Japanese Yen retreats to the lower end of its daily range against US Dollar

- The Japanese Yen attracts some intraday sellers in the wake of weaker domestic data.

- A modest USD uptick assists the USD/JPY pair to climb back closer to mid-149.00s.

- BoJ rate hike bets and the risk-off mood should help limit any meaningful JPY slide.

The Japanese Yen (JPY) surrenders a major part of intraday gains against its American counterpart, pushing the USD/JPY pair back closer to mid-149.00s heading into the European session on Tuesday. Data released from Japan earlier today showed an unexpected uptick in the Unemployment Rate and a fall in corporate capital expenditure for the first time in three years, which, in turn, prompts some selling around the JPY.

Any meaningful JPY depreciation, however, still seems elusive in the wake of the hawkish sentiment surrounding the Bank of Japan's (BoJ) policy outlook. Apart from this, the risk-off mood and US President Donald Trump's threat to Japan over currency devaluation should act as a tailwind for JPY. This makes it prudent to wait for some follow-through buying before confirming that the USD/JPY pair has formed a near-term bottom.

Japanese Yen bulls turn cautious amid a modest USD uptick; downside seems cushioned

- Growing speculation that the Bank of Japan will hike interest rates sooner rather than later keeps the yield on the benchmark 10-year Japanese government bond close to its highest level since 2009 and continues to underpin the Japanese Yen.

- Ukrainian President Volodymyr Zelenskiy's meeting with US President Donald Trump ended in disaster on Friday. A White House official confirmed that the US has paused military aid to Ukraine, which adds to the uncertainty in markets.

- Trump’s tariffs on Mexican and Canadian goods will take effect this Tuesday, along with a new 10% levy on Chinese goods. China’s Commerce Ministry vowed to take necessary countermeasures to safeguard legitimate rights and interests.

- Trump said on Monday that he has warned the leaders of China and Japan against devaluing their currencies against the US Dollar, arguing that such actions put American industries at a disadvantage.

- Japan's Finance Minister, Katsunobu Kato, said on Tuesday that the country is not pursuing a policy of devaluing the domestic currency and Japan has confirmed its "basic stance on currency policy" with US Treasury Secretary Scott Bessent.

- Speaking at a separate news conference, Japan's Economy Minister Ryosei Akazawa said that the government intervenes in the currency market only when the movement is "speculative".

- Japan's Prime Minister Shigeru Ishiba adds that the government is not pursuing so-called currency devaluation policy.

- Data released earlier this Tuesday showed that the Unemployment Rate in Japan unexpectedly edged up from 2.4% to 2.5% in January and Japanese companies reduced spending on plants and equipment in October-December by 0.2%.

- The Institute for Supply Management's (ISM) Manufacturing PMI slipped to 50.3 in February from 50.9 in the previous month, while the Prices Paid Index jumped to 62.4, or nearly a three-year high amid worries about duties on imports.

- Moreover, investors remain concerned that Trump's policies would increase price pressures and slow down activity in vital industrial sectors. This might force the Federal Reserve to cut rates further and weigh on the US Dollar.

USD/JPY might struggle to build on modest intraday bounce; the 150.00 mark holds the key

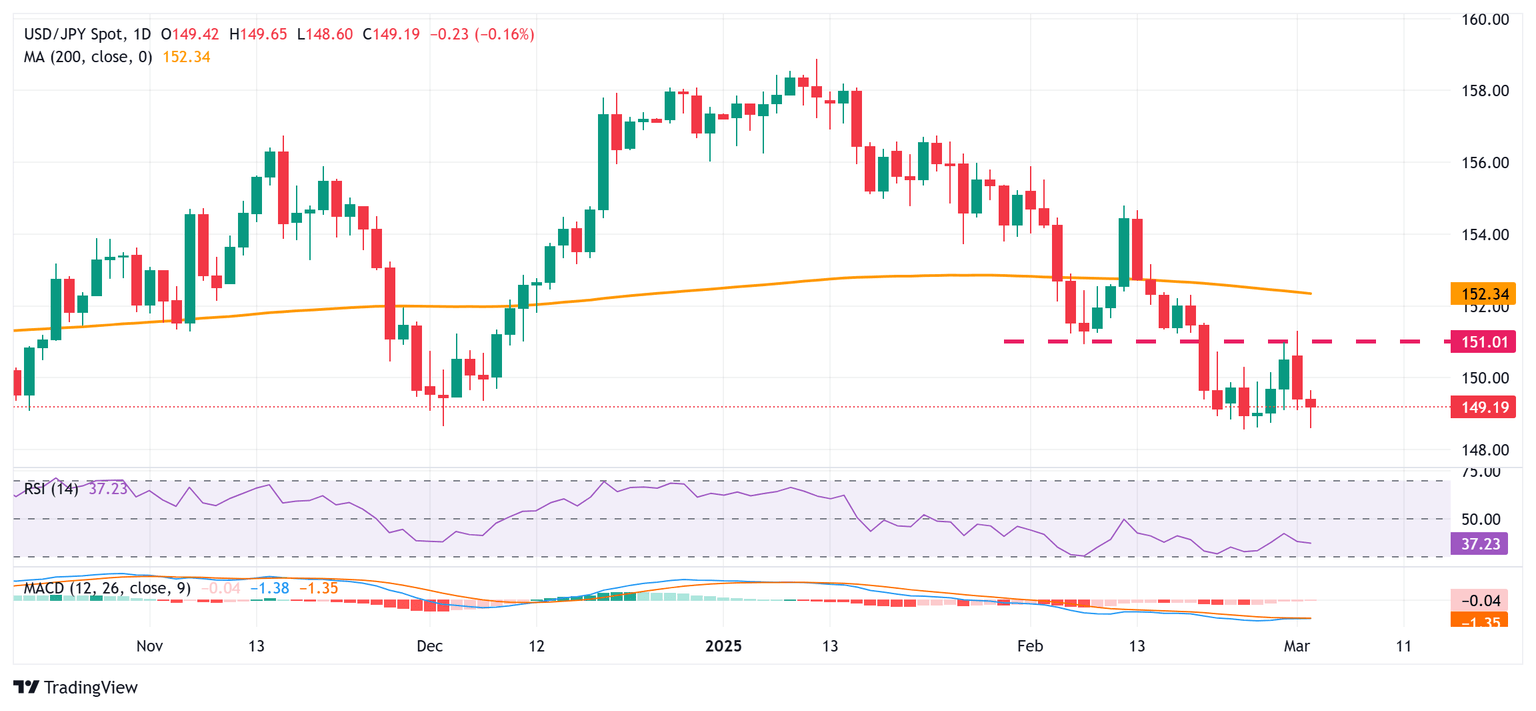

From a technical perspective, the overnight failure near the 151.00 support breakpoint, now turned resistance, validates the near-term bearish outlook for the USD/JPY pair. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, supports prospects for an extension of the pair's recent well-established downtrend witnessed over the past two months or so. Hence, some follow-through weakness below mid-148.00s, towards the next relevant support near the 148.00 round figure, looks like a distinct possibility. The downward trajectory could extend further towards the 147.35-147.30 region en route to the 147.00 mark.

On the flip side, the 149.65-149.70 area now seems to act as an immediate hurdle ahead of the 150.00 psychological mark. Any further move up might still be seen as a selling opportunity near the 150.60 region, which, in turn, should cap the USD/JPY pair near the 150.90-151.00 key hurdle. The latter should act as a pivotal point, which if cleared decisively might prompt a short-covering rally towards the 151.40-151.45 intermediate hurdle en route to the 152.00 round figure and the 152.35 region, or the very important 200-day Simple Moving Average (SMA).

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.