Japanese Yen hangs near multi-week low against USD as traders keenly await US CPI report

- The Japanese Yen struggles to lure buyers amid rising trade tensions and reduced BoJ rate hike bets.

- Domestic political uncertainty keeps the JPY bulls on the defensive amid a broadly firmer USD.

- Traders now look forward to the US consumer inflation figures for some meaningful impetus.

The Japanese Yen (JPY) languishes near a three-week low against a softer US Dollar (USD) heading into the European session on Tuesday and seems vulnerable to prolonging the monthly downtrend. The growing market conviction that the Bank of Japan (BoJ) will keep interest rates low for longer than it wants amid concerns about the economic fallout from higher US tariffs turns out to be a key factor undermining the JPY.

Meanwhile, hopes that trade deals would be struck before US President Donald Trump's August 1 deadline for reciprocal tariffs and that a global trade war would be averted remain supportive of a positive risk tone. This, in turn, is seen denting demand for traditional safe-haven assets, including the JPY. That said, a modest USD pullback from a multi-week high caps the USD/JPY pair ahead of US consumer inflation figures.

Japanese Yen bears have the upper hand as rising trade tensions temper BoJ rate hike bets

- US President Donald Trump softened his stance on trade and told reporters at the White House on Monday that he was open to further trade negotiations. Trump added that Europe has expressed interest in pursuing a different kind of agreement.

- Meanwhile, Trump’s 25% tariff on Japanese goods effective from August 1 could result in a loss of economic momentum and a cooler inflation outlook. This could potentially curb expectations for an immediate interest rate hike by the Bank of Japan.

- Meanwhile, recent opinion surveys suggest that Japanese Prime Minister Shigeru Ishiba's coalition may lose its majority at the upcoming upper house election on July 20. According to the Asahi newspaper, the LDP will likely win just around 35 seats.

- The benchmark 10-year Japanese government bond (JGB) yield rose to 1.595% on Tuesday, a level unseen since October 2008, as investors brace for the possible loss of fiscal hawk Ishiba, straining Japan's already frail finances.

- This would further complicate the BoJ's efforts to normalise its monetary policy, which, along with a turnaround in the global risk sentiment, is seen undermining the Japanese Yen and acting as a tailwind for the USD/JPY pair on Tuesday.

- The US Dollar shot to its highest level since June 24 amid the growing acceptance that the Federal Reserve would keep interest rates elevated in anticipation of worsening inflation as a result of higher import taxes and a still resilient US labor market.

- Hence, the focus remains glued to the release of the latest US consumer inflation figures, due later this Tuesday. The heading Consumer Price Index (CPI) is expected to rise 2.7% YoY in June, while the core gauge is seen coming in at 3.0% YoY.

- Nevertheless, the crucial data would influence market expectations about the Fed's rate-cut path and determine the near-term trajectory for the USD. Apart from this, trade developments should provide a fresh impetus to the USD/JPY pair.

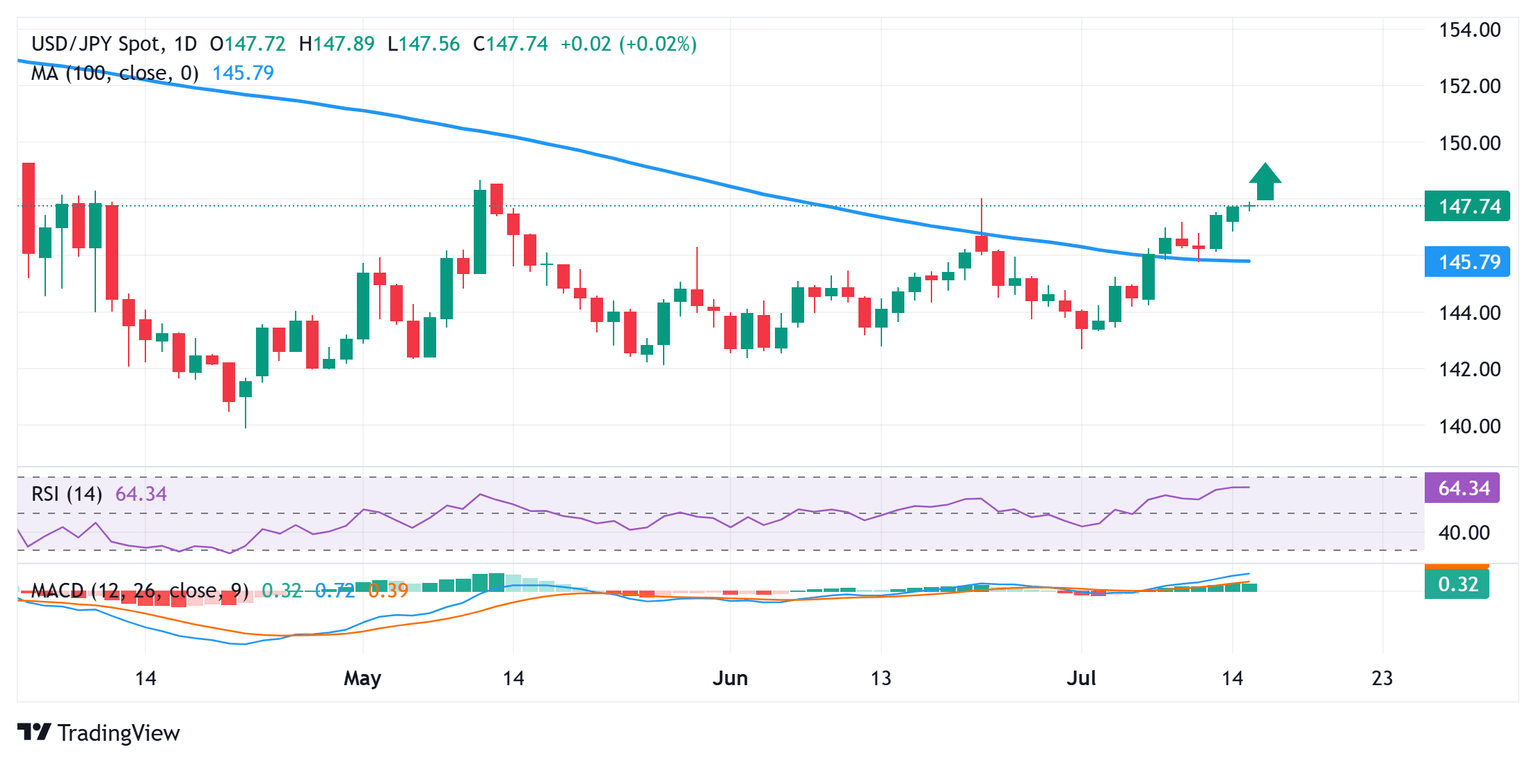

USD/JPY awaits sustained strength and acceptance above 148.00 before the next leg up

The recent breakout through the 100-day Simple Moving Average (SMA) and a subsequent strength beyond the 147.00 mark was seen as a key trigger for the USD/JPY bulls. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought territory. This, in turn, suggests that the path of least resistance for spot prices remains to the upside and backs the case for an extension of a two-week-old uptrend. From current levels, the June swing high, around the 148.00 mark, could act as an immediate hurdle, above which the currency pair could test the 148.65 region (May swing high) before aiming to reclaim the 149.00 round figure.

On the flip side, any meaningful corrective slide could be seen as a buying opportunity near the 147.20-147.15 region. This is closely followed by the 147.00 mark, below which the USD/JPY pair could accelerate the fall towards the 146.60-146.55 region en route to the 146.00 round figure and the 100-day SMA, currently pegged near the 145.80 region. The latter should act as a key pivotal point and a convincing break below might shift the near-term bias in favor of bearish traders, paving the way for a decline towards the 145.50-145.45 area en route to the 145.00 psychological mark.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Tue Jul 15, 2025 12:30

Frequency: Monthly

Consensus: 2.7%

Previous: 2.4%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.