JPY near lows as intervention risks rise – MUFG

The Japanese Yen (JPY) has continued to trade close to recent lows at the start of the week after USD/JPY hit a high last week of 157.89. The pair has risen by around 10 big figures since Sanae Takaichi won the LDP leadership election. Last week’s yen sell-off was driven by heightened concerns over the government fiscal plans when they announced a larger than expected fiscal stimulus plan. The 10-year JGB yield jumped to a new cyclical high of 1.85% at the end of last week before dropping back below 1.80% helping to ease yen selling momentum, MUFG's FX analyst Lee Hardman reports.

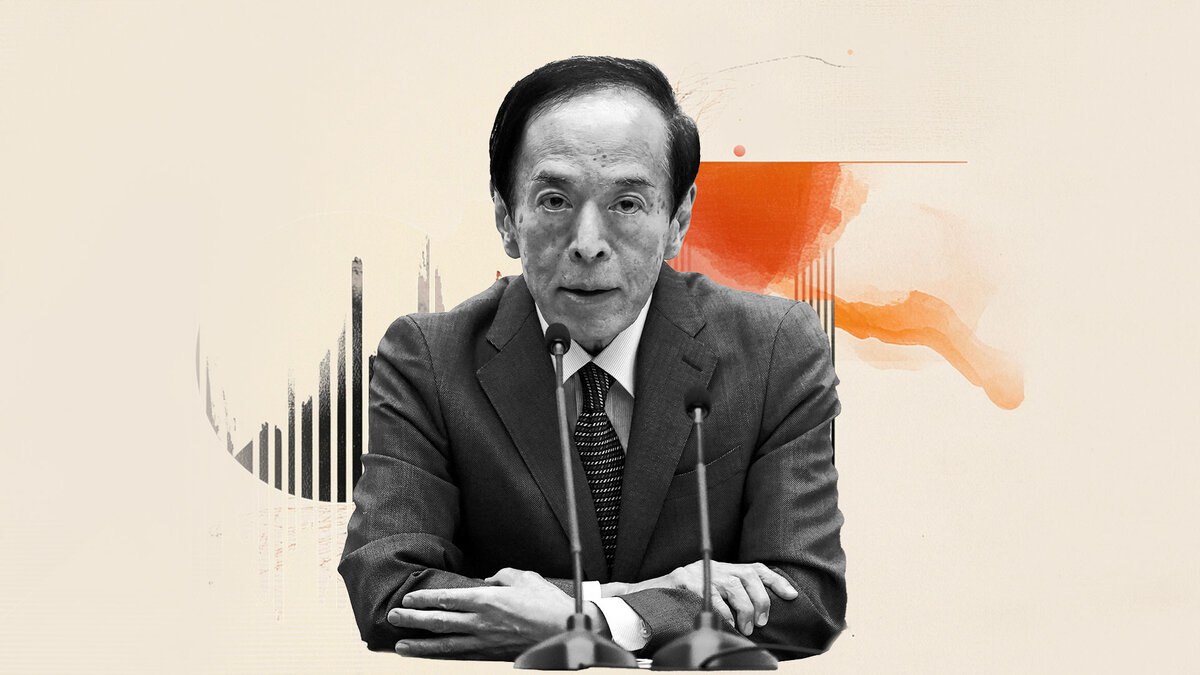

BoJ signals growing urgency for rate hike

"The sharp one-sided yen sell-off is generating building concern amongst Japanese policymakers who have signalled a rising risk of direct intervention to support the yen if the unwanted price action continues. Furthermore, BoJ officials have been indicating that yen weakness could encourage an earlier resumption of rate hikes. The Nikkei reported comments late on Friday from BoJ board member Kazuyuki Masu who stated 'I can’t say what month it’ll be, but in term of distance, we’re close' to raising rates again."

"It was his first exclusive interview since joining the BoJ policy board in July. He believes that the policy rate is lower than the neutral rate and strongly believes we need to change that quickly'. The comments were notable as Kazuyuki Masu had previously been viewed as one of the more dovish BoJ board members. Earlier in the week both BoJ Governor Ueda and Junko Koeda had also indicated more concern over yen weakness and the need for policy normalization."

"Recent rhetoric supports another rate hike in December or January although market participants remain sceptical given the ongoing uncertainty over whether the government will push back against an earlier hike to maintain more supportive policy for growth. While those doubts persist, the yen will struggle to rebound from deeply undervalued levels."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.