Japanese Yen remains depressed; USD/JPY sticks to gains above mid-150.00s

- The Japanese Yen attracts some sellers on Wednesday, though the downside seems limited.

- The divergent BoJ-Fed expectations should cap USD/JPY amid subdued USD price action.

- Traders might also opt to wait for the Tokyo CPI and the US PCE Price Index due on Friday.

The Japanese Yen (JPY) maintained its offered tone through the early European session on the back of softer domestic data, which showed that the Service Producer Price Index (PPI) in Japan eased to the 3.0% YoY rate in February. Apart from this, a generally positive tone around the equity markets is seen undermining the safe-haven JPY. This, along with the emergence of some US Dollar (USD) dip-buying, assists the USD/JPY pair to stick to intraday gains above mid-150.00s.

Meanwhile, the markets have been pricing in the possibility that the Bank of Japan (BoJ) will continue raising interest rates amid expectations that strong wage growth would underpin consumption and filter into broader inflation trends. This marks a big divergence in comparison to the Federal Reserve's (Fed) forecast for two 25-basis-point rate cuts in 2025. The resultant narrowing of the Japan-US rate differential could support the lower-yielding JPY and cap the USD/JPY pair.

Japanese Yen retains its negative bias as the upbeat market mood offsets BoJ rate hike bets

- The Bank of Japan reported earlier this Wednesday that the Services Producer Price Index (PPI) – a leading indicator of Japan's service-sector inflation – rose 3.0% from a year earlier in February. The reading was slightly below the 3.1% increase in January. On a monthly basis, the index remained flat during the reported month after falling 0.5% in January.

- Moreover, BoJ Governor Kazuo Ueda reiterated that the central bank will continue to raise interest rates if economic and price developments move in line with forecasts made in the quarterly outlook report. Adding to this, significant wage hikes for the third consecutive year keep alive expectations of further interest rate hikes by the Japanese central bank.

- In contrast, the Federal Reserve signaled last week that it would deliver two 25-basis-point interest rate cuts by the end of this year. Meanwhile, the Fed gave a bump higher to its inflation projection, though it revised the growth outlook downward amid the growing uncertainty over the impact of US President Donald Trump's aggressive trade policies.

- Trump is expected to announce so-called retaliatory tariffs – that offset levies on US goods and are set to take effect on April 2 – on about 15 major US trading partners. Furthermore, Trump imposed a secondary tariff on Venezuela and said that any country that buys oil or gas from Venezuela would face a 25% tariff when trading with the US.

- The increasing pessimism about the US economy led to a sharp downturn in the US Consumer Confidence, which dropped for a fourth straight month in March. The Conference Board's survey further revealed that the Expectations Index fell to 65.2, or the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead.

- This, in turn, prompted a modest US Dollar pullback from a nearly three-week high touched on Tuesday and weighed heavily on the USD/JPY pair. The USD bulls failed to gain any respite from Fed Governor Adriana Kugler's hawkish remarks, saying that the progress toward returning inflation to the 2% target has slowed since last summer.

- Several Fed officials are set to speak in the coming days and will play a key role in influencing the USD price dynamics. In the meantime, traders will look to Wednesday's release of US Durable Goods Orders for short-term impetus. The focus, however, remains on the US Personal Consumption Expenditure (PCE) Price Index on Friday.

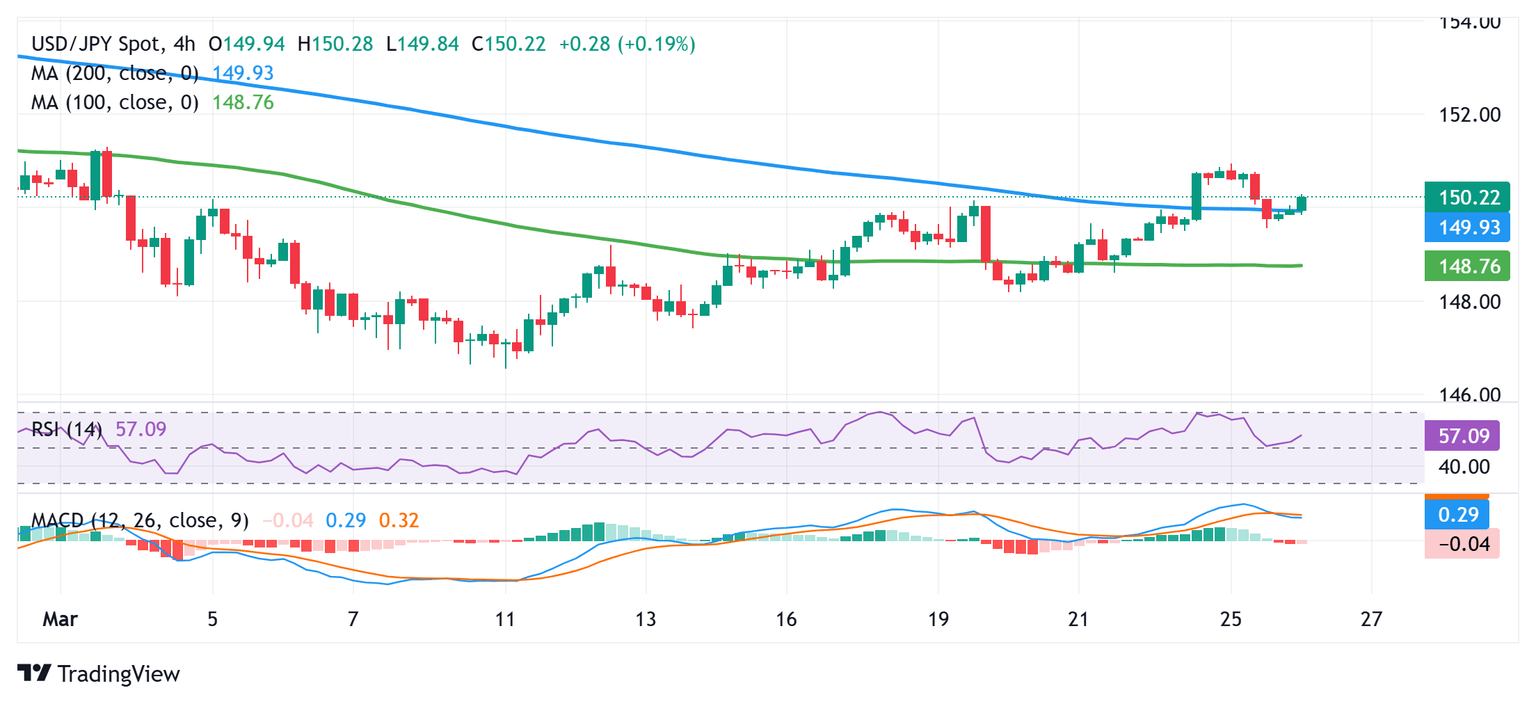

USD/JPY bulls might wait for sustained move beyond the 151.00 mark before placing fresh bets

From a technical perspective, this week's breakout above the 200-period Simple Moving Average (SMA) on the 4-hour chart was seen as a key trigger for bullish traders. Moreover, oscillators on the daily chart have just started gaining positive traction and suggest that the path of least resistance for the USD/JPY pair is to the upside. However, the overnight failure ahead of the 151.00 mark warrants some caution. Hence, it will be prudent to wait for sustained strength and acceptance above the said handle before positioning for an extension of the recent recovery from a multi-month low. The subsequent move-up could lift spot prices beyond the monthly top, around the 151.30 area, towards the 152.00 round figure.

On the flip side, the 149.55 area, or the overnight swing low, now seems to protect the immediate downside, below which the USD/JPY pair could slide to the 149.00 mark en route to the 148.75-148.70 support. The latter coincides with the 100-period SMA on the 4-hour chart, which if broken might shift the bias in favor of bearish traders. Spot prices might then accelerate the fall towards the 148.00 round figure and slide further towards the 147.35-147.30 region before eventually dropping below the 147.00 mark, towards the 146.55-146.50 area, or the multi-month low touched on March 11.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.