LCID Stock News: Lucid Group Inc rallies 2% ahead of its production preview events

- NASDAQ:LCID extended its advance on a positive market's mood.

- Production Preview Week kicks off on Monday as Lucid inches closer to deliveries.

- Tesla CEO Elon Musk believes the chip shortage is coming to an end.

/stock-market-graph-gm532464153-55981218_XtraLarge.jpg)

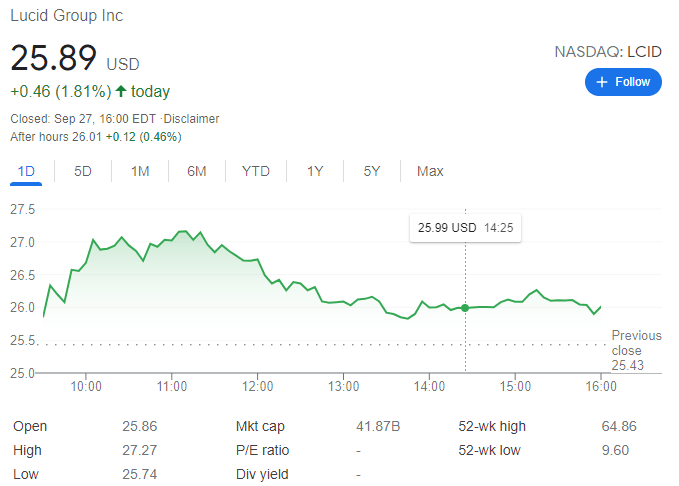

Update September 28: NASDAQ: LCID retreated sharply from multi-day tops of $27.27 but managed to end Monday with 1.81% gains at $25.89. The negative close on the Nasdaq Composite failed to deter Lucid group optimists, as they preserved a part of the daily gains. The shares of LCID rally heading into its production preview events at its Advanced Manufacturing Plant (AMP-1) factory in Casa Grande.

NASDAQ:LCID dropped lower out of the open today, but thanks to a late day surge, the stock managed to post back to back positive sessions. Lucid shares eked out a small gain as the stock rose by 0.04% on Friday, and closed the trading day at $25.43. The electric vehicle maker outpaced the NASDAQ index, which was the only major index to close the session lower. It was a mixed day for EV stocks, as Tesla (NASDAQ:TSLA) jumped higher by 2.75%, while major Chinese EV makers including Nio (NYSE:NIO), XPeng (NYSE:XPEV), and Li Auto (NASDAQ:LI) all closed the week in the red.

Stay up to speed with hot stocks' news!

Next week marks the start of Lucid’s Production Preview Event, where investors, media, and customers will be able to get an indepth look at Lucid’s Arizona facility. For the first time, Lucid Air sedans will be available to the public for test driving, and many investors are hoping that a delivery date will be announced by CEO Peter Rawlinson. With over 10,000 reservations in the queue, investors and customers will be anxiously waiting to hear about Lucid’s delivery program.

LCID stock price forecast

Tesla CEO Elon Musk had some interesting comments on Friday about the ongoing global chip shortage that has affected multiple EV makers around the world. Musk stated that he believes with the production of chip fabrication plants around the world, the chip shortage should be over by 2022. Tesla itself recently entered discussions with Samsung to produce the next generation Full Self Driving chips for its vehicles.

Previous updates

Update: NASDAQ:LCID ended Monday up 1.81% at $25.89 per share. Despite up, it ended the day far from its intraday high of $27.26 as optimism among Wall Street's traders faded throughout the day. The Nasdaq Composite finished the day in the red, down 77 points of 0.52%, while the S&P 500 lost 6 points. The Dow Jones Industrial Average managed to settle in the green, up 73 points.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet