Japanese Tokyo CPI inflation rises to 2.2% from 1.8%, recovers from 26-month low

Japan's Tokyo Consumer Price Index (CPI) inflation rose to 2.2% YoY in May, climbing from the previous 1.8%. May's CPI inflation in Tokyo rebounded from April's 1.8%, a 26-month low.

Tokyo CPI inflation trends higher than national-level CPI inflation figures, which tend to be released three weeks after the Tokyo inflation, which serves as a preview of Japanese inflation trends. The Bank of Japan (BoJ) has been deeply entrenched in a monetary policy stance, and fear of declining inflation has kept the BoJ from raising rates and trimming the wide rate differential that exists between the Japanese Yen (JPY) and other major global currencies.

Economic Indicator

Tokyo Consumer Price Index (YoY)

The Tokyo Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households in the Tokyo region. The index is widely considered as a leading indicator of Japan’s overall CPI as it is published weeks before the nationwide reading. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Last release: Thu May 30, 2024 23:30

Frequency: Monthly

Actual: 2.2%

Consensus: -

Previous: 1.8%

Source: Statistics Bureau of Japan

Recovering CPI inflation could provide confidence in future policy adjustment expectations from the BoJ.

Core Tokyo CPI inflation also rose to 1.9% from 1.6% Yoy, while 'core-core' Tokyo CPI inflation (headline CPI inflation less volatile food and energy prices) also rose 2.2% on an annual basis from 1.8%.

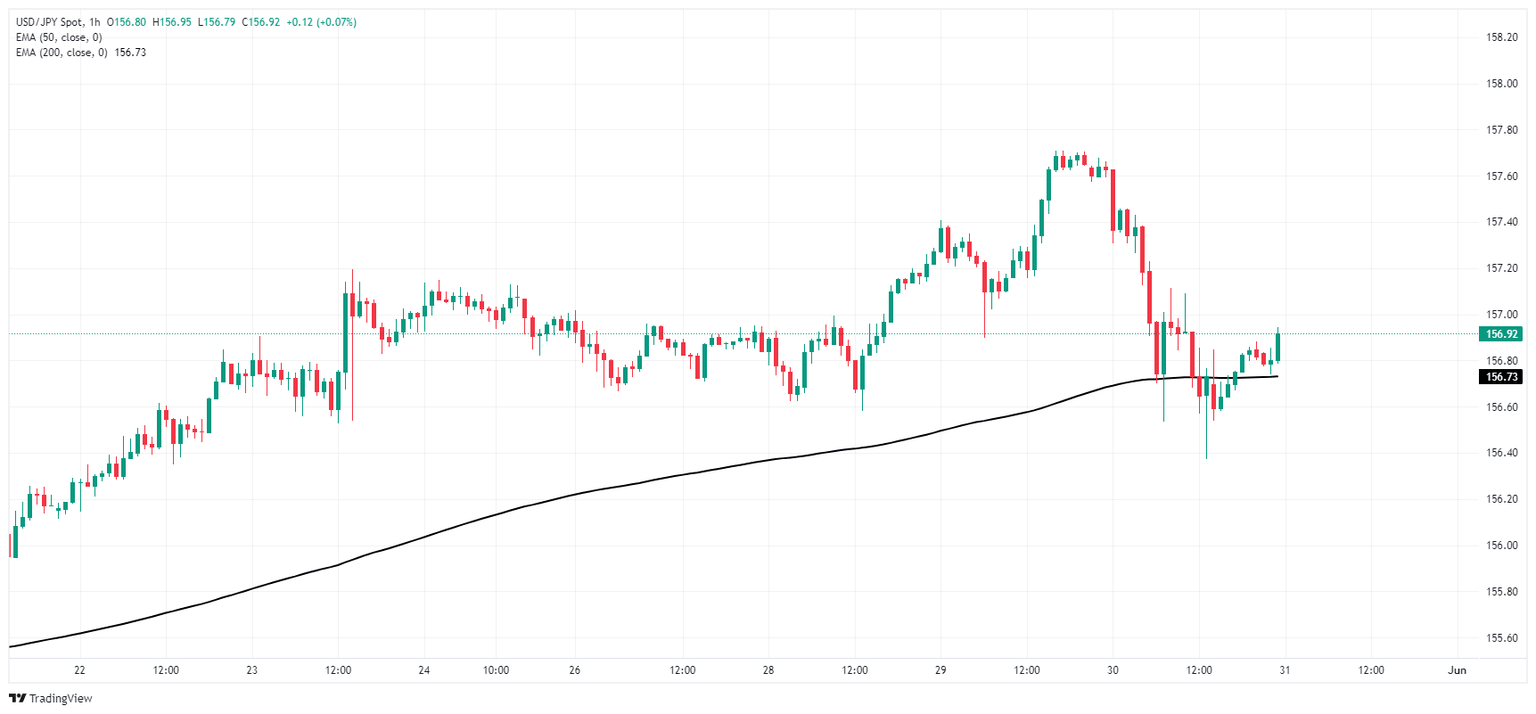

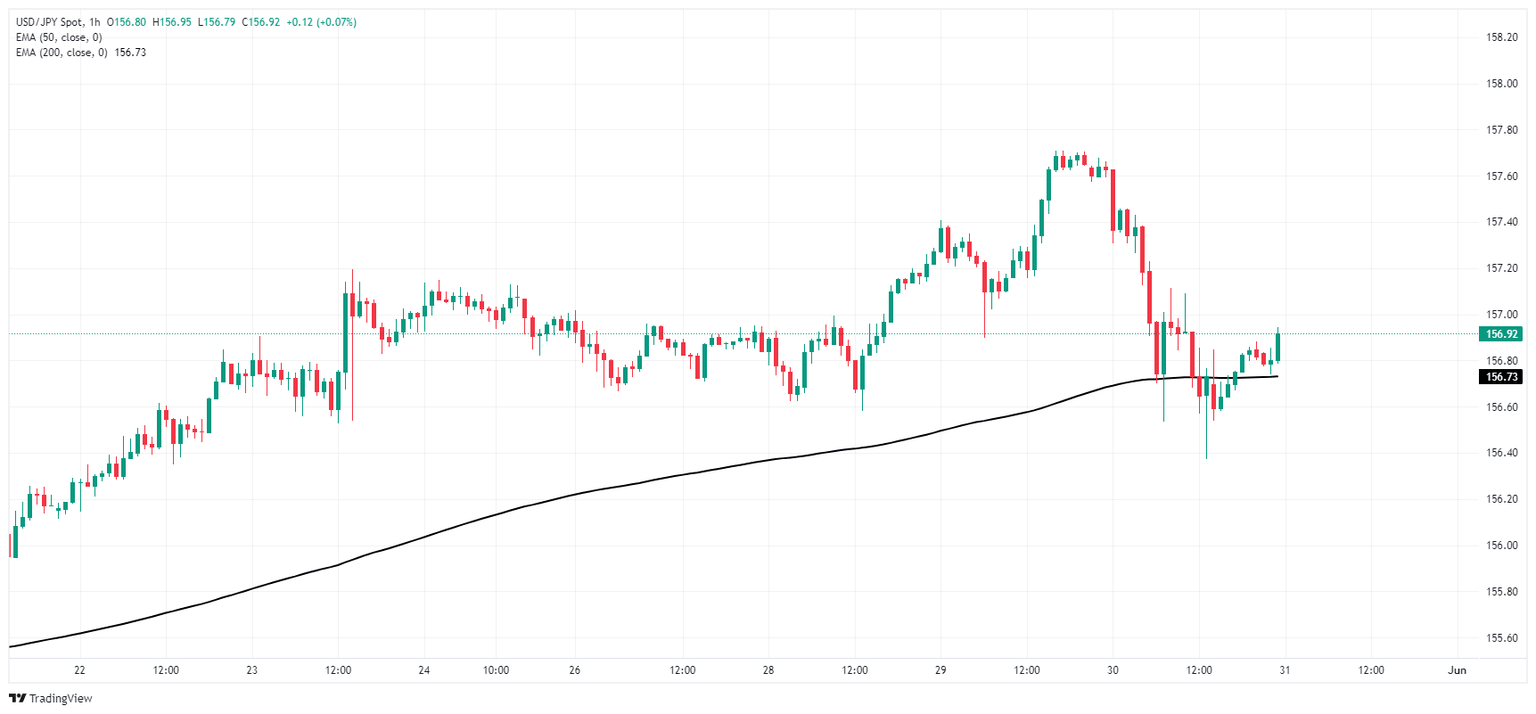

Market reaction

USD/JPY is trading on the high side in the early Friday Pacific market session, testing near the 157.00 handle after slipping to an intraday low of 156.37.

USD/JPY hourly chart

About Tokyo CPI inflation

The Tokyo Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households in the Tokyo region. The index is widely considered as a leading indicator of Japan’s overall CPI as it is published weeks before the nationwide reading. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.