MARA Price Prediction: Marathon Digital Holdings' Bitcoin hangover continues, key technical levels

- MARA suffers as Bitcoin loses some sparkle.

- MARA shares dropped nearly 50% from April 6 high.

- MARA needs a Bitcoin bounce, struggles with resistance levels.

Marathon Digital Holdings is a cryptocurrency mining company, formerly called Marathon Patent Group. MARA has two main areas of operation. Montana in the US, where it operates a data centre, and also North Dakota where MARA has a site with Bitcoin mining machines in operation.

Stay up to speed with hot stocks' news!

MARA is a highly volatile, retail-driven stock, which is basically a proxy for crypto currency and Bitcoin in particular. MARA is highly correlated to Bitcoin but is actually more volatile.

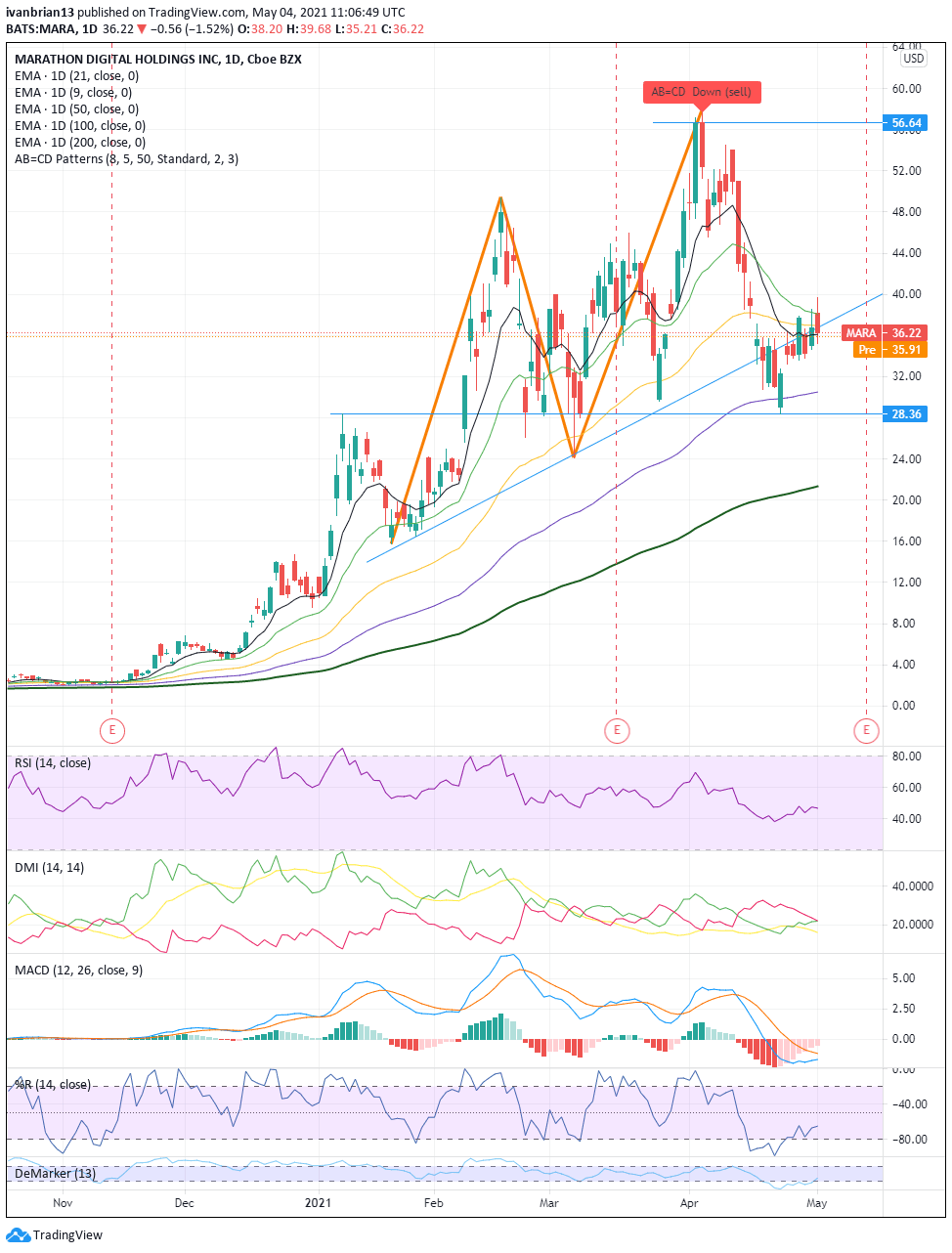

MARA shares peaked at $57.75 in early April but slumped nearly 50% to a low of $28.36 by april 23. The main reason for the slump was Bitcoin having some falls of its own as Turkey banned certain usage of cryptocurrencies.

MARA has bounced but has a long way to go. A 50% fall obviously needs a 100% gain just to get back to breakeven, so MARA has some task ahead of it.

MARA stock forecast

So where to from here and how to trade this one? As mentioned the stock is highly volatile so careful risk management is essential. Using options can help with risk management as the downside is limited.

First things first, MARA has stalled at the 21-day moving average resistance, currently at $38.06. This has neatly filled the gap from April 16 to 19. This can be taken as a bearish signal if MARA fails to break and hold above the 21-day moving average. Breaking above the 21-day moving average brings little resistance until nearly $50. MARA moved so quickly from $50 to $40 that there is little price discovery and volume in this area. A sharp move lower can lead to a sharp move back through these levels.

However, currently the chart looks more bearish. The Moving Average Convergence Divergence (MACD) has crossed into negative territory, The Directional Movement Index (DMI) is about to cross. Failure at $38.06 should see MARA shares target $36.09, the 9-day moving average and a break below this obviously means the short-term trend is negative and joins the longer-term negative trend. Downside targets would, therefore, be $30.51 (the 100-day moving average) and $28.36 (trend line support from April 23 and the high from January 8). A break of this level would have $24 as interim support on the way to 200-day moving average support at $21.34.

$40 calls for May 28 are trading around $3.35 and can be used to play the vacuum mentioned.

Those bearish can look at $32 puts for the same expiry date on May 28. This option is trading around $3 but again a move lower should accelerate and gap down to $28.36 support, and a break of that should again see a sharp break lower toward $21.34.

Obviously, it goes without saying that Bitcoin is the big daddy here that leads the crypto stocks back and forth.

MARA reports earnings on May 17, which will bring some clarity to matters. Earnings per share (EPS) are expected to be $0.02. This release date is not confirmed.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.