JSW Steel Indian Elliott Wave technical analysis [Video]

![JSW Steel Indian Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_NIKKEI-2_XtraLarge.jpg)

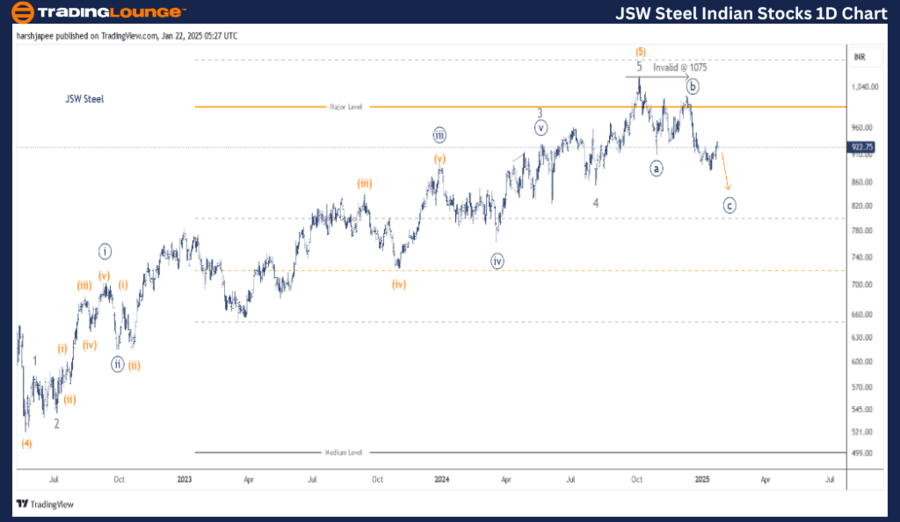

JSW Steel Elliott Wave technical analysis

Function: Counter Trend (Minor Degree Grey).

Mode: Corrective.

Structure: Flat.

Position: Minute Wave ((c)) Navy.

Details: Minute Wave ((c)) is now progressing lower against 1075. It could terminate around 850-60 zone.

Invalidation point: 1075.

JSW Steel daily chart technical analysis and potential Elliott Wave counts

JSW STEEL daily chart is indicating a major top in place around 1075 mark, which is labelled as Minor Wave 5 of Intermediate Wave (5) Orange. Since then, a Minuette degree corrective drop is either complete or near to completion around 840-50 zone.

The stock terminated Intermediate Wave (4) Orange around 520 mark in May 2022. A five wave rally has unfolded since then at Minor degree labelled as 1 through 5, pushing prices through 11075 high in October 2024. It is worth noting that a larger degree flat could be unfolding at Minor degree against 1075 mark.

JSWSTEEL Elliott Wave technical analysis

Function: Counter Trend (Minor Degree Grey).

Mode: Corrective.

Structure: Flat.

Position: Minute Wave ((c)) Navy.

Details: Minute Wave ((c)) is now progressing lower against 1075. The sub waves suggest it is unfolding as an impulse and might have terminated Minuette Wave (iv) Orange around 930. It could terminate around 850-60 zone.

Invalidation point: 1075.

JSW Steel four-hour chart technical analysis and potential Elliott Wave counts

JSW STEEL 4H chart is highlighting the sub waves post 1075 high, Minor Wave 5 of (5) termination. Minuette (a)-(b)-(c) unfolded to carve terminate Wave ((a)) around 910 mark. Minute Wave ((b)) pushed through 1020 mark again sub dividing into three waves at Minuette degree.

Since then, Minute Wave ((c)) is progressing lower s an impulse. Potential target is seen towards the 850-60 zone before bulls could be back in control. Also note that 854 is previous Wave 4 termination as well.

Conclusion

JSW STEEL is progressing lower within Minute Wave ((c)) towards 850-60 zone against 1075 mark.

JSW Steel Indian Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.