Japanese Yen recovers few pips from two-week low against USD; not out of the woods yet

- The Japanese Yen continues losing ground amid worries about the economic impact of US tariffs.

- Domestic political uncertainty further undermines the JPY amid reduced BoJ rate hike bets.

- Diminishing odds for early Fed rate cuts act as a tailwind for the US Dollar and the USD/JPY pair.

The Japanese Yen (JPY) recovers slightly from over a two-week trough touched against a broadly firmer US Dollar (USD) earlier this Wednesday, though any meaningful upside still seems elusive. Investors now seem convinced that the Bank of Japan (BoJ) will forgo raising interest rates this year amid concerns about the potential economic fallout from US President Donald Trump's 25% tariffs from a new deadline of August 1. This, along with domestic political uncertainty, turns out to be a key factor undermining the JPY.

In fact, recent media polls have shown that the Liberal Democratic Party (LDP) and its junior ruling coalition partner Komeito may fail to secure a majority at the July 20 House of Councillors election. This could complicate trade negotiations and favor the JPY bears. The USD, on the other hand, stands firm amid bets the Federal Reserve (Fed) will hold off cutting interest rates amid expectations that higher tariffs would underpin the inflation, which should limit any meaningful corrective slide for the USD/JPY pair.

Japanese Yen bears not ready to give up amid rising trade tensions

- US President Donald Trump announced a 25% tariff on Japanese goods effective August 1 and warned that any retaliatory levies would draw a like-for-like response. Japanese Prime Minister Shigeru Ishiba said on Tuesday that bilateral talks would continue towards seeking a mutually beneficial trade deal.

- Nevertheless, trade tensions add to woes for Japan’s economy, which shrank in the first quarter on soft consumption. Adding to this, Japan's real wages in May fell at the fastest pace in 20 months. This backs the case for the Bank of Japan's caution in the near term, which is seen undermining the Japanese Yen.

- Recent surveys raised doubts about whether the ruling coalition of the Liberal Democratic Party (LDP) and Komeito will be able to secure enough seats in the upcoming House of Councillors election on July 20 to maintain their majority. This adds a layer of uncertainty and contributes to the JPY's downfall.

- The US Dollar, on the other hand, shot to a two-week high on Tuesday amid expectations that the Federal Reserve would keep interest rates elevated in anticipation of worsening inflation as a result of higher import taxes and a resilient US labor market. This lends additional support to the USD/JPY pair.

- The USD bulls, however, seem reluctant and opt to wait for more cues about the Fed's policy outlook before placing fresh bets. According to the CME Group's FedWatch tool, market participants are currently pricing in around 50 basis points of Fed rate cuts by the end of this year, starting in October.

- Hence, the focus remains glued to the release of FOMC meeting minutes, due later during the US session on Wednesday. Investors will look for fresh cues about the Fed's rate-cut path, which, in turn, will influence the USD price dynamics and provide a fresh impetus to the USD/JPY pair.

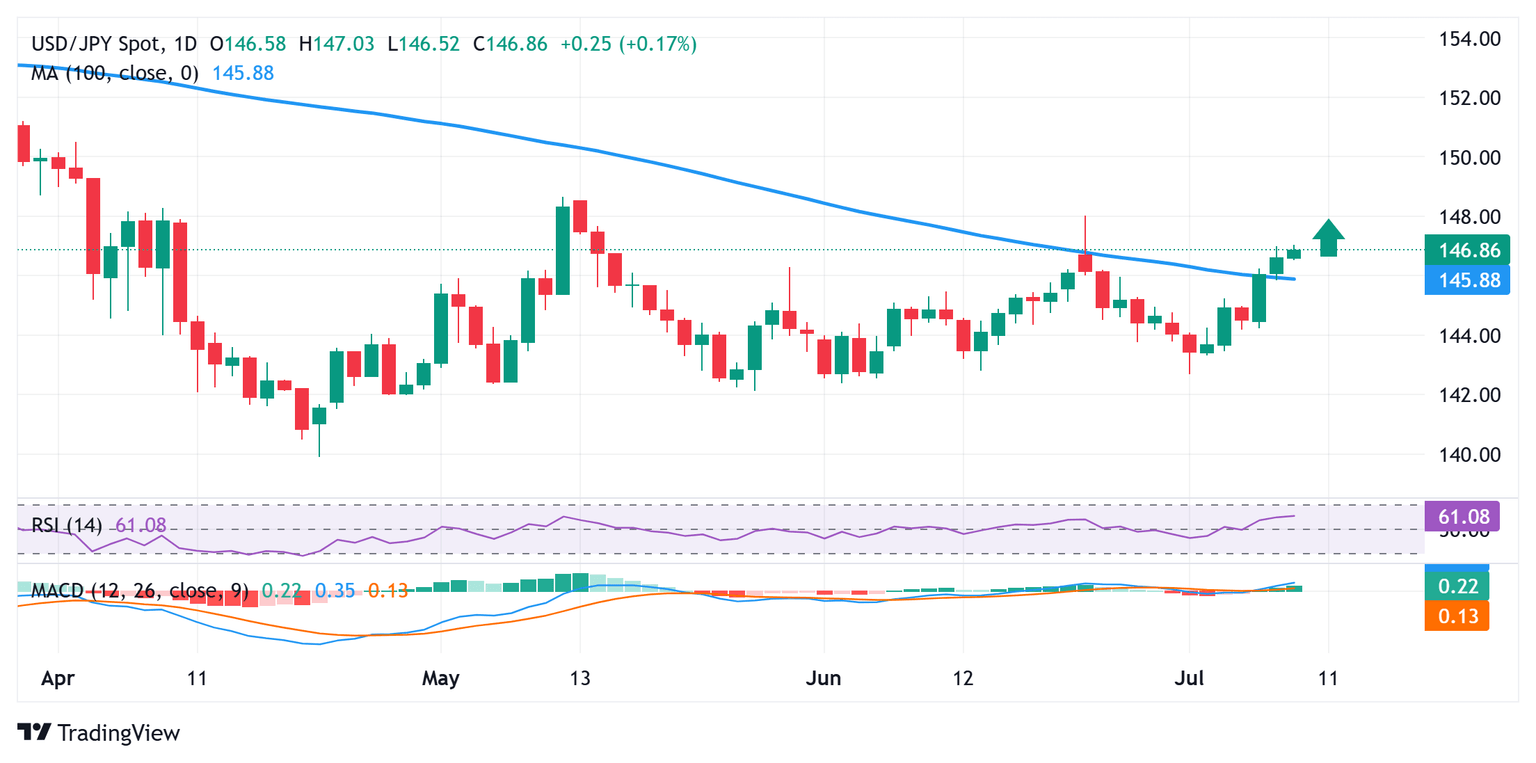

USD/JPY bullish technical setup backs the case for a move towards 148.00

The USD/JPY pair's overnight close above the 100-day Simple Moving Average (SMA) for the first time since February could be seen as a fresh trigger for bullish traders. Moreover, oscillators on the daily chart have been gaining positive traction and are still far from being in the overbought zone. The technical setup backs the case for a further near-term appreciating move towards the 147.60-147.65 intermediate hurdle en route to the 148.00 round figure, or the June monthly swing high.

On the flip side, the Asian session low, around the 146.50 area, now seems to protect the immediate downside. Any further corrective slide could be seen as a buying opportunity and remain limited near the 100-day SMA resistance breakpoint, currently pegged just below the 146.00 round figure. The latter should act as a key pivotal point, which if broken decisively might shift the near-term bias in favor of bearish traders and pave the way for some meaningful downside.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed Jul 09, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.