Lululemon Athletica Inc. Elliott Wave technical analysis [Video]

![Lululemon Athletica Inc. Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_1_XtraLarge.png)

LULU Elliott Wave Analysis Trading Lounge.

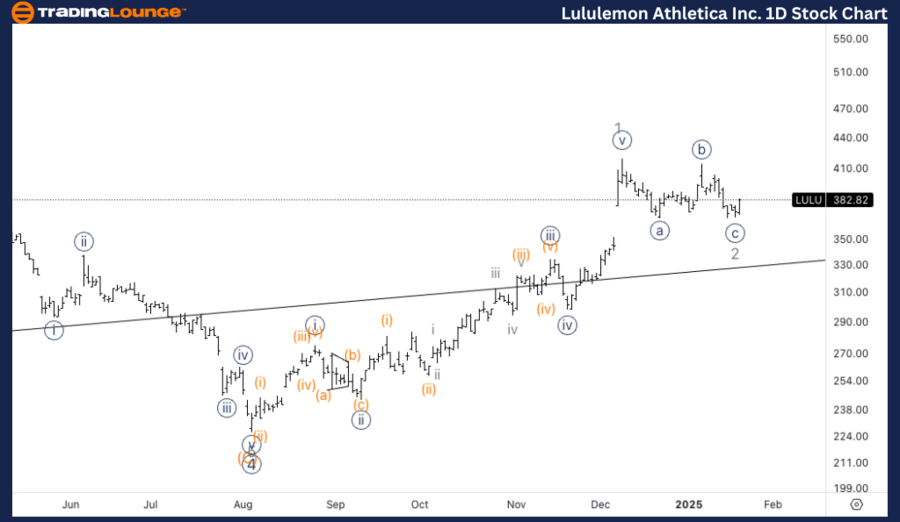

Lululemon athletica Inc., (LULU) Daily Chart.

LULU Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave 2 of (1).

Direction: Bottom in wave 2.

Details: We are looking for a potential bottom in wave 2 as we seem to have completed a wave {c}. Looking for further upside as we break out of 400$.

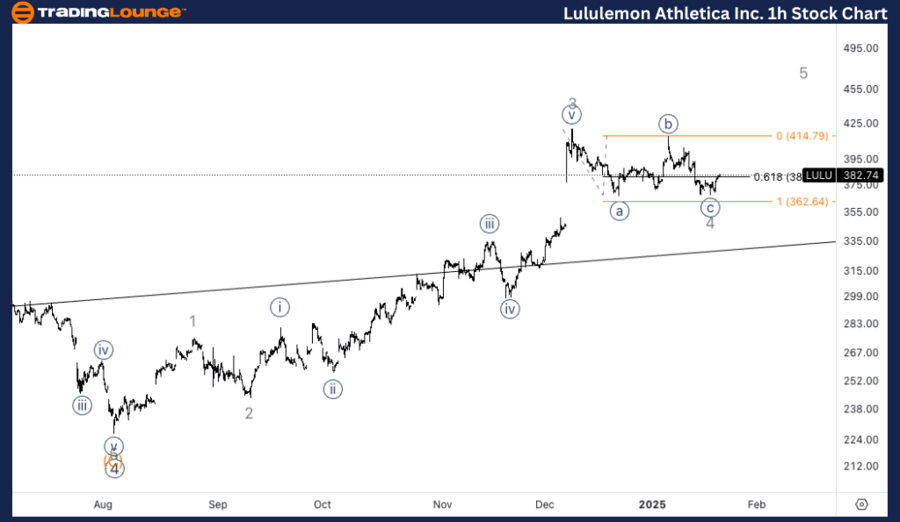

Lululemon athletica Inc., (LULU) 1H Chart.

LULU Elliott Wave Technical Analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave {c} of 4.

Direction: Bottom in wave {c}.

Details: Here I present to you an alternative count suggesting we are in a wave 4 of (1) and the whole move up from August 2024 low is yet to be complete and we could see completion as we approach Trading Level 5 at 500$.

This Elliott Wave analysis of Lululemon athletica Inc., (LULU) outlines both the daily and 1-hour chart structures, highlighting the current trends and possible future price movements.

LULU Elliott Wave technical analysis – Daily chart

Lululemon (LULU) is showing signs of a potential bottom in wave 2 of a corrective Zigzag pattern. This suggests we may have completed wave {c}, setting the stage for further upside. A breakout above the $400 mark could confirm the start of a new bullish leg, as the stock looks to resume its upward trend.

LULU Elliott Wave technical analysis – One-hour chart

In this 1H chart of Lululemon (LULU), there’s an alternative count suggesting that we are currently in a wave 4 of (1), meaning the entire move up from the August 2024 low may still be unfolding. A potential completion of this move could occur as we approach the key Trading Level 5 at $500, where the stock might encounter resistance.

Technical analyst: Alessio Barretta.

LULU Elliott Wave Technical Analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.