Japanese Yen remains on the back foot against mildly positive US Dollar

- The Japanese Yen drifts lower on Thursday and is pressured by a combination of factors.

- Rebounding US bond yields and a positive risk tone undermine the JPY amid stronger USD.

- Bets that the BoJ continues to hike interest rates helps limit the downside for the JPY.

The Japanese Yen (JPY) remains on the back foot against its American counterpart, allowing the USD/JPY pair to hold above the 149.00 mark through the early European session on Thursday. Bank of Japan (BoJ) Governor Kazuo Ueda's comments last week about potentially increasing regular bond buying, along with concerns over US President Donald Trump's tariff plans and a positive risk tone, seems to undermine the JPY.

Apart from this, a modest pickup in the US Treasury bond yield, which assists the US Dollar (USD) to build on the overnight bounce from its lowest level since December 10, contributes to driving flows away from the lower-yielding JPY. That said, the growing acceptance that the BoJ will continue raising interest rates in the wake of broadening inflation in Japan favors the JPY bulls and warrants caution before positioning for deeper losses.

Japanese Yen bulls have the upper hand amid rising bets for further BoJ rate hikes

- Bank of Japan Governor Kazuo Ueda said last week the central bank was ready to increase government bond buying if long-term interest rates rise sharply, dragging Japanese government bond yields away from a more-than-a-decade high.

- In fact, the yield on the benchmark 10-year JGB touched its lowest level since February 12 and undermined the Japanese Yen, pushing the USD/JPY pair back closer to mid-149.00s during the Asian session on Thursday.

- Japan’s inflation accelerated at the fastest pace since the summer of 2023 in January and keeps the Bank of Japan on track to raise its benchmark interest rate further, which might hold back traders from placing aggressive JPY bearish bets.

- US President Donald Trump ordered an investigation on copper imports to assess whether tariffs should be imposed due to national security concerns. Trump also confirmed that tariffs on Canada and Mexico are "on time and on schedule".

- Trump has already raised tariffs on goods from China and threatened new reciprocal tariffs for each country. Furthermore, Trump said on Wednesday that his administration will soon announce a 25% tariff on imports from the European Union.

- Bets for more interest rate cuts by the Federal Reserve are on the rise amid the recent downbeat US macro data, which pointed to a cooling economy and fueled worries about the growth outlook. This keeps the US Dollar bulls on the defensive.

- Atlanta Fed President Raphael Bostic said on Wednesday that inflation has seen a lot of progress, though is still high and the US central bank should hold rates where they are, at a level that continues to put downward pressure on inflation.

- Investors now look forward to a slew of key economic reports from Japan, due on Friday, including Industrial Production, Retail Sales, and Tokyo inflation, which could provide further clarity on the BoJ's monetary policy outlook.

- Friday's economic docket also features the release of the US Personal Consumption Expenditure (PCE) Price Index – the Fed's preferred inflation gauge. This would influence the USD and provide a fresh impetus to the USD/JPY pair.

USD/JPY could attract sellers and remain capped near 150.00 psychological mark

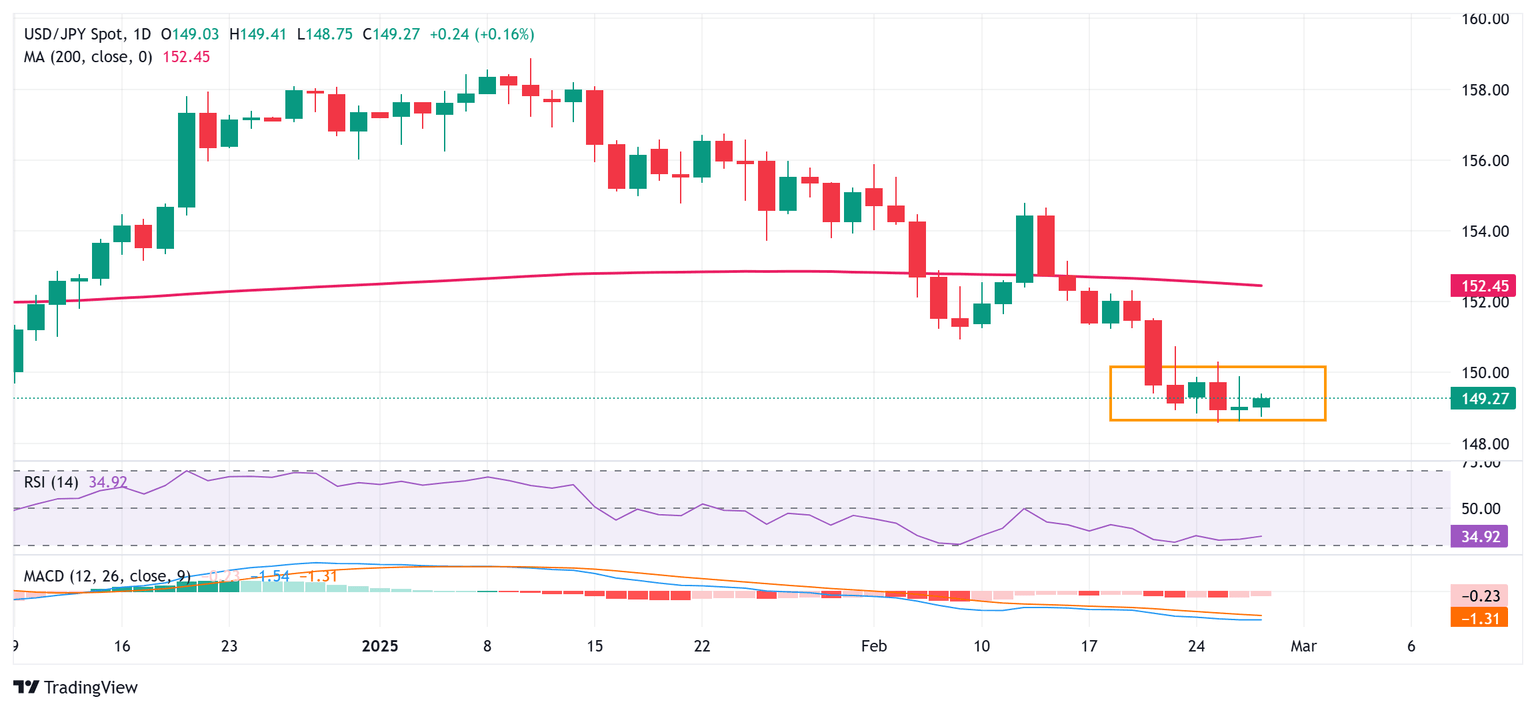

From a technical perspective, the USD/JPY pair has been oscillating in a familiar range since the beginning of this week. This comes on top of the recent downfall from the year-to-date high touched in January and might still be categorized as a bearish consolidation phase. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone, suggesting that the path of least resistance for spot prices remains to the downside.

Hence, any further move up could be seen as a selling opportunity near the 149.75-149.80 region and remain capped near the 150.00 psychological mark. A sustained strength beyond the latter, however, could trigger a short-covering rally and lift the USD/JPY pair further towards the 150.90-151.00 horizontal support breakpoint, now turned strong barrier.

On the flip side, the 149.00 round figure now seems to protect the immediate downside ahead of the 148.60 region, or the multi-month low. Some follow-through selling will be seen as a fresh trigger for bearish traders and drag the USD/JPY pair to the 148.00 mark en route to the next relevant support near the 147.35-147.30 area and the 147.00 round figure.

Economic Indicator

Tokyo Consumer Price Index (YoY)

The Tokyo Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households in the Tokyo region. The index is widely considered as a leading indicator of Japan’s overall CPI as it is published weeks before the nationwide reading. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Next release: Thu Feb 27, 2025 23:30

Frequency: Monthly

Consensus: -

Previous: 3.4%

Source: Statistics Bureau of Japan

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.