights into potential market opportunities based on current trends and wave structures. We will examine both the daily and 1-hour charts to offer a comprehensive analysis of META's market behavior.orms Inc. (META) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.