JPY underperforms ahead of BOJ hike – BBH

The Japanese Yen (JPY) is lagging as markets price in a 25bps BOJ hike on December 19, with Governor Ueda signaling moderate inflation risk but persistent upward wage pressures; USD/JPY may slide toward 140 following US-Japan yield differentials, BBH FX analysts report.

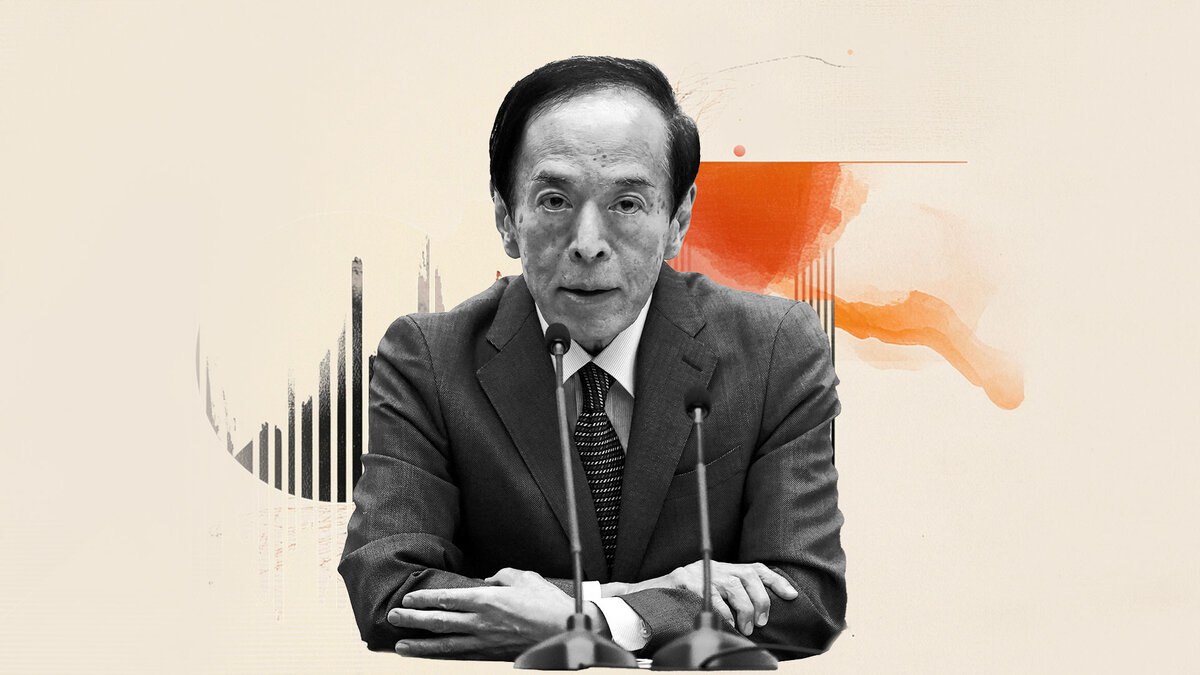

Governor Ueda highlights future wage pressures

"JPY is underperforming. Bank of Japan (BOJ) Governor Kazuo Ueda struck a balance tone in his latest interview. Ueda noted he does not see very high risk of too much inflation at present but cautioned that 'upward pressure on wages will continue in the future' due to a labor shortage."

"The swaps curve price in 90% odds of a 25bps BOJ rate hike to 0.75% on December 19. Tighter monetary policy paired with Japan’s government latest fiscal stimulus package is JPY positive. We see room for USD/JPY to adjust lower towards the level implied by US-Japan two-year bond yield spreads around 140.00."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.