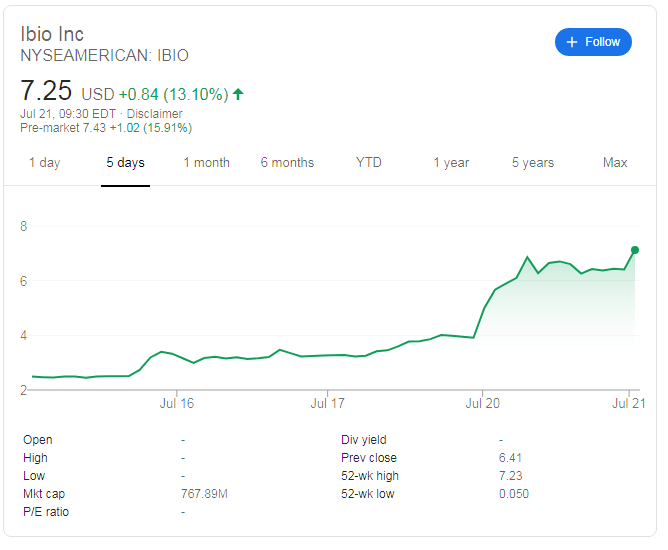

IBIO Stock Price: iBioPharma Inc.nears weekly tripling amid plant-based coronavirus vaccine

- NYSEAMERICAN: IBIO is trading above $7.10, up around 200% within a week.

- iBioPharma Inc is working on a plant-based COVID-19 vaccine with Beijing CC-Pharming Ltd.

- Combining two strong trends may trigger further gains toward a $1 billion valuation.

For the anti-vaxxers that prefer not injecting chemicals into their bodies – even in the face of coronavirus – iBioPharma Inc.may have a solution. The Delaware-registered firm is working with China's Beijing CC-Pharming Ltd. on a plant-based immunization for COVID-19.

While the news had already been announced back in early February – before many Americans became aware of the illness – the share is rising now.

iBioPharma, trading under NYSEAMERICAN: IBIO is aiming to create rapid delivery of such treatments using its FastPharming facility. Its Beijing-based partner is experienced with previous coronaviruses – including the Middle East Respiratory Syndrome (MERS) that hit South Korea in 2015.

Ibio has recently filed for a shelf-registration to issue as much as $100 in equity.

NYSEAMERICAN: IBIO is benefiting from impressive performance amid an ever-crowding field of pharma firms racing to develop a coronavirus vaccine. The Lancet published promising results of a Phase 1/2 trial by AstraZeneca (LON: AZN) and the University of Oxford that showed substantial safety and creating double protection.

Contrary to IBIO, the performance of the heavyweight AZN stock has left investors unimpressed.

IBIO stock forecast

At current pricing, IBIO is still valued under $1 billion. If its plant-based COVID-19 solution works, it will likely surpass that mark and the $10 mark. However, it is essential to note that apart from AstraZeneca, other competitors such as Moderna (MRNA) and Pfizer (PFE) are also in the race.

Support awaits at around $6.40, around the previous close, and then at $4, the pre-leap levels.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.