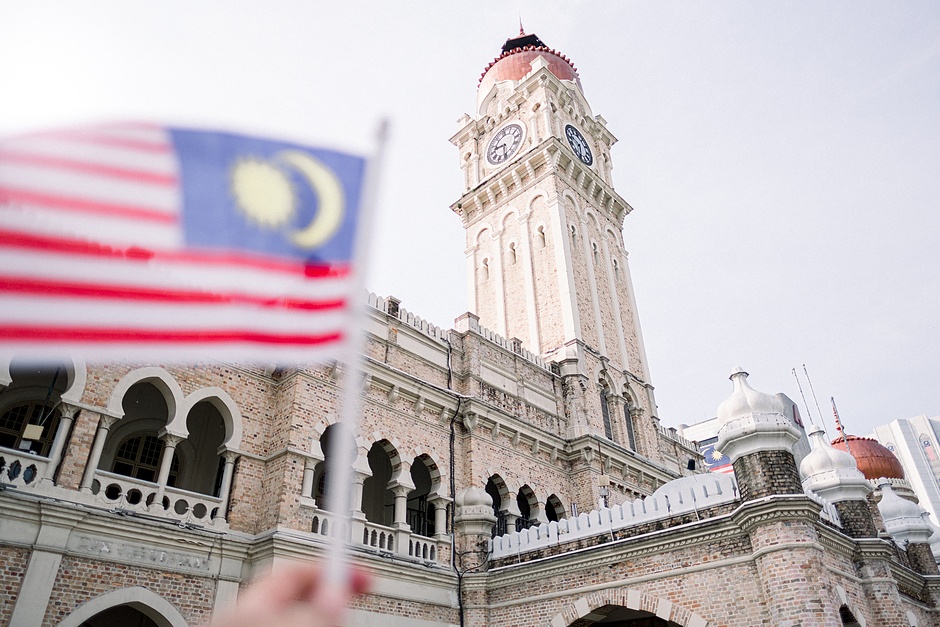

Malaysia: GDP expected to expand 4.0%-5.0% in 2023 – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest projections by the Bank Negara Malaysia (BNM).

Key Takeaways

“Bank Negara Malaysia (BNM) projects GDP growth to moderate to 4.0%-5.0% in 2023 (2022: 8.7%), driven by firm domestic demand amid slower global growth. The risks to growth are fairly balanced with downside risks primarily coming from external developments while there are upside risks from domestic factors including improved labor prospects, investments projects, and increasing tourism activity.”

“Headline and core inflation are expected to average above long-term averages at 2.8%-3.8% this year (2022: headline 3.3%, core 3.0%) after taking into account moderating global commodity prices, easing of supply constraints, and existing price controls and subsidies. Inflation is expected to stay elevated in 2023 owing to demand pressures and gradual subsidy rationalization.”

“On the path of interest rates, the current Overnight Policy Rate (OPR) of 2.75% remains supportive of growth and is just below our projected neutral level of ~3.00%. Given that growth is expected to be fairly robust while inflation risks are tilted higher, we expect one more 25bps hike at the next MPC meeting in May. On financial stability, Malaysia’s banking system remains resilient with strong capital ratios and liquidity buffers that are above the minimum requirements even under highly stressed scenarios.”

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.