Japanese Yen bulls remain on the sidelines; USD/JPY stands firm above mid-157.00s

- The Japanese Yen continues to be undermined by wavering BoJ rate hike expectations.

- The au Jibun Bank Japan Services PMI was revised down to 50.9 from 51.4 for December.

- The USD stands near a two-year top amid the Fed’s hawkish shift and supports USD/JPY.

The Japanese Yen (JPY) sticks to its intraday negative bias heading into the European session on Monday amid the uncertainty about the likely timing of when the Bank of Japan (BoJ) will hike interest rates again. Apart from this, the recent widening of the US-Japan yield differential, bolstered by the Federal Reserve's (Fed) hawkish signal, is seen undermining the lower-yielding JPY. This, along with a positive risk tone, drives flows away from the safe-haven JPY and lifts the USD/JPY pair back closer to a multi-month peak touched in December.

Meanwhile, data released earlier this Monday showed that the business activity in Japan's service sector expanded for the second straight month in December. This comes on top of a pick-up in Japan's service-sector inflation and backs the case for a January BoJ rate hike. Furthermore, geopolitical risks and concerns about Trump's tariff plans could support the JPY amid speculations that Japanese authorities might intervene to prop up the domestic currency. This, in turn, warrants caution before placing aggressive bearish bets around the JPY.

Japanese Yen remains vulnerable BoJ rate-hike doubts

- The Bank of Japan last month offered few clues on how soon it could push up borrowing costs again, while stressing the need to be more cautious amid domestic and global uncertainties.

- The au Jibun Bank Service Purchasing Managers' Index (PMI) was revised down to 50.9 for December, from the flash reading of 51.4, still marked expansion for the second straight month.

- The survey further revealed that the subindex of new business rose for a sixth straight month, employment grew for the 15th consecutive month and business sentiment stayed positive.

- BoJ Governor Kazuo Ueda hopes that wages and prices increase at a balanced pace this year and said that the timing of adjusting monetary support depends on economic, price and financial developments.

- Markets expect that the BoJ will raise rates to 0.50% by the end of March from 0.25%. The next BoJ meeting is scheduled on January 23-24 followed by another meeting on March 18-19.

- The Institute of Supply Management (ISM) reported on Friday that the US Manufacturing PMI improved from 48.4 to 49.3 in December, pointing to signs of resilience and potential for growth.

- The Federal Reserve signaled in December that it would slow the pace of interest rate cuts in 2025, which has been pushing the US Treasury bond yields and the US Dollar higher in recent weeks.

- San Francisco Fed President Mary Daly said on Saturday that despite significant progress in lowering price pressures over the past two years, inflation remains uncomfortably above the 2% target.

- Traders now look to the US economic docket – featuring the release of the final Services PMI and Factor Orders data – for some impetus and short-term trading opportunities later today.

- Investors this week will confront other important US macro data – ISM Services PMI, JOLTS Job Openings, the ADP report on private-sector employment and the Nonfarm Payrolls (NFP) report.

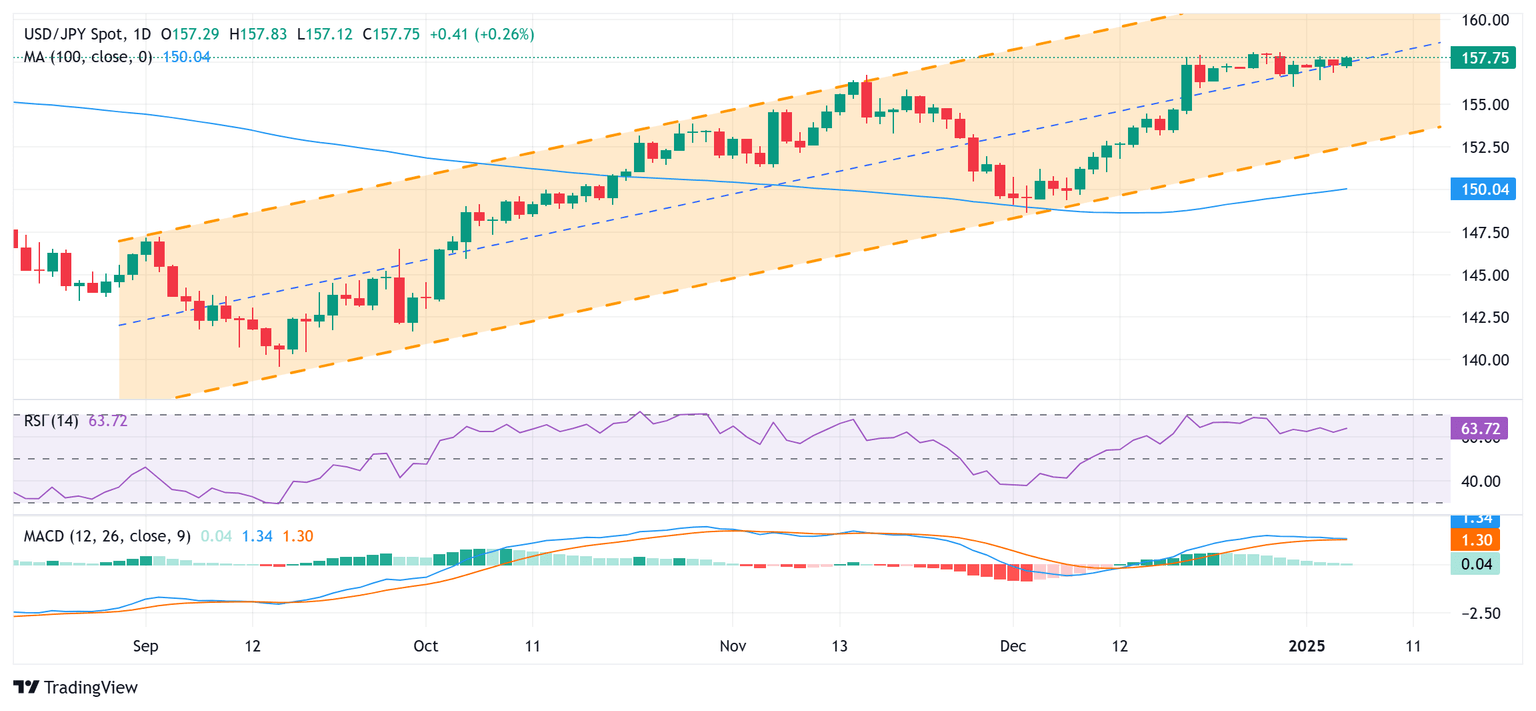

USD/JPY technical setup seems tilted firmly in favor of bulls

Any subsequent move-up is likely to face some resistance around the 158.00 neighbourhood, or the multi-month peak. A sustained move beyond will be seen as a fresh trigger for bullish traders and pave the way for additional gains amid positive oscillators on the daily chart. The USD/JPY pair might then aim to surpass the 158.45 intermediate hurdle and reclaim the 159.00 mark. The momentum could extend further towards the 160.00 psychological mark en route to the 160.50 area, which coincides with the top end of a multi-month-old ascending channel.

On the flip side, the Asian session low, around the 157.00 mark, now seems to protect the immediate downside ahead of the 156.65 horizontal zone and the 156.00 mark. Any further decline could be seen as a buying opportunity near the 155.50 region and help limit losses for the USD/JPY pair near the 155.00 psychological mark. The latter should act as a strong base for spot prices, which if broken decisively might shift the near-term bias in favor of bearish traders.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | -0.16% | 0.28% | -0.38% | -0.20% | -0.12% | -0.01% | |

| EUR | 0.04% | -0.13% | 0.29% | -0.28% | -0.12% | -0.04% | 0.07% | |

| GBP | 0.16% | 0.13% | 0.43% | -0.15% | 0.01% | 0.08% | 0.19% | |

| JPY | -0.28% | -0.29% | -0.43% | -0.66% | -0.46% | -0.38% | -0.07% | |

| CAD | 0.38% | 0.28% | 0.15% | 0.66% | 0.10% | 0.21% | 0.34% | |

| AUD | 0.20% | 0.12% | -0.01% | 0.46% | -0.10% | 0.07% | 0.18% | |

| NZD | 0.12% | 0.04% | -0.08% | 0.38% | -0.21% | -0.07% | 0.11% | |

| CHF | 0.00% | -0.07% | -0.19% | 0.07% | -0.34% | -0.18% | -0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.