Japanese Yen surrenders major part of intraday gains against USD; bullish bias remains

- The Japanese Yen draws support from BoJ rate hike bets and the global flight to safety.

- Trade jitters and escalating geopolitical tensions continue to benefit safe-haven assets.

- The divergent BoJ-Fed expectations also exert downward pressure on the USD/JPY pair.

The Japanese Yen (JPY) maintains its bid tone through the first half of the European session on Thursday amid bets that the Bank of Japan (BoJ) will keep raising interest rates this year strong wage growth could boost consumer spending. This, in turn, might contribute to rising inflation and give the BoJ headroom to stick to tighten its policy further. The resultant narrowing of the rate differential between Japan and other countries continues to underpin the lower-yielding JPY.

Furthermore, the uncertainty over US President Donald Trump's trade policies and geopolitical risks turn out to be other factors underpinning the JPY's safe-haven status. This further contributes to the USD/JPY pair's intraday slide to the 148.00 neighborhood, though a modest US Dollar (USD) uptick helps limit further losses. Meanwhile, expectations that the Federal Reserve (Fed) will cut interest rates several times this year should cap the USD and the currency pair.

Japanese Yen bulls retain control amid persistent safe-haven demand and BoJ rate hike bets

- The Bank of Japan decided to keep its key policy rate steady at the end of a two-day review meeting on Wednesday and noted that the uncertainty surrounding Japan's economy, and prices remains high.

- In the post-meeting presser, BoJ Governor Kazuo Ueda said that the central bank wants to conduct policies before it is too late and that achieving a 2% inflation target is important for long-term credibility.

- The Federal Reserve, as was widely anticipated, also held interest rates steady for the second meeting in a row and signaled that it is likely to deliver two 25 basis points rate cuts by the end of this year.

- Meanwhile, policymakers trimmed their growth forecast for the year amid the growing uncertainty over the impact of US President Donald Trump's aggressive trade policies on economic activity.

- Furthermore, the Fed gave a bump higher to its inflation projection. Traders, however, still see over a 65% chance that the US central bank would resume its rate-cutting cycle at the June policy meeting.

- Ukrainian President Volodymyr Zelenskiy and Trump agreed to work together to end the Russia-Ukraine war. Russian President Vladimir Putin, however, rejected a proposed full 30-day ceasefire.

- The Israeli military said that it launched a limited ground incursion into Gaza, a day after an aerial bombardment of the strip that shattered the two-month-old ceasefire with Hamas.

- Israeli Prime Minister Benjamin Netanyahu warned of fierce war expansion, raising the risk of a further escalation of Middle East tensions and benefiting safe-haven assets, including the Japanese Yen.

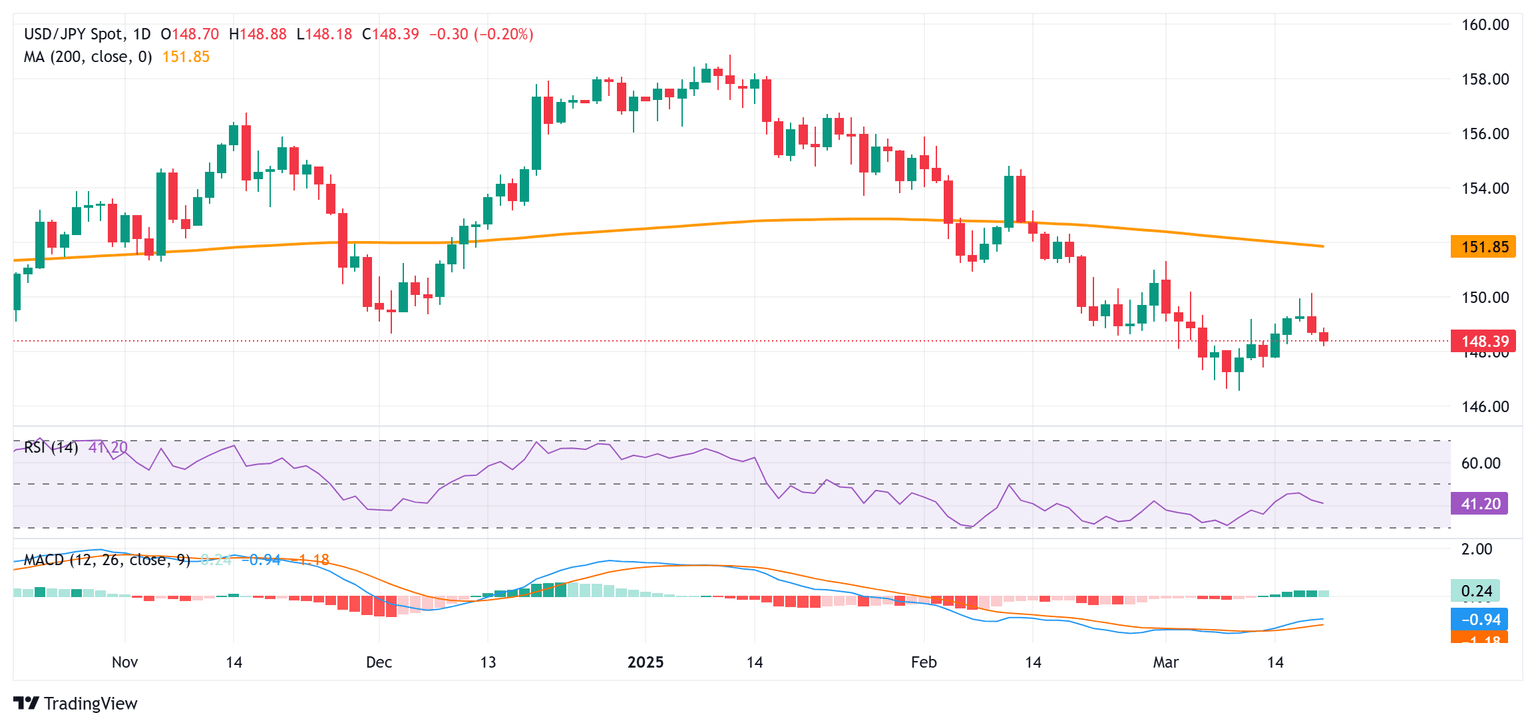

USD/JPY might struggle to climb beyond the 149.00 mark, bearish potential remains intact

From a technical perspective, the overnight failure to find acceptance above the 150.00 psychological mark and the subsequent decline suggests that the recent bounce from a multi-month low has run out of steam. Moreover, negative oscillators on the daily chart support prospects for a further depreciating move for the USD/JPY pair. Hence, some follow-through weakness below the 148.00 mark, towards the next relevant support near the 147.75 horizontal support, looks like a distinct possibility. The downward trajectory could extend further towards the 147.30 region en route to the 147.00 round figure and the 146.55-146.50 area, or the lowest level since early October touched earlier this month.

On the flip side, any attempted recovery might now confront an immediate hurdle near the Asian session high, just ahead of the 149.00 mark. This is followed by the 149.25-149.30 supply zone, above which the USD/JPY pair could aim to reclaim the 150.00 mark. Some follow-through buying beyond the overnight swing high, around the 150.15 region, could prompt a short-covering rally and lift spot prices to the 150.60 intermediate barrier en route to the 151.00 mark and the monthly peak, around the 151.30 region.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.