Is this bullish reversal signal the key to huge gains ahead? [Video]

![Is this bullish reversal signal the key to huge gains ahead? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/financial-figures-7116094_XtraLarge.jpg)

Watch the free-preview video above extracted from the WLGC session before the market opens on 4 Jun 2024 to find out the following:

-

What the change of character bar with increasing supply indicates about market sentiment.

-

How does the key confirmation level act as a confirmation point for market movements

-

This outperforming industry group that is holding up the index.

-

The divergence signal prompts a red flag as the index turns higher.

-

And a lot more...

Market environment

The bullish vs. bearish setup is 345 to 143 from the screenshot of my stock screener below.

Both the long-term and short-term market breadth have been decreasing compared to last week and …

Only limited theme/industry groups show strength despite the index moving higher.

I highlighted my favourite in the email update 1 day before the live session.

Three stocks ready to soar

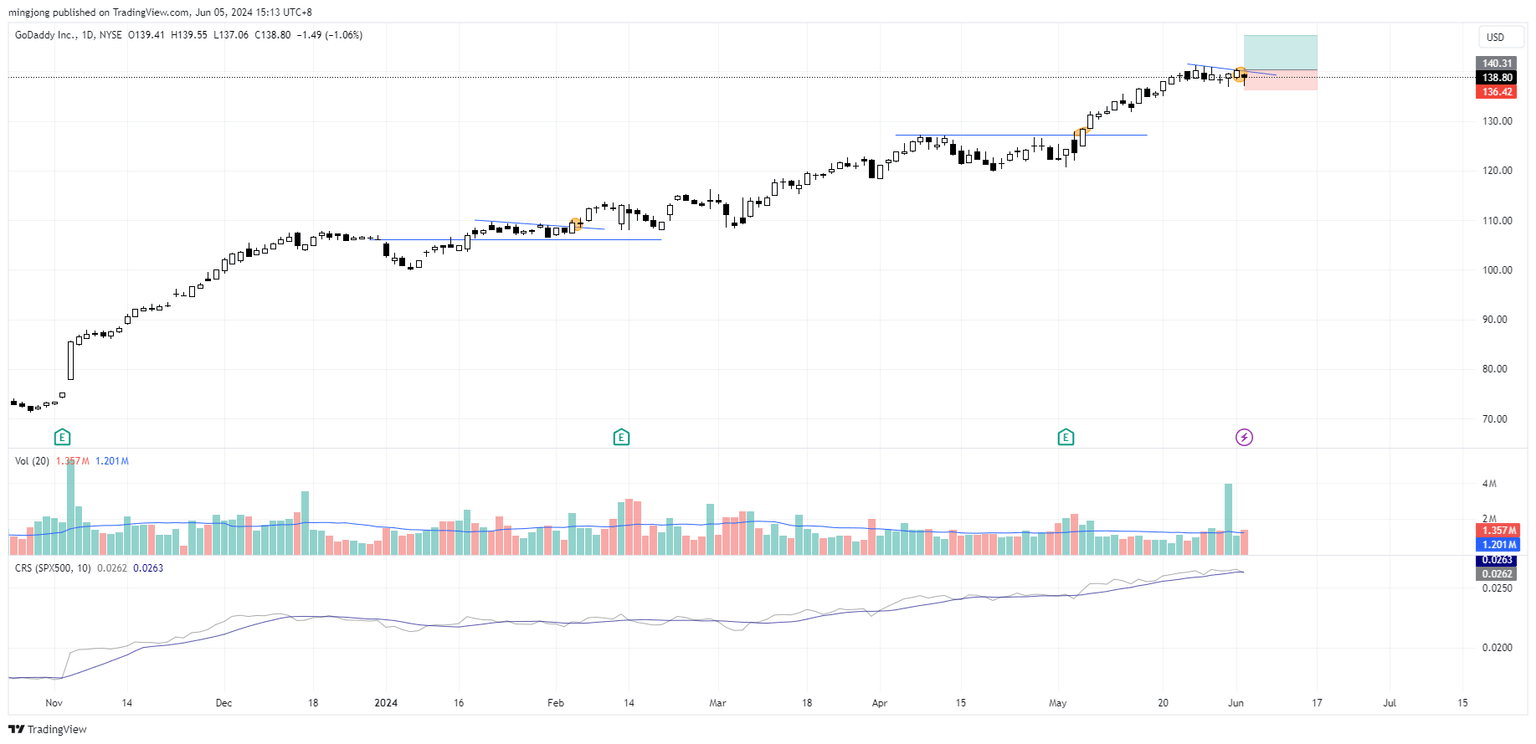

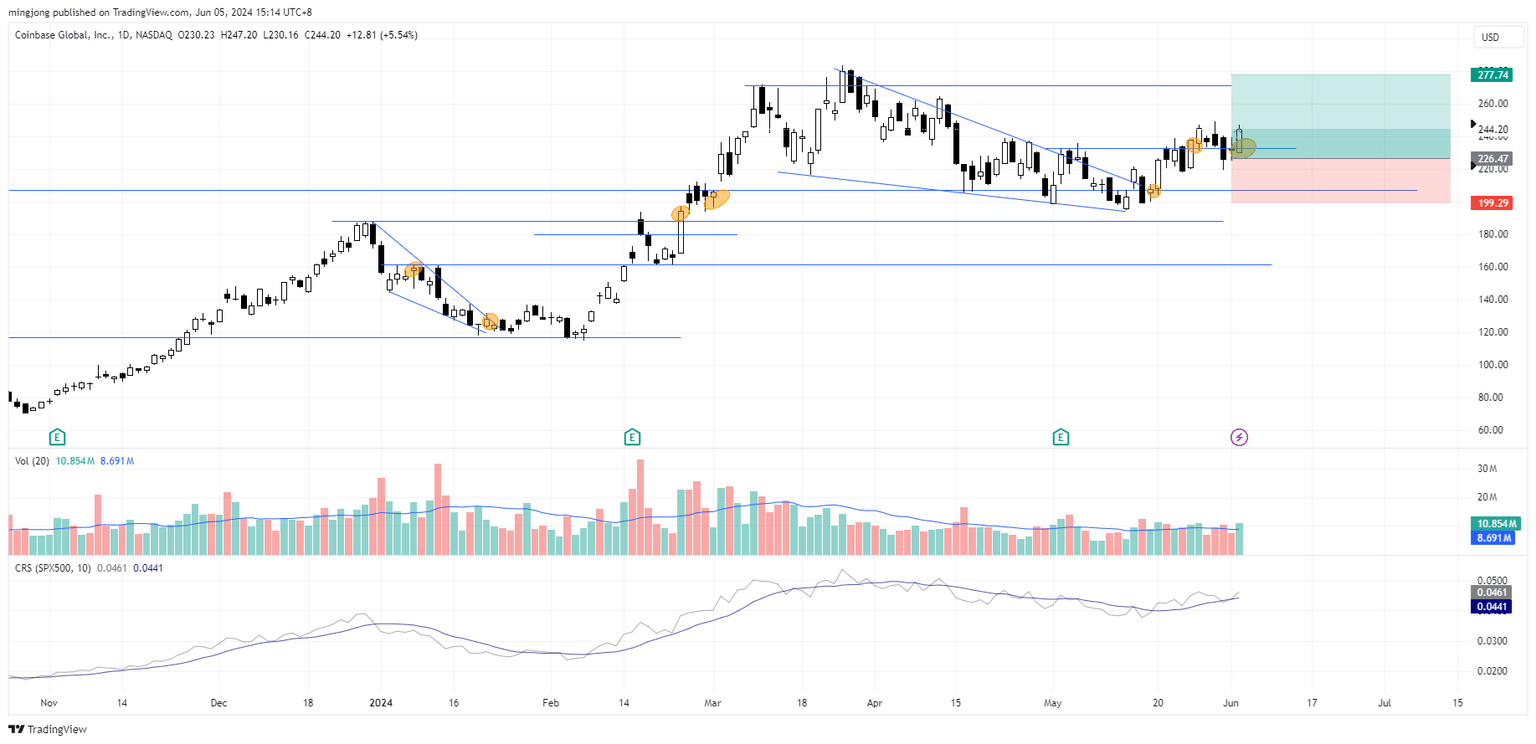

5 “low-hanging fruits” (AMD, GDDY) trade entries setups + 11 actionable setups (COIN) were discussed during the live session before the market open (BMO).

AMD

GDDY

COIN

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.