Japanese Yen remains on the back foot amid receding safe-haven demand; downside seems limited

- The Japanese Yen kicks off the new week on a weaker note, though the downside seems limited.

- Rising geopolitical tensions and hawkish BoJ expectations should lend some support to the JPY.

- Traders might also opt to move to the sidelines ahead of this week’s key central bank event risks.

The Japanese Yen (JPY) remains on the back foot against its American counterpart for the second straight day on Monday amid expectations that the Bank of Japan (BoJ) might forego another interest rate hike this year. Adding to this, a generally positive tone around the equity markets is seen as another factor undermining demand for the safe-haven JPY. However, persistent trade-related uncertainties and rising geopolitical tensions in the Middle East act as a tailwind for the JPY.

Moreover, the growing acceptance that the BoJ will stick to the path toward policy normalization amid the broadening inflation in Japan should contribute to limiting losses for the JPY. This, along with the emergence of some US Dollar (USD) selling, should cap the upside for the USD/JPY pair. Traders might also refrain from placing aggressive bets and opt to wait for this week's key central bank event risks – the BoJ and the FOMC policy decisions on Tuesday and Wednesday, respectively.

Japanese Yen struggles to attract lure buyers despite a combination of supporting factors

- The Bank of Japan is reportedly weighing a plan to reduce the pace of its Japanese government bond (JGB) purchases by half, starting in April 2026. The proposal is set to be discussed at the two-day policy meeting, which begins this Monday, and is expected to receive a majority backing from board members.

- Meanwhile, the BoJ is widely anticipated to hold its benchmark rate steady at 0.5% at the end of the June policy meeting on Tuesday. Policymakers, however, see slightly stronger inflation than they had anticipated earlier this year, which, in turn, could pave the way for future interest rate hike discussions.

- The growing market acceptance that the BoJ might push for tighter monetary conditions, along with trade-related uncertainties and a further escalation of geopolitical tensions in the Middle East, lends some support to the safe-haven Japanese Yen. This caps the USD/JPY pair's move higher on Monday.

- Israel struck Iran’s nuclear sites and key personnel last Friday, calling the operation necessary to counter an existential threat.

- Iran responded with hundreds of drones over the weekend and warned of further retaliation. This ramps up geopolitical uncertainty in the Middle East and favors the JPY bulls.

- The US Dollar, on the other hand, struggles to attract any meaningful buyers and remains close to a three-year low touched last week amid persistent trade-related uncertainties. Moreover, bets that the Federal Reserve will lower borrowing costs further in 2025 act as a headwind for the Greenback.

- Traders keenly await the crucial BoJ and Fed decisions on Tuesday and Wednesday, respectively, for cues about the future policy outlook and a fresh impetus. Nevertheless, the divergent BoJ-Fed expectations suggest that the path of least resistance for the USD/JPY pair is to the downside.

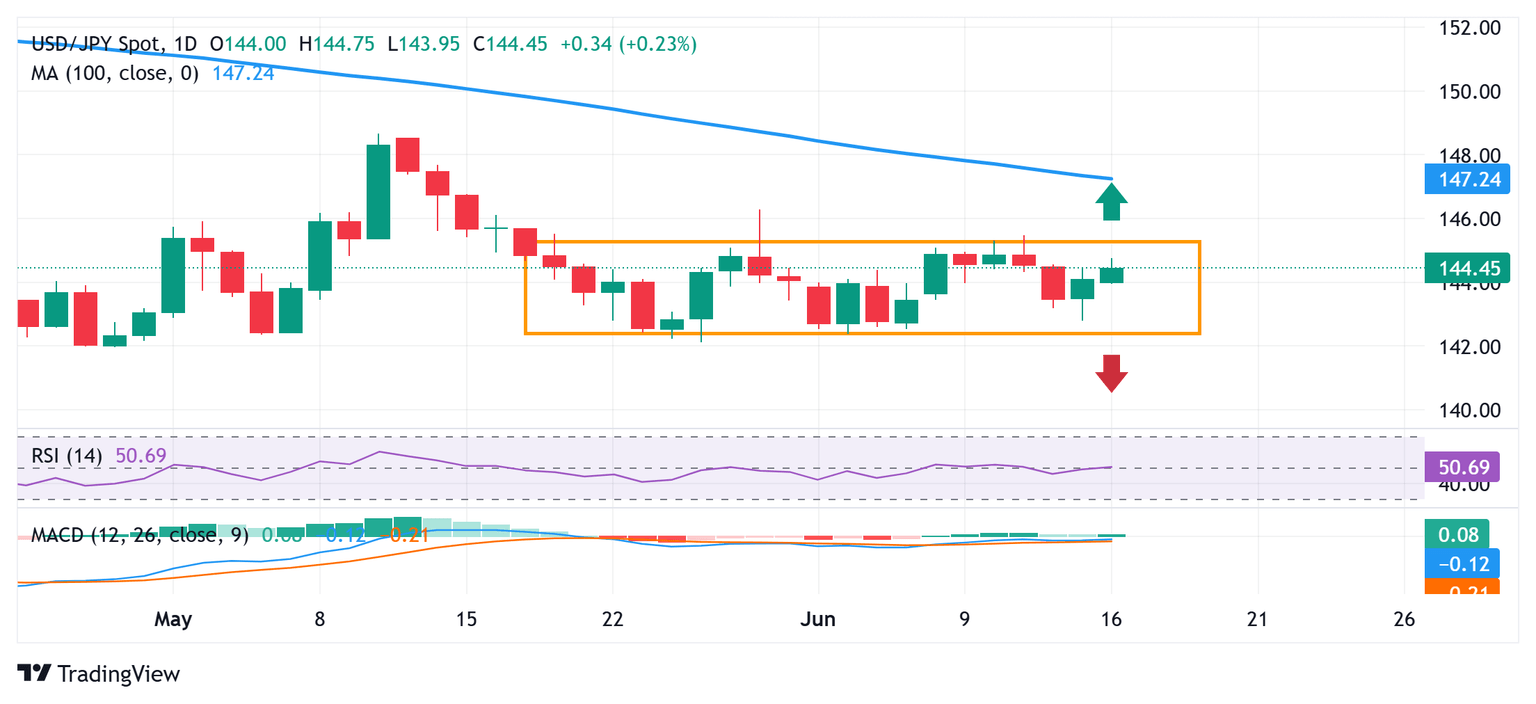

USD/JPY needs to break below 144.00 to back the case for some meaningful intraday slide

From a technical perspective, the intraday move higher falters near the 144.75 region or a resistance marked by the top end of a multi-week-old trading range. Some follow-through buying, leading to a subsequent move beyond the 145.00 psychological mark, will be seen as a key trigger for bulls and lift the USD/JPY pair to the monthly swing high, around the 145.45 region. The momentum might then allow spot prices to reclaim the 146.00 round figure and extend further towards the 146.25-146.30 region, or the May 29 peak.

On the flip side, the 144.00 mark now seems to protect the immediate downside and any subsequent slide is more likely to attract some buying near the 143.55-143.50 region. A convincing break below the latter could drag the USD/JPY pair to the 143.00 round figure en route to Friday's swing low, around the 142.80-142.75 region and the lower boundary of the trading range, around mid-142.00s. Failure to defend the said support levels would set the stage for the resumption of the downtrend from the May monthly swing high.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.