Kiwi extends backslide from recent high, opens the way up to 0.6100

- The Kiwi has seen two consecutive down days, pulling the NZD down from 0.6200.

- Market risk appetite has turned south this week, pushing investors into safe havens.

- Investor focus squarely on US data this week with NFP in the pipe.

The NZD/USD heads into the Wednesday market session struggling near the 0.6130 level as the kiwi (NZD) locks in two consecutive days of declines against the US Dollar (USD).

Market sentiment soured early Tuesday after Moody’s downgraded China’s sovereign debt outlook, with the ratings agency citing the Chinese government’s looming expenses should China need to start bailing out beleaguered local governments and drowning state-owned agencies.

US data came in mixed on Tuesday, with the Institute for Supply Management’s Services Purchasing Managers’ Index (PMI) came in at 52.7 for the annualized period into November, compared to the median market forecast of 52, and the Services sector PMI showed a step up from October’s 51.8.

US JOLTS Jobs Openings showed still-tightening labor market conditions with the report printing 8.733 million job postings, a two-and-a-half-year low and undercutting the previous month’s 9.35 million (revised down slightly from 9.553 million).

With a still-tight labor market weighing down investors hopes for a sooner-rather-than-later Federal Reserve rate cut cycle, market sentiment has knocked back on multiple fronts, sending the US Dollar higher against most major currencies heading into the midweek.

Wednesday brings US ADP Employment Change, and Friday will close the trading week out with another round of the US’ Nonfarm Payrolls (NFP); both labor indicators are expected to show improving employment conditions and a still-tightening labor market. The ADP Employment Change is expected to print at 130K in November compared to the previous 113K, while the NFP is forecast to come in at 185K vs October’s 150K.

NZD/USD Technical Outlook

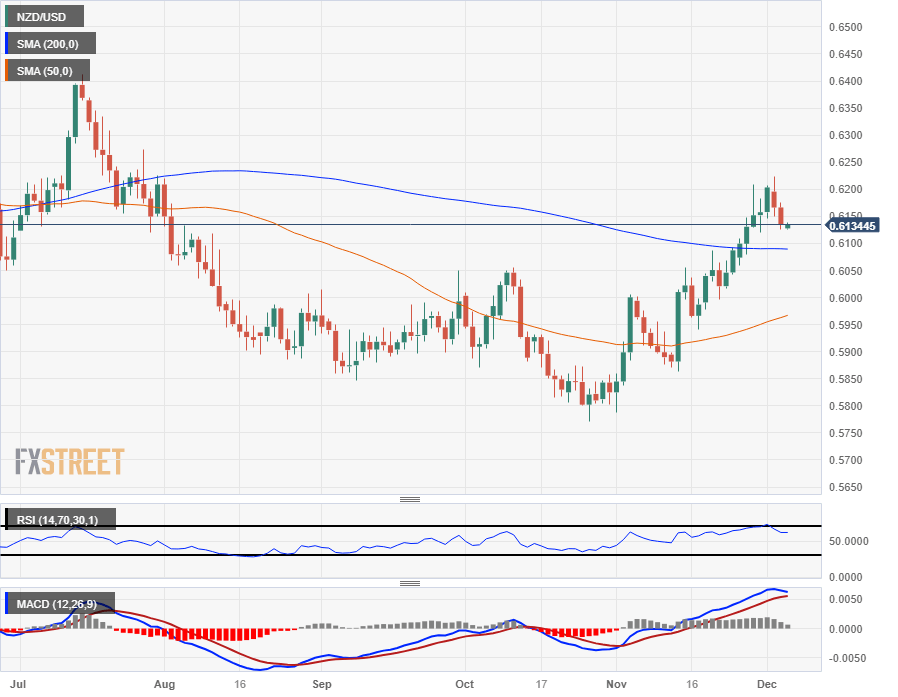

The Kiwi has backslid straight into the 200-hour Simple Moving Average (SMA) near 0.6130, and intraday price action is set to get hung up near the price level with exposure risk tilting firmly to the downside as the 50-hour SMA turns bearish into 0.6160, capping off upside bids.

Daily candlesticks have the NZD/USD is set to confirm a bearish pullback to the 200-day SMA just below 0.6100, and Monday’s four-month peak just below 0.6225 represents the nearest technical ceiling for near-term bids.

NZD/USD Daily Chart

NZD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.