Japanese Yen stands firm against USD; looks to US ADP for fresh impetus

- The Japanese Yen jumps to over a one-month top against the USD amid BoJ rate hike bets.

- Expectations for a further narrowing of the Japan-US rate differential also underpin the JPY.

- Worries about Trump’s trade tariffs hitting Japan and a positive risk tone might cap the JPY.

The Japanese Yen (JPY) retains bullish bias through the early European session on Wednesday, with the USD/JPY pair hanging just above the 153.00 mark or its lowest level since December 13. A rise in Japan's real wages reaffirms bets that the Bank of Japan (BoJ) will raise interest rates again, which, in turn, provides a strong boost to the JPY. Moreover, the prospects for more policy easing by the Federal Reserve (Fed) would result in a further narrowing of the rate differential between the US and Japan. This turns out to be another factor driving flows toward the lower-yielding JPY.

Meanwhile, expectations that the Fed will lower borrowing costs further by the end of this year drag the US Dollar (USD) to a fresh weekly low and contribute to the heavily offered tone surrounding the USD/JPY pair. However, worries that Japan would also be an eventual target for US President Donald Trump's tariffs, along with the prevalent risk-on environment, might hold back traders from placing fresh bullish bets around the safe-haven JPY. Traders now look forward to the US ADP report and the US ISM Services PMI for short-term opportunities later during the early North American session.

Japanese Yen remains well supported by BoJ rate hike bets; seems poised to appreciate further

- Preliminary government data released earlier this Wednesday revealed that inflation-adjusted real wages in Japan climbed 0.6% from the year before in December. Adding to this, the previous month's reading was revised to show a 0.5% rise against a 0.3% drop reported originally.

- Meanwhile, the consumer inflation rate that the government uses to calculate real wages accelerated from November's 3.4% to 4.2%, or the fastest pace since January 2023. This, in turn, supports prospects for further policy tightening by the Bank of Japan and lifts the Japanese Yen.

- BoJ's Director General of monetary affairs Kazuhiro Masaki said that the central bank sees underlying inflation gradually heading toward 2% and services prices are rising moderately.Price rises post-pandemic have been driven mostly by cost push factors, Masaki added further.

- A survey compiled by S&P Global Market Intelligence showed that Japan's service activity expanded for a third straight month in January. In fact, the au Jibun Bank Service Purchasing Managers’ Index (PMI) rose from 50.9 to 53.0 in January, marking the highest level since September 2024.

- The US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday that the number of job openings on the last business day of December stood at 7.6 million. This was below the 8.09 million openings in November and expectations of 8 million.

- The data pointed to a slowdown in the job market, which could allow the Federal Reserve to cut rates further. This marks a big divergence in comparison to the hawkish BoJ expectations and drags the USD/JPY pair to over a one-month low during the Asian session on Wednesday.

- Fed Vice Chairman Philip Jefferson said on Tuesday that there is no need to hurry further rate cuts as a strong economy makes caution appropriate. Interest rates are likely to fall over the medium term and the Fed faces uncertainty around government policy, Jefferson added further.

- US President Donald Trump offered concessions to Canada and Mexico by delaying the 25% trade tariffs for 30 days. Adding to this hopes for a trade breakthrough between the US and China help to ease trade war fears and remain supportive of the prevalent risk-on environment.

- Investors remain worried that Japan would also be an eventual target for Trump's trade tariffs. Japan's Prime Minister Shigeru Ishiba is set to meet with Trump later this week and their conversation may provide more hints about the risk as Japan has a large trade surplus with the US.

- Traders now look forward to the US economic docket – featuring the release of the ADP report on private-sector employment and the ISM Services PMI. The data provide some impetus to the US Dollar ahead of the closely-watched US Nonfarm Payrolls report on Friday.

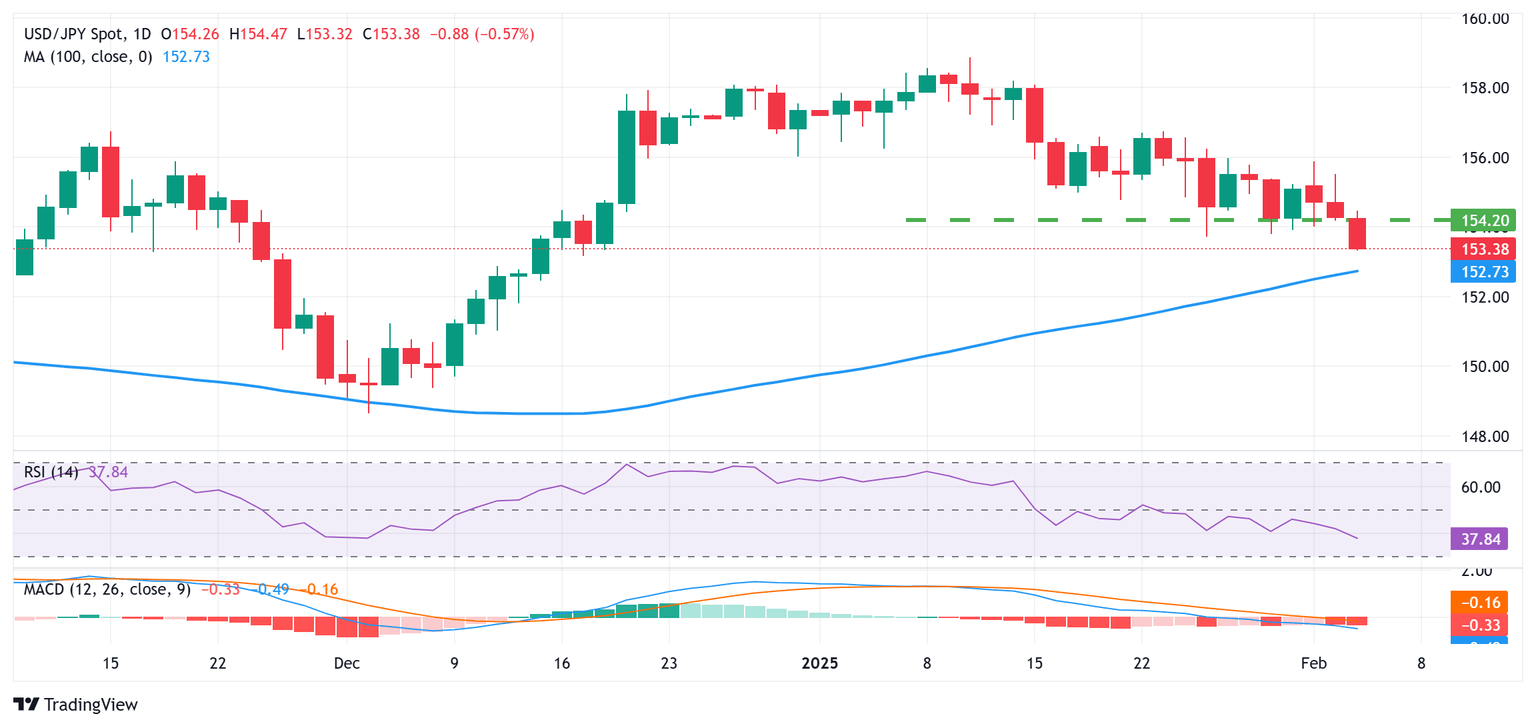

USD/JPY remains on track to challenge 100-day SMA, break below the 153.00 mark awaited

From a technical perspective, the intraday breakdown and acceptance below the 154.00 mark could be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and are still away from being in the oversold territory. This, in turn, suggests that the path of least resistance for the USD/JPY pair is to the downside and supports prospects for a further depreciating move. Hence, a subsequent fall towards the 153.00 mark, en route to the 100-day Simple Moving Average (SMA), currently pegged near the 152.45 region, looks like a distinct possibility.

On the flip side, any attempted recovery might now confront immediate resistance near the 154.00 round figure. Some follow-through buying, however, might prompt a short-covering rally and lift the USD/JPY pair to the 154.70-154.75 intermediate hurdle en route to the 155.00 psychological mark. Meanwhile, a further move up could be seen as a selling opportunity and remain capped near the 155.25-155.30 region. The latter should act as a key pivotal point, which if cleared decisively will negate the negative outlook and shift the near-term bias in favor of bullish traders.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Feb 05, 2025 13:15

Frequency: Monthly

Consensus: 150K

Previous: 122K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.