Investors suspect coronavirus apex in US and China

Markets have been second-guessing a potential Apex in the global coronavirus spread, specifically relating to the two largest economies of the work, the US and China.

This has given the global stock market a boost as investors cheer prospects of a faster rate of economic recovery.

The MSCI world equity index, IACWI, which tracks shares in 50 countries, rose another 0.54% following a 1.1% gain at the start of the week, leaving it on course to recovery towards fresh bull cycle highs.

Investors in the US have cheered news that the US Food and Drug Administration had granted full approval to the COVID-19 vaccine developed by Pfizer and BioNTech.

This is expected to accelerate inoculations in the United States.

It was a move that has sent both the NASDAQ and the S&P 500 index into new record highs with the Dow tracking higher closely behind them.

Meanwhile, China reported no new locally transmitted Covid-19 cases on Monday for the first time since July, according to its National Health Commission (NHC), as authorities double down on the country's stringent zero-Covid approach.

Today, China reported just 4 new confirmed local cases in the Mainland.

However, in Japan, things are not so positive.

Around 21,500 new daily COVID-19 cases were reported across the country Tuesday, with eight prefectures logging record infections as the highly contagious Delta variant of the virus continues to spread.

The nation will expand its coronavirus state of emergency to the northern island of Hokkaido and seven other prefectures, public broadcaster NHK reported on Tuesday.

They will join 13 other prefectures, including Tokyo, currently, which are under the measures until Sept. 12, NHK said.

The envisaged expansion will mean that from Friday, over 70 per cent of Japan's 47 prefectures will be covered by some form of emergency to battle the spread of the novel coronavirus.

Meanwhile, New Zealand has extended a national lockdown that was triggered by a single COVID-19 case.

The outbreak has now led to 148 cases and counting.

Similarly, Australia's NSW recorded 919 new local COVID-19 cases and one new death. Victoria recorded 45 new cases.

So long as there is uncertainty, the US dollar can remain underpinned as investors put faith in a faster pace of the economic recovery and divergence in central banks.

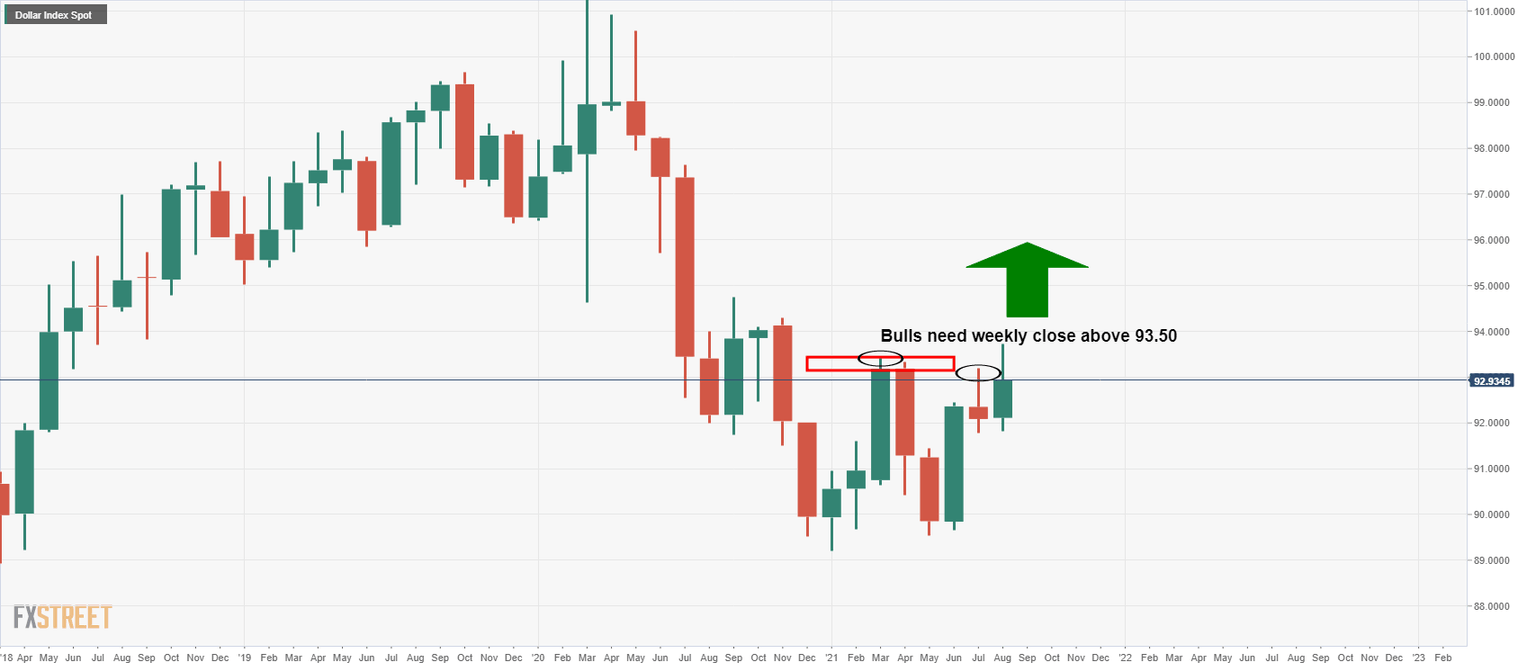

(DXY monthly chart)

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.