Indonesia FX Today: The Rupiah awaits confirmation of Bank Indonesia's cautious approach

The Indonesian Rupiah (IDR) is trading cautiously against the US dollar (USD) on Tuesday, with the USD/IDR pair up 0.2% on the day at around 16,400.

As Bank Indonesia (BI) meets on Wednesday at 07:30 GMT, the consensus is almost unanimous, with analysts anticipating a status quo in the interest rate at 5% following two consecutive cuts in July and August.

But beyond this expected pause, markets are closely scrutinizing monetary discourse and economic policy signals, as the government sets its sights on 8% annual growth.

Monetary policy in Indonesia: A tense pause

Bank Indonesia is set to pause its series of interest rate cuts on Wednesday. This decision comes against a backdrop of pressure on the currency, caused by political instability and fears over the country's fiscal trajectory.

As ANZ economist Krystal Tan explains, "the sudden ousting of the Finance Minister has undermined investor confidence and put external stability back at the top of the BI's immediate agenda".

Since the beginning of the easing cycle last September, the BI has cut its key interest rate by 125 basis points (bps), including two surprise cuts this summer.

But faced with the depreciation of the IDR, which briefly touched 16,600 against the USD, the monetary authority had to intervene on the foreign exchange market, then temper its accommodative bias.

According to Bank of America, the central bank could nevertheless ease policy further via liquidity tools to support activity without exacerbating pressure on the currency.

The current approach reflects the flexibility offered by a monthly meeting schedule. As Jason Tuvey of Capital Economics sums up, "the BI seems to prefer to stall to assess the fallout from recent volatility, and wait for political calm to set in before resuming rate cuts".

Inflation under control, robust economy, but political instability

On the inflation front, the latest data suggest a monetary pause. In August, headline inflation slowed to 2.3% YoY, while core inflation hit its lowest level since October 2024 at 2.2%, well below the BI's official target ceiling of 3.5%.

This decline reflects weakened domestic demand, confirmed by a marked fall in consumer confidence to its lowest level in almost three years.

On the economic front, the signals were mixed. Exports rebounded by 9.9% YoY in July, driven by Chinese, American, and regional demand. The Purchasing Managers Index (PMI) for the manufacturing sector has returned to positive territory.

Consumption, however, remains fragile, held back by the credit slowdown. Despite five interest-rate cuts since September 2024, lending interest rates, especially consumer rates, are struggling to come down, as MUFG notes.

On the political front, the change in fiscal course is fuelling uncertainty following the resignation of Finance Minister Sri Mulyani, a reassuring figure for the markets. In particular, her resignation has raised concerns about the independence of the central bank. According to a Reuters poll, 7 out of 10 economists are now "somewhat worried" about this issue.

The new Finance Minister, Purbaya Yudhi Sadewa, has promised to respect the 3% deficit ceiling, while launching a stimulus package worth close to $1 billion aimed at boosting activity in Q4 via food aid, construction loans and employment programs.

While these measures meet social expectations, they also increase the pressure on fiscal and monetary coordination, at a time when the central bank is keen to contain capital outflows.

As Goldman Sachs sums up, "recent developments have reduced the likelihood of a further cut this month, but the bias remains accommodative. Everything will depend on the stabilization of the rupiah and visibility on fiscal policy".

Technical analysis of USD/IDR: Bullish recovery to be confirmed

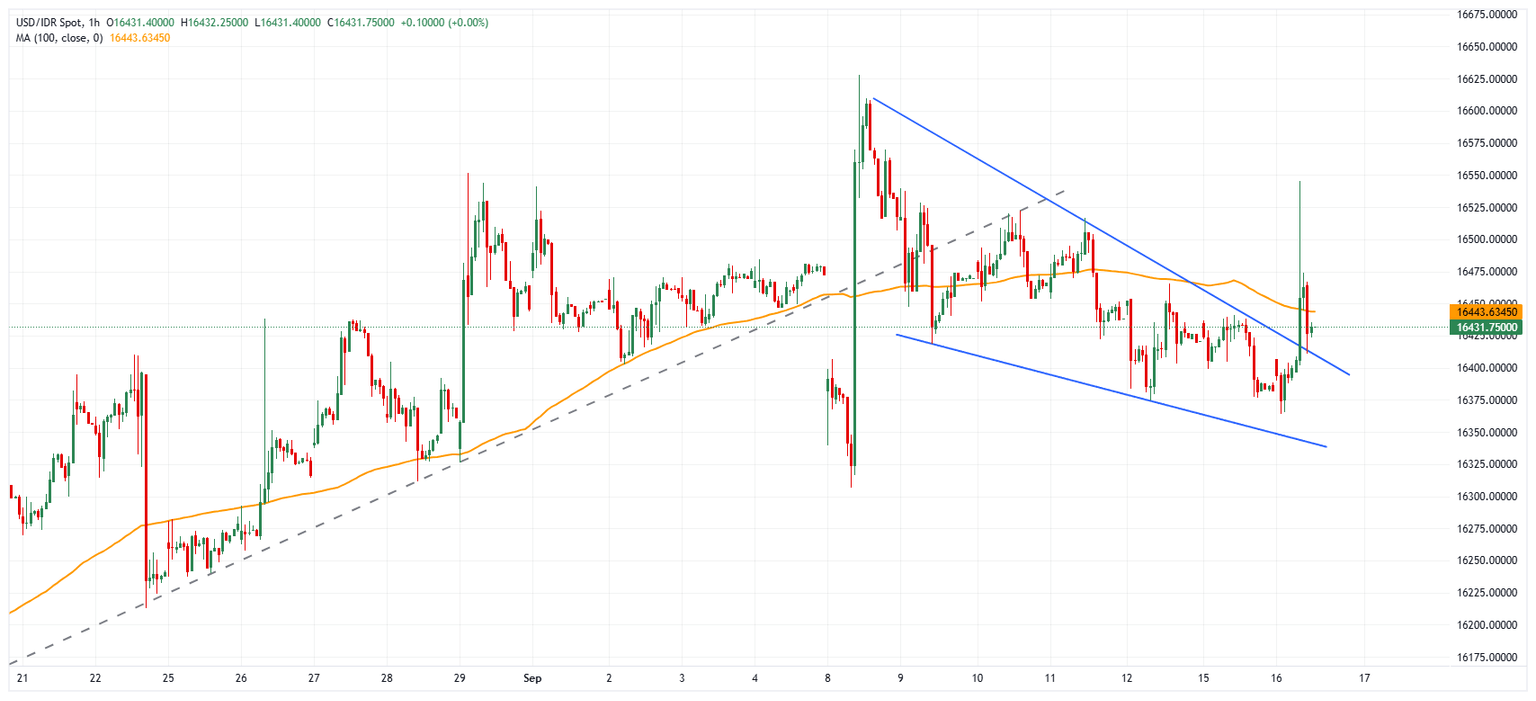

USD/IDR 1-hour chart. Source: FXStreet.

The USD/IDR pair marked a market top at 16,627.95 on September 8, before initiating a bearish correction in a wedge-shaped chart pattern, visible on the hourly chart.

On Tuesday, the currency pair initiated a bullish breakout from the wedge, above 16,415, leading to an intraday peak of 16,545. The move was followed by a rapid bearish correction, but the former upper bound of the wedge is now acting as support, reinforcing the short-term bullish bias.

As long as the wedge acts as support, USD/IDR can resume its bullish march, potentially towards the intraday peak at 16,545.

Conversely, if the pair re-enters the wedge, bearish pressures could resume, leading to a test of the lower bound currently at 16,340.

The table below shows the percentage change of Indonesian Rupiah (IDR) against listed major currencies today. Indonesian Rupiah was the strongest against the Australian Dollar.

| IDR | EUR | GBP | JPY | CAD | AUD | NZD | USD | |

|---|---|---|---|---|---|---|---|---|

| IDR | -0.70% | -0.45% | -0.40% | -0.37% | -0.16% | -0.27% | -0.27% | |

| EUR | 0.70% | 0.09% | 0.12% | 0.19% | 0.40% | 0.39% | 0.30% | |

| GBP | 0.45% | -0.09% | 0.06% | 0.11% | 0.31% | 0.31% | 0.21% | |

| JPY | 0.40% | -0.12% | -0.06% | 0.03% | 0.17% | -0.00% | 0.11% | |

| CAD | 0.37% | -0.19% | -0.11% | -0.03% | 0.14% | 0.17% | 0.09% | |

| AUD | 0.16% | -0.40% | -0.31% | -0.17% | -0.14% | 0.09% | -0.09% | |

| NZD | 0.27% | -0.39% | -0.31% | 0.00% | -0.17% | -0.09% | -0.12% | |

| USD | 0.27% | -0.30% | -0.21% | -0.11% | -0.09% | 0.09% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indonesian Rupiah from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent IDR (base)/USD (quote).

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.