JPY: Tokyo inflation slightly beats expectations – Commerzbank

The inflation figures for the Greater Tokyo Area published this morning, which are a reliable indicator of price developments across the country, came in slightly above expectations. Overall, prices rose by 2.7% year-on-year, and excluding fresh food and energy, the figure was 2.8%, Commerzbank's FX analyst Volkmar Baur notes.

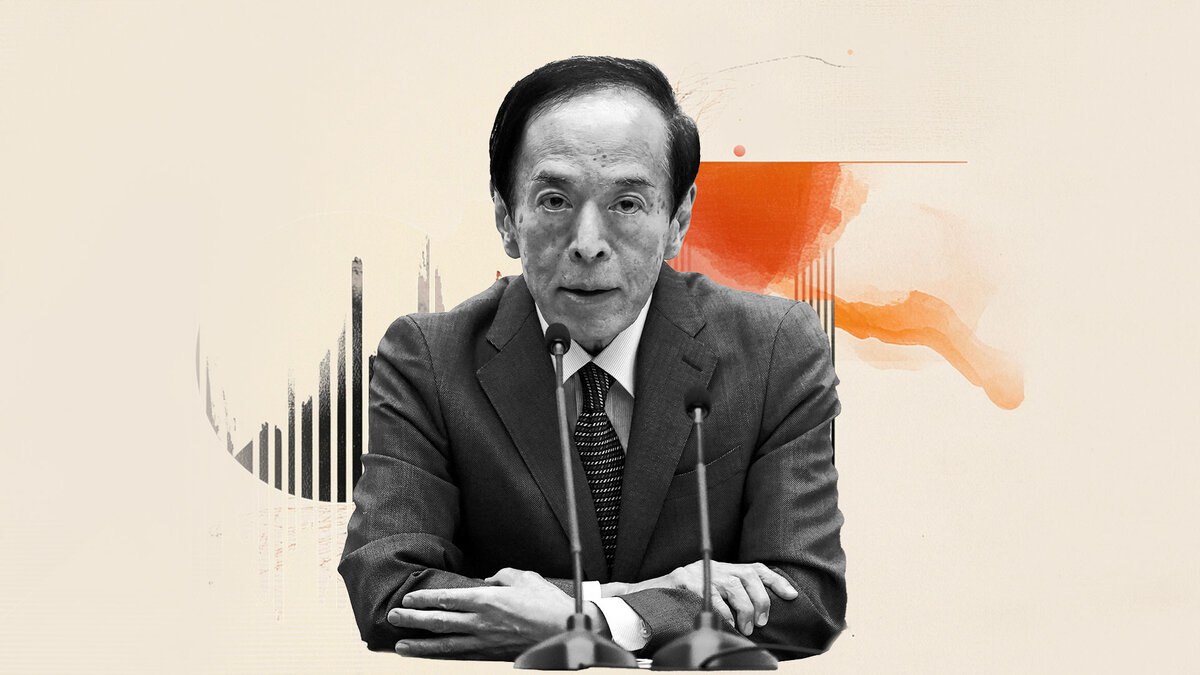

BoJ rate-hike odds jump ahead of key remarks

"One would assume that an additional fiscal package would increase demand and thus drive inflation. However, it is not quite that simple in this case, at least in the short term. This is because, at least in the short term, the suspension of the petrol tax is likely to cause a temporary reduction in inflation. However, it must be said that this will only reduce inflation in purely visual terms. Overall, inflationary pressure is likely to increase, of course. However, while the suspension of the tax will have an immediate effect, the additional demand will take time to have an impact."

"However, while the fiscal package will certainly have an inflationary effect in the medium term, it remains unclear exactly how food prices will develop. The Bank of Japan would therefore be well advised to end its current pause in normalizing monetary policy and raise interest rates. Asahi Noguchi, a member of the Monetary Policy Committee, hinted at this in his speech yesterday. Noguchi remained cautious, warning against adjusting monetary policy too quickly."

"On the other hand, he also said that it would be a mistake to proceed too cautiously and too slowly. And given that the Bank of Japan's last interest rate hike was 10 months ago and the key interest rate is still only 0.5%, the latter is probably more likely to be true. The market is therefore already pricing in a BoJ interest rate hike in December at over 50%. A week ago, we were still below 20%. If Ueda also hints on Monday that a hike in December is conceivable, the probability is likely to increase further. In this case, the JPY should benefit."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.